Warner Brothers Deep Dive Part 1

Analyst: Joshua

Time to read: 40 min

First, I’d like to welcome new readers to The Retail Deep Dive. So glad to have you join us! Our mission is to analyse companies with exciting prospects and unpack them logically for our readers.

This month’s deep dive is on Warner Brothers Discovery (WBD), a new media behemoth, and a strong streaming player.

We decided to split our research into 2 separate articles to break it down nicely for you. The first article will focus on an analysis of WBD, while the second article will evaluate WBD’s financials.

Disclaimer: I currently own shares in WBD.

Breakdown

History, Market perceptions, Stock price action

Business model and revenue breakdown

Analysis of WBD’s content library

Analysis of WBD’s declining cable business

Analysis of management’s strategy

Analysis of WBD’s debt

Conclusion

History

Warner Bros. Discovery, or WBD for short, was formed from the merger of Discovery and AT&T’s Time Warner division in early 2022. Before the merger Discovery was the largest non-scripted content producer. It owned HGTV, TLC, Discovery Channel, Food Network, Eurosport and so many more networks. It had its own streaming platform called Discovery+. On the other hand, Time Warner was one of the largest scripted content producers. It owned franchises such as Harry Potter, DC, Monsterverse, Game of Thrones, etc. As a result of the merger, WBD has several streaming platforms, the flagship one now being HBO Max. It’s not hard to see that the combined company is a media behemoth. Now, allow me to give you a brief summary of the market perceptions of WBD.

Market Perceptions

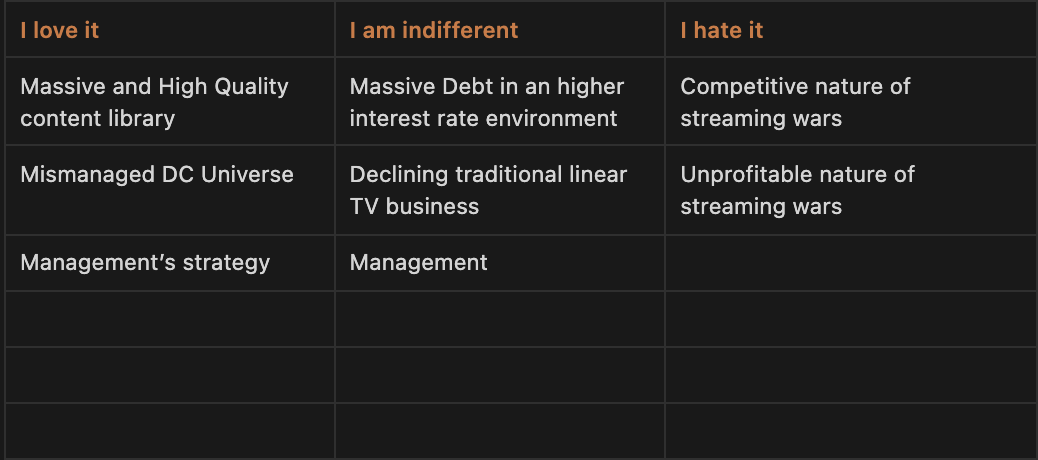

Note: These market perceptions are based upon my perceptions of what other researchers focus on when they write about WBD.

Based on the above table, the number of “Hate it” far outweighs the number of “Love it”, which is probably why the stock has sunk so low over the past couple of months. In this analysis, I aim to analyze both the bull and bear views of WBD and come to my own conclusion on whether they are sound or not.

Stock price action

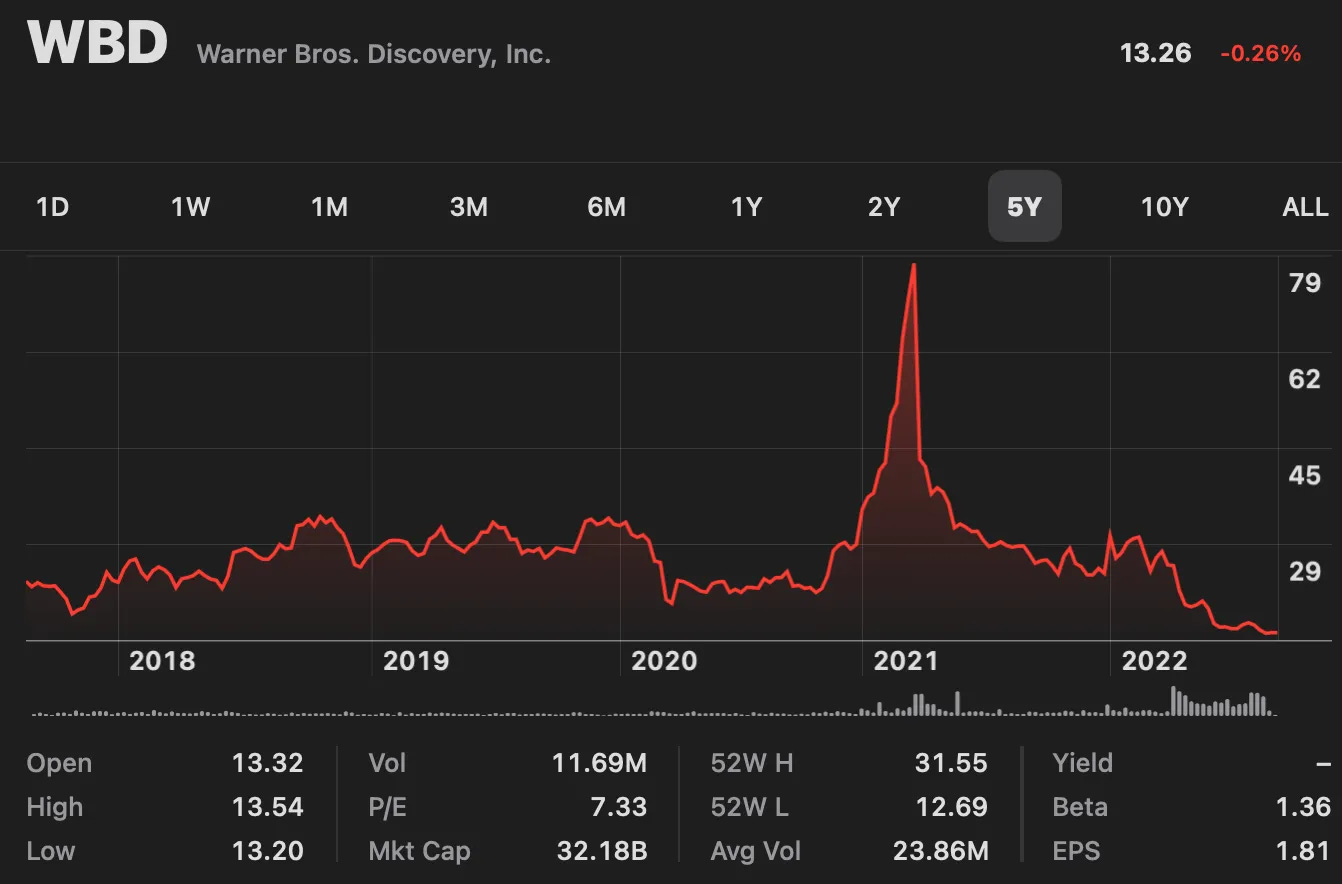

WBD’s stock price currently trades at $13.20, down 83% from its all-time highs in March 2021. Some reasons for this massive decline include :

Reason 1: Dividend-seeking AT&T shareholders selling WBD stock

Reason 2: Netflix losing of 200,000 subscribers in Q1Y22

Reason 3: Strong competition in the streaming space

Reason 4: High level of debt compared to peers

Reason 5: Messy post-merger operations

Reason 6: Lousy macroeconomic outlook

Market Cap & EV

Currently, WBD has an enterprise value of $84 billion, 80% of NFLX, and 35% of DIS. As compared to its peers, WBD has the greatest relative debt.

Business Model

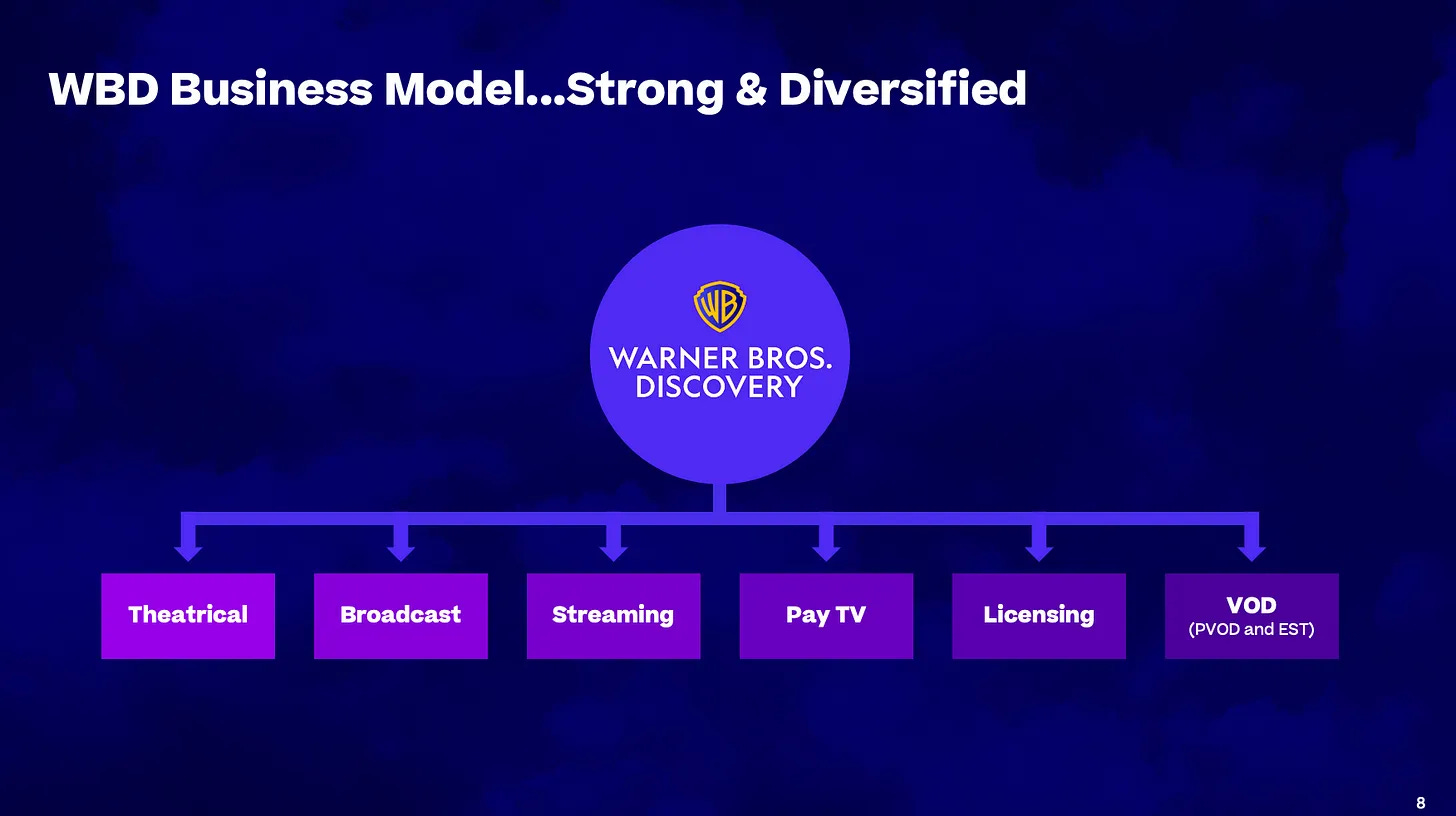

As a legacy media conglomerate, WBD has a diverse business model. It produces shows and distributes them through many channels, theatres, cable TV, and streaming.

Revenue Breakdown

WBD categorizes its revenues into 3 streams, Networks, Studios, and DTC. It only started breaking down revenues this way after its merger in 2022. For Q2 2022, its breakdown is as follows:

1. Networks

WBD’s Networks segment consists of revenues earned from shows it producers for its traditional cable TV networks. As seen above, Networks is currently WBD’s largest revenue contributor. Albeit a profitable segment, we have to keep in mind that it’s a declining business as people cut the cord in favour of streaming.

2. Studios

WBD’s Studios segment consists of revenues earned from licensed content and gaming. For example, Ted Lasso is a famous TV show created by HBO (not to be confused with HBO Max. HBO is the production studio, while HBO Max is the streaming platform) for Apple TV. As seen above, Studios is currently WBD’s 2nd largest revenue contributor. Like Networks, it is currently a profitable segment.

3. DTC

WBD’s Direct-To-Consumer segment consists of revenues earned mainly from HBO Max and Discovery+, its two main streaming platforms. It currently makes up WBD’s smallest revenue segment and is unprofitable. However, it is expected to grow fast, and carry the company in the future.

Now, that we know what WBD’s business model looks like, let’s analyze its market share.

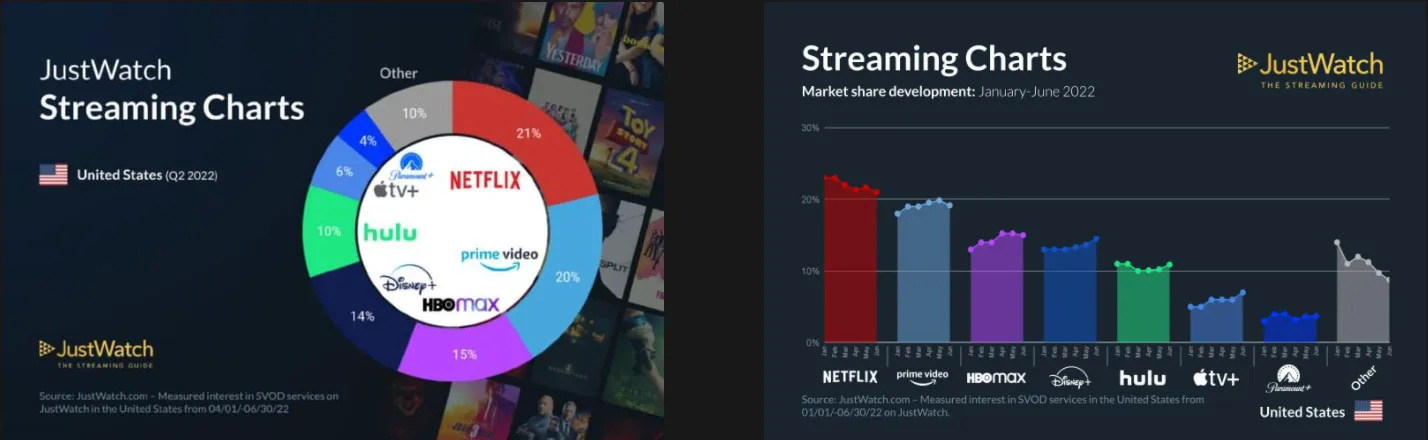

Here are the latest streaming market share statistics.

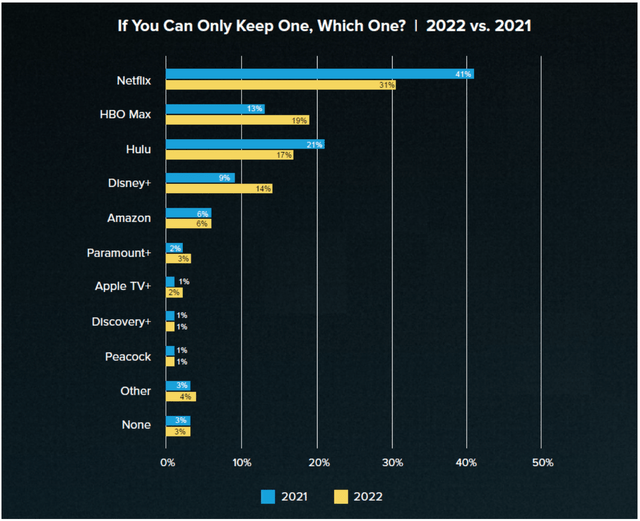

Currently, WBD has two streaming platforms, HBO MAX and Discovery+. Based on the chart above, HBO Max has the 3rd largest market share, while Discovery+ market share is too small and has been categorized under Others. WBD intends to combine HBO Max and Discovery+ into one streaming that will be launched in June 2023. For now, we will call this new service WBD+.

From the above chart, we can see that WBD has a good market share. It is also interesting to note how Prime Video, HBO Max, and Disney+ are all growing whilst NFLX is losing market share. Do not make the mistake of counting legacy media companies out of the streaming wars just yet!

Analysis of WBD’s content library

To assess a streaming company’s content portfolio, we have to consider 3 things:

The acquisition strength of its content

The churn rate of its subscribers

The amount spent on producing its content

Current subscriber satisfaction

Ideally, we want a company with a content library that has high acquisition strength, low subscriber churn rate, and doesn’t have to spend excessively to produce the content. Now, let’s find out if WBD has these three characteristics.

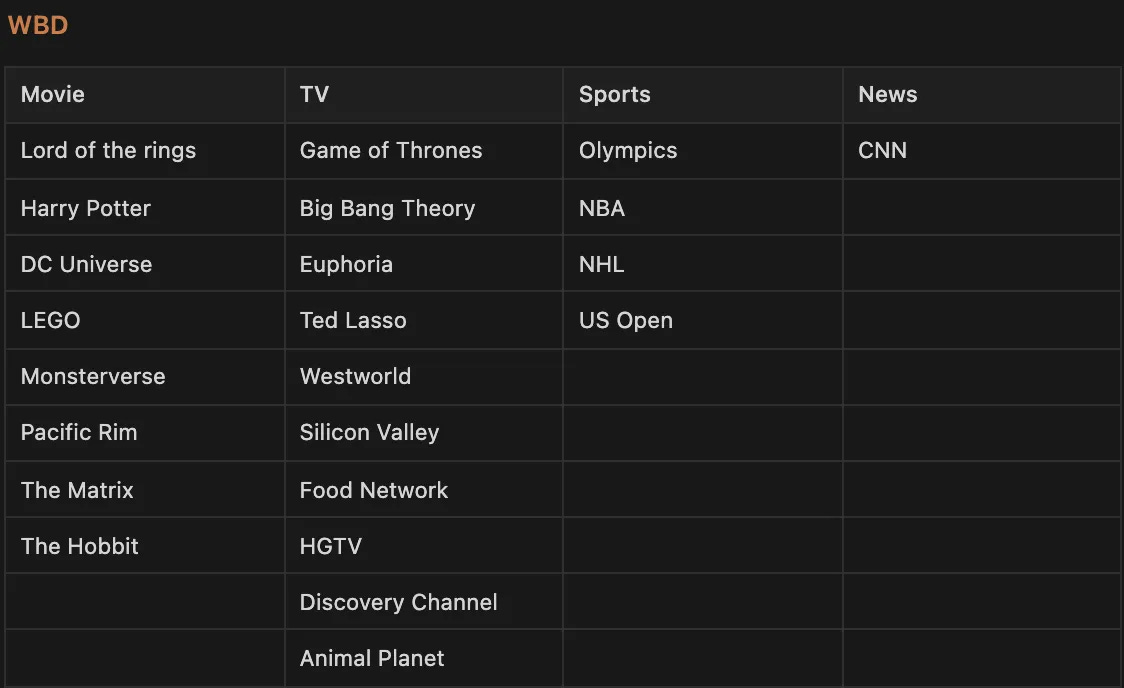

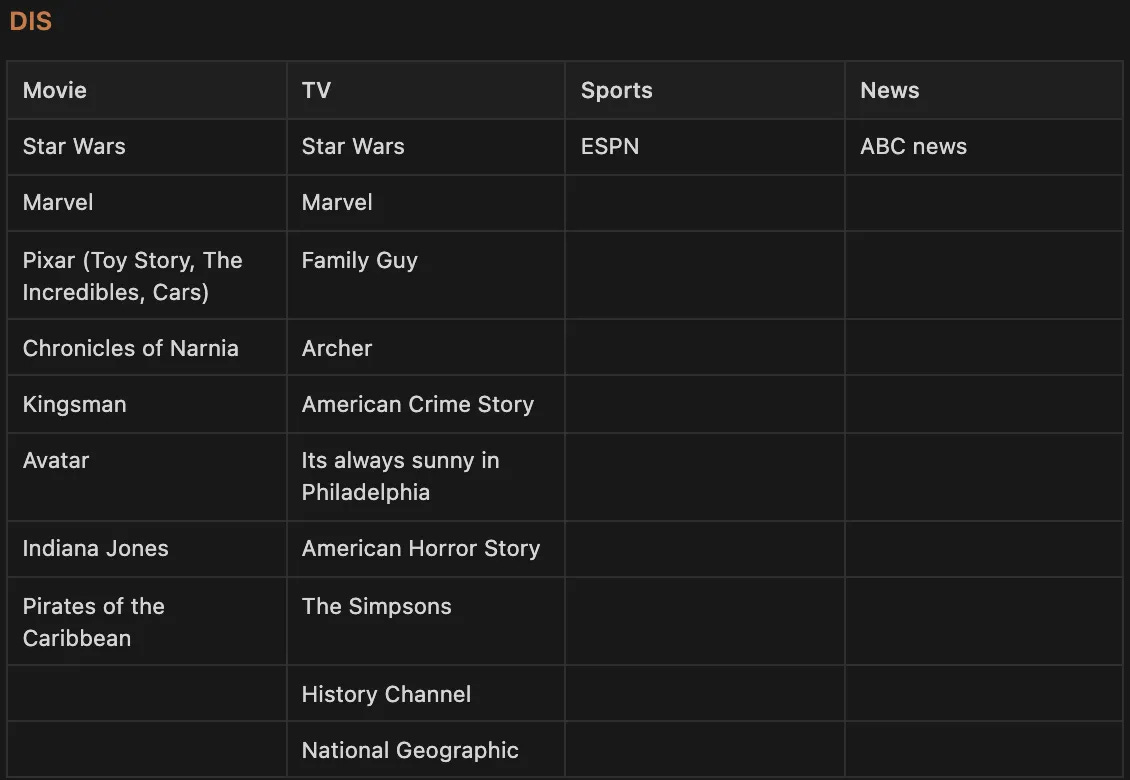

To get a sense of how WBD’s intellectual property fares against its competitors, I have collated the major franchises of each streaming company in the tables below.

1. Acquisition Strength

To compare acquisition strength, that is the ability of shows to generate excitement and draw in interests of a large number of people, I have decided to use the number of branded movie and TV franchises as the metric. In terms of this metric, Disney definitely takes the first spot. Arguably, WBD has the second strongest library of franchises. For instance, according to HBO, House of the Dragon debuted to the largest audience for any new original series in HBO history. I would then rank PARA and NFLX in last place. The reason for this is that although NFLX has been able to develop numerous quality TV shows, PARA has strong movie IPs that it can build on. Take Top Gun: Maverick for example. It grossed ($623.3 million) to become the ninth-highest grossing movie in domestic box office history. Of course, this ranking is also based on personal preference, so take it with a pinch of salt.

One thing that stood out to me about WBD’s IP, is its DC brand. If executed well, it could potentially replicate the success that Marvel has had. Management knows this too, and has recently assembled a team to create a 10-year plan for its DC comics-related franchise that includes "Wonder Woman", "Superman" and "Aquaman". The approach was similar in structure to Walt Disney Co's approach to the Marvel Cinematic Universe, Chief Executive David Zaslav said.

When I wrote my previous article on NFLX, I stated that NFLX had won the most Primetime Emmy Awards in 2021. But guess what? HBO is in the lead this year. In the Q2 earnings call, WBD said “The quality of our content engine speaks for itself as evidenced by the 193 Emmy nominations this year, more than any other media company.” Clearly, WBD’s content acquisition strength is not to be trifled with.

Therefore in terms of acquisition strength, aka how attractive its content is, we rank them in order of:

Now, let’s compare their churn rates.

2. Churn Rate

As mentioned earlier, WBD was formed by the merger of Discovery and Warner Brothers. The former was the largest unscripted content producer, while the latter was a strong scripted content producer.

Discovery’s content has lower churn compared to Warner Brothers This is because its shows are more educational in nature and have many parts to them. John Malone, Discovery’s largest shareholder, said:

Discovery+ is not blockbuster, it's personality, it's great entertainment, but it's not the kind of acquisition type content that Warner can bring to the table. So you have to look at this game both from getting people to reach into their wallet and pull out their credit card point of view, the marketing point of view, but you also have to look at the churn and the satisfaction of the consumer. Discovery does very well on the customer satisfaction, but it doesn't have the Wonder Woman type of big event content that will get you an acquisition program where you can add hundreds of thousands or millions of consumers in one campaign.

On the other hand, Warner Brother’s content has higher acquisition strength compared to Discovery. This is because blockbusters like The Dark Knight are attractive. David Zaslav, Discovery’s CEO said:

What we’ve learned is people love Discovery+ in ways that even surprises us, over 3 hours they’re spending with us... Churn is extremely low. But we’re also learning that to get people to come in... the ability to drop into this product, the King Kong or Godzilla or a Game of Thrones. That together, we think that this could be much more compelling... . I met one of the biggest streaming players, who said to me recently, ‘If I had you, my churn would be zero.’ And I think just the combination of people now spending over 3 hours with us, and then you add to that Batman, Wonder Woman, King Kong, Sex and the City, Friends. It’s just -it’s an unrivalled combination. And churn matters.

In short, it seems that WBD+ will have a lower churn rate than peers because it will offer leading scripted and unscripted content together. However, that is not all! WBD can bundle sports and news to reduce its churn further if it wanted to.

Sports content is imperative in making the content provider more attractive. Levy, chairman of data firm Genius Sports said: “With sports, there’s a guaranteed built-in audience, It’s much different than entertainment. With entertainment, every show is hit or miss, and you always have to market content. You never know what will succeed and what won’t. That’s why sports is the best content to invest in, and it will be no matter what the distribution model is.” Therefore, adding sports to a library of movies and TV shows will help reduce the subscription churn.

In terms of sports coverage, Disney is the best. It owns ESPN which is the most popular sports coverage channel. WBD and PARA follow in 2nd place with the Eurosport channel and CBS sports channel respectively. In this regard, many of the other streaming competitors are at a disadvantage. Netflix, Amazon Prime, and Apple TV all do not have their foot in the realm of sports.

Like sports, news helps reduce churn further. Because of its ever-changing nature, people continuously have to keep up to date with new news, and that is why news has very low churn. However, it is of no surprise that news content has the lowest acquisition strength. Nobody would realistically pay for news as there are many avenues for it, especially with the prevalence of social media. Thus, as a standalone product, the odds of its success are dismal, but together as part of a bundle with stronger acquisition strength content such as movies and TV shows, news would help reduce churn.

WBD and Disney can reduce their churn by incorporating their news channels into their streaming services. WBD owns CNN, one of the largest news networks in the world regardless of your political alignments. Disney and Paramount don’t lag too far behind as they still have exposure to news, but Netflix, Amazon, and Apple tie for last place with zero news exposure.

Source: Statista

In short, we think WBD, DIS and PARA will have a much lower churn rate compared to their peers who have a portfolio consisting of only scripted content and are not exposed to unscripted content, news, or sports. Amazon has an E-commerce offering, and Apple bundled its streaming service with its cloud and music service. Thus, we expect them both to have relatively low churn rates as well. Therefore in terms of churn rate, we rank them in order of:

3. Content spending

WBD is expected to spend a total of $18 billion on content production this year. Out of that, only $9 billion will be allocated to streaming content production. In comparison, its peers NFLX and DIS will be spending more on DTC content this year. However, such surface-level analysis may not be adequate in this case.

Firstly, we must remember that WBD has unscripted content, sports, and news content to help it reduce churn. However, NFLX does not have such content. Their only means to reduce churn is to pump out blockbusters every other week. This strategy requires greater content spending. Moreover, scripted content is more expensive to make than other types of content, so naturally, NFLX who only produces scripted content has to spend more content compared to peers who make unscripted content.

Additionally, as I mentioned in my NFLX article there is a limit on the number of shows people can watch because of time, relationship, and work constraints. Streaming companies should be mindful of this ceiling when producing shows to keep subscribers entertained. In that article, I deduced that DTC content spending for each player will eventually stabilize at around $25 billion each. (If you want to know why check out my previous deep dive on NFLX!). As WBD is already spending a total of $18 billion on content production, and as streaming gains market share, most of the content spending will eventually be ported over to streaming. This means that WBD is about to reach an inflexion point where it no longer has to increase spending any further to keep viewers engaged. When this limit is reached, I can more safely assume that content spending will remain relatively constant, and meaningful cash flows will start to be produced. Therefore, I am not worried that WBD’s content production will be outsized by its competitors.

Now, let’s take a look at whose content subscribers love most!

4. Customer satisfaction

According to the survey below, in terms of overall satisfaction, HBO Max currently takes the lead, followed by Disney+. This actually surprised me, as I expected NFLX to take the lead, since all its content is on its streaming platform, while WBD’s content is split between streaming and linear networks.

Source: Whip Media 2022 Streaming Satisfaction Report, Variety.com

Below is another survey done by Whip Media that asked subscribers which streaming service they would keep if they only had one choice. NFLX is currently the most popular service. However, the number of people who would choose it as their only service declined by 9% in the last year alone. In contrast, HBO Max saw the greatest increase in the number of people choosing it and currently stands in second place. This trend already supports the fact that WBD’s streaming market share is growing rapidly.

Source: Whip Media 2022 Streaming Satisfaction Report, Variety.com

Coffee Break!

Content library analysis conclusion

Based on our analysis above, we estimate that WBD will have the second strongest content library in 5 years. Moreover, in the best-case scenario, if management successfully builds its DC Universe, WBD may even rank first.

According to the survey above, a majority of subscribers choose to cut the cord because of the exorbitant prices of cable TV. The average price a person pays is around $107 per month for a cable subscription, and the price has steadily been going up. In contrast, a streaming subscription usually costs around $11 /person/month. Right now, having 3 streaming services costs less than half the price of a cable subscription! No wonder, 82% of all households in the US have at least one streaming service and 49% have three or more services. Given the fact that almost all streaming services are still unprofitable, I posit that the main reason for the huge disparity between traditional TV and streaming pricing may be because streaming services are artificially keeping their prices low to gain market share. This is bad for all streaming companies. However, the good news is that there is room for these companies to raise prices once the winners of the streaming wars have been established.

How fast is the general Linear TV market declining?

Cable subscriptions have indeed been declining fast. Here are some stats:

According to Nielsen ratings, TV viewing has been dropping about 10% per quarter.

In total, major US cable TV and satellite TV have lost 25 million subscribers since 2012, and are projected to lose another 25 million by 2025.

Adults ages 18 through 29 are the largest age group without cable, with 34% of them not having subscriptions to satellite or cable TV services. It seems that the younger generation defaults straight to streaming and do not even consider cable TV as an option for content consumption.

With such an apparent rapid decline in cable TV, will WBD’s cable business drag down the company? Maybe not!

1. Although Cable revenues are declining fast, Streaming revenues are growing faster.

Consumer spending on pay TV and streaming video in the United States from 2016 to 2026 ($ billion)

Note: The graph refers to revenues earned and not the number of subscribers.

Based on the above projections by Statista, a company that engages in both cable TV and streaming would experience net revenue growth. This is because revenue growth from Streaming would outpace revenue lost from Cable TV. This may mean that companies like WBD and DIS would experience a 36% revenue growth from 2016 to 2026, a CAGR of 3.2%.

I must clarify that the projections above only take account of revenue from subscription costs and not revenues gained from ads. Since ads will become more personalized in the streaming world, we can assume that ad revenue generated from streaming services will be greater than from cable tv services. For example, Discovery+ makes $11 a US subscriber from a $5 monthly fee and over $6 in advertising for only 3 minutes of ad time vs. $7 from their Cable TV services. This is 57% higher. It was no surprise therefore that WBD CEO stated, “If we lost a million [cable] subs…all we need to do is pick up 650,000 [streaming] subs in order to be making more money.” Therefore as long as WBD maintains its competitive advantage in content production, both revenues and margins for its overall business should increase.

2. WBD has one of the strongest cable offerings.

Below is how many subscribers each cable channel lost:

Channels from Warner Media and Discovery both experienced lower rates of viewership dropoff compared to the other TV network companies. The average viewership drop-off for WBD stood at 30% compared to the other networks of 75% drop-off. That is no small difference and suggests that WBD’s cable networks have a competitive advantage over other cable companies. Therefore, from this comparison, we can expect WBD to earn greater revenues than its peers who may potentially have a CAGR of 3.2%. I am anticipating a CAGR of 3.5-5% for WBD.

3. WBD has the advantage of earning double earnings for the near future

Distribution of cord cutters in the United States in 2020 and 2021, by age group

As can be seen from the graph, younger generations embrace streaming services faster than older generations do. Because of this lag in the adoption of streaming between the various age groups, there will be a period where households subscribe to both streaming as well as cable services. This means companies like WBD, DIS and PARA can earn “double” the revenues for each show that it creates. WBD is producing Game of Thrones, and it can air it on both HBO Max and Linear TV, while NFLX can only air it on one platform. By “double” I do not mean exactly two times the revenues, but rather more than 1 time.

Moreover, viewers who aren’t cutting the cord aren’t necessarily only watching cable and satellite TV content. Currently, 56% of Americans say they watch cable or satellite TV, while 78% of U.S. households have subscriptions to Netflix, Amazon Prime, or Disney+. This clearly indicates that there is an overlap in consumers. Knowing this, would you prefer owning a company that can only distribute its shows on its streaming platform, or a company that can distribute its shows on both Linear TV and Streaming?

It is also important to differentiate between subscribers and viewership. Subscriber refers to the number of people who pay for the service, while viewership refers to the number of people who view the shows. Today, Netflix has more viewers than cable and satellite TV combined. However, cable still leads in terms of the number of subscribers. That is why the second chart of this article shows that subscribers are still spending more on pay TV than streaming. This goes to show that the cable TV space is still a highly lucrative market, and suggests that although people spend more time on streaming platforms than on cable TV, they are unwilling to cancel their cable subscriptions perhaps because of some shows that are only aired there. Take for example sports, news, and reality TV. The inflexion point where streaming will overtake Linear TV in consumer spending is only expected to occur in 2024. Therefore owning a company that has access to lucrative residual revenues from Linear TV as well as exposure to streaming is a smart move.

Therefore, we should assign WBD a higher multiple relative to its streaming-only peers during our valuation.

Declining cable business analysis conclusion

Declining linear TV revenues is not a bad thing for WBD. Linear TV and Streaming are just methods of distribution of content. Having more distribution methods is more beneficial for content-producing companies. Moreover, not only is the rise of streaming faster than the decline of cable, but WBD also owns some of the best cable networks. Therefore, I can conclude that WBD’s declining cable business, will not drag it down.

Coffee Break!

Analysis of Management’s strategy

To the despair of some investors, and the shock of other investors, WBD management announced that they are not going to pursue a streaming-only let alone a streaming-first strategy. Instead, they were going to continue to produce shows for its linear TV networks and shows for other streaming platforms, and grow its streaming platform at the same time.

Some WBD investors were upset as it seemed that WBD have conceded the streaming market to its competitors. But did it? Personally, I don’t think so. I think what prompted WBD to engage in this strategy was that WBD is simply too huge. Before the merger, Discovery was the largest media company in unscripted content. Largest! Their linear TV operations were already international. Let us not forget how massive HBO also is by itself.

Because of WBD’s massive size, it does not make economic sense to collapse all its linear network operations into its streaming platform. Let me illustrate it with the current prices below.

Note: I have assumed that HBO Max makes the same ad dollars on its ad tier as Discovery+ does.

If WBD were to keep HBO Max and Discovery+ separate, it would earn a total of $27 from both ad tiers and earn $22 from both ad-free tiers. In this scenario, WBD can earn advertising revenues from both its platforms.

Now consider the case that WBD combines all Discovery+ and HBO Max shows into one platform. I will call this platform WBD+. In this case, WBD can only earn advertising revenue from its one and only platform. It is not a good deal for WBD at all! To maintain the same revenues as case 1, WBD+ would have to have a subscription cost of (27 - 6 = 21) for its ad tier and $22 for its ad-free tier.

Now, would you as a subscriber pay $21 for an ad-free tier? Although it is probably worth it for the amount of content available to me, my answer will be no! It’s simply too expensive. Thus, the problem that WBD faces is that if it folds all its Linear TV content into its new platform WBD+ , it will simply be too huge and thus will require a subscription price out of the league of many subscribers! As seen earlier, cheaper streaming services are the main reason why people cut the cord. If one streaming service is almost twice the price of the other streaming services, it will definitely not bode well for its subscription numbers. No wonder Zaslav’s tone is one of “contempt” towards streaming. With the current prices of streaming, consumers are getting content for a steal! What would you do if you were the CEO of WBD? For me, I would solve this by:

Using the opportunity to get rid of low-quality content

Building the streaming content slowly and waiting for competitors to increase their subscription prices

Using the extra content in other ways

Fortunately, WBD is doing exactly this!

1. Use the opportunity to get rid of low-quality content

You can’t get rid of content that has already been produced. You can only get rid of content that is in production or content that has not begun production. WBD has done exactly this and axed Batgirl and a couple of other shows that it has deemed as unattractive or too expensive for its prospective attractiveness.

2. Build the streaming content slowly and wait for competitors to increase their subscription prices

This is evident from WBD taking a streaming-second mindset. With competitors like Amazon charging only $14.99 for Prime, WBD can’t raise its prices now. Its competitors have set prices low to gain market share, and so WBD can only wait. Fortunately, competitors have already started to budge with both Netflix and Amazon raising prices in the past couple of years.

3. Use the extra content in other ways.

Since WBD has so much content and putting them all on streaming will be a total waste, it is necessary that the company look for other ways to monetize this content. It has done exactly this and is looking to continue releasing content on theatres and its linear networks.

Watching movies in theatres is more accessible to a greater number of people. For example, Paramount’s Top Gun: Maverick drew many viewers into theatres, at a time when people thought the pandemic had killed theatres. I think that there is a difference between watching movies in theatres and watching movies at home. Watching movies in theatres is a social activity done mostly with friends. On the other hand, watching movies at home is mostly a family activity, or just to satisfy an individual interest.

WBD’s CEO said: “When we bring the theatrical films to HBO Max, we find they have substantially more value. And we have an ecosystem where we can have the premier motion picture business…. And the economic model is much stronger.” I can’t help thinking that WBD was referencing Marvel’s strategy in that quote. In the Marvel Cinematic Universe, Marvel released the big and expensive blockbusters like “Avengers” in theatres and the smaller cheaper series spin-off versions of the big blockbusters like “Loki” on Disney+. This strategy not only gave the whole world the opportunity to view its major blockbusters but also gave fans the opportunity to view subplots from the various spinoff series on Disney+.

Now let’s not forget how profitable theatrical releases can be.

Some of WBD’s DC productions have been extremely profitable in theatres. It would be an absolute waste, and irresponsible for Zaslav not to maximize the use of this incredible cash register.

Management’s strategy analysis conclusion

Therefore, it seems wise that WBD does not adopt a streaming-first mindset. WBD’s content portfolio is simply too big for the current streaming market. The right strategy is indeed the one it is engaging in already. Make full use of its linear TV and theatrical cash registers whilst waiting for its other streaming competitors to raise their prices so that WBD’s own streaming cash register can mature at the right pace.

Coffee Break!

Analysis of WBD’s debt

WBD’s huge debt is a major reason why many investors shy away from the company. Let’s dig in deeper below!

How much debt does WBD have?

Taking into account the $6 billion in debt WBD paid off in August, WBD should have a total debt figure of $47 billion. Compared to its peers, its debt levels are on the higher end. In an increasing interest rate environment and an anticipated economic downturn, companies with high debt levels are more at risk of going bankrupt. As such, the market has punished the stock. But let’s dig more into it.

How much of its debt is short-term?

According to management’s presentation, only 29% of total debt, or $13.6 billion of debt is due within the next 3 years. Fortunately, the average maturity of its debt is 14 years.

What is the interest rate on debt?

The average cost of debt is 4.3%. Fortunately, 87% of its debt is fixed, while 13% is variable.

Management Expectations

WBD defines gross leverage target as gross debt divided by the sum of the most recent four quarters’ Adjusted EBITDA. Thus, to make sense of their expected gross leverage target of 3.0x by the end of 2024, we have to take a look at management’s expectations of adjusted EBTIDA as well.

Management expects an adjusted EBITDA of $9 Billion for 2022 and $12 Billion for 2023. I will conservatively assume an adjusted EBITDA of $13 Billion for 2024. Based on this assumption and taking management’s expectation of a 3x gross leverage ratio for 2024, it implies a debt target of $39 billion. That means that the company will pay down at least 8 billion of debt in 2023 and 2024.

At the surface level, this seems a reasonable goal to meet. Management has targeted $3 billion in cost synergies. Thankfully, during the last earnings call, CFO Wiedenfels stated the $3 billion target might be conservative. “I am very pleased with how well the program has progressed so far and based on the savings potential in our initiative funnel, I have full confidence that we will expect at least $3 billion of synergies overall, with $2 billion to $3 billion of synergy realization in 2023. Naturally, we'll update the market regularly as certainty on value and timing increases.” Q2 Earnings Call. Retail investors can confirm management’s moves by assessing the various measure already reported in the news. Here are some of management’s latest corrective measures:

1. Shutting down CNN

WBD’s management shut down CNN+ a few weeks after it launched. The executive who helped design CNN's streaming strategy, Andrew Morse, also departed. It was said that CNN+ got off to a slow start, reportedly attracting just 10,000 viewers a day. WBD saw this and immediately axed the program and changed course. "CNN will be strongest as part of WBD’s streaming strategy which envisions news as an important part of a compelling broader offering along with sports, entertainment, and nonfiction content,” CNN Worldwide Chairman and CEO Chris Licht said in a statement. Going forward, Licht said CNN will focus its resources on its core news-gathering operations and building CNN Digital. Personally, I think whoever proposed CNN+ should have been fired straight away. In the age of social media, who would pay to stream news?

2. Layoffs

In mid-June, WBD announced that it would slash 30% of its advertising sales team. The division has 3,000 employees and plans to cut up to 1,000 jobs.

In August, WBD let go of 70 HBO Max employees, roughly 14% of staff under head content officer Casey Bloys. This move was made to pave the way for HBO Max and Discovery+ being combined into a single service set to launch in the United States next summer. HBO Max’s unscripted spaces were impacted the most by the layoffs. Logically, they downsized given Discovery’s successful footprint in the unscripted realm.

3. Shutting down high-cost projects

WBD shut down the production of ‘Demimonde’, a science-fiction drama by American filmmaker and 'Star Wars director J.J. Abrams. Abrams had requested a budget of more than USD 200 million. By contrast, HBO's upcoming 'Game of Thrones prequel House of the Dragon' has a budget of less than USD 200 million. Because of this, in early June 2022, HBO/HBO Max head Casey Bloys opted to part ways with the series. The difference between the previous management team and the management team under Zaslav couldn’t be more different.

Apart from Demimonde, two films slated for an HBO Max release — "Batgirl," starring "In The Heights" star Leslie Grace, as well as "Scoob!: Holiday Haunt" — have also been pulled. The DC Comics film was nearly complete and cost the studio a reported $70 million to $90 million to produce. "We can't find an economic case for direct-to-streaming film. Launching expensive movies directly to streaming doesn’t make economic sense”, Zaslav said. “Batgirl” cost $90 million to make. “Our conclusion is expensive direct-to-streaming movies, in terms of how people are consuming them on the platform, how often people buy a service for them, how they get nourished over time, is no comparison to what happens when you launch a film in the theatres,” Zaslav said. “This idea of expensive films going direct to streaming, we can’t find an economic value for it, and so we’re making a strategic shift.”

It seems that the culture is perhaps set: unless the content produced is economical, it should not be made. That's a shareholder-maximizing mindset!

4. Selling Assets

Just 3 weeks after announcing the merger with WarnerMedia, Discovery sold its Great American Country Network.

It’s clear that management is pulling as many levers as it can to reduce WBD’s debt load.

Can WBD’s FCF pay off its near-future debt?

According to management, the company will be able to generate a free cash flow of around $3 billion in 2022 and $4 billion in 2023. This is more than enough to cover the $1.3 billion due in 2023 and $4.3 billion due in 2024. I think this is a reasonable estimate and am confident in management’s figures.

WBD’s debt analysis conclusion

From my analysis, it is obvious that WBD does indeed have a massive amount of debt. Fortunately, most of it is not due anytime soon and has a fixed interest rate. What debt is due in the coming years can easily be paid down with its expected free cash flows. Moreover, having seen how quickly and effectively the cost-cutting measures were executed, I think it is likely that WBD’s debt load will not pose a problem.

Let’s wrap up!

As I mentioned at the start, here are the market’s perceptions of WBD.

After my analysis, here are my perceptions of WBD

Clearly, I think that many of the market’s perceptions about WBD are misguided, which may make WBD an interesting stock to own.

Up Next!

I will be analyzing WBD’s financials. Has WBD’s current stock price accurately priced in its risk and reward? Do I think it is a good investment? What are you waiting for? Subscribe to not miss out on our next drop!!!

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own due diligence or consult a financial advisor. Investing includes risks, including loss of principal.

Thanks

When will part 2 be ready?