Paramount Deep Dive Part 2

Analyst: Joshua

Time to read: 20 min

First, I’d like to welcome new readers to The Retail Deep Dive. So glad to have you join us! Our mission is to analyze companies with exciting prospects and unpack them logically for our readers.

This month’s deep dive is on Paramount (PARA), another media behemoth, and an upcoming streaming player. The man himself, Warren Buffet, owns a 10% stake in PARA. But let’s discover PARA for ourselves!

We decided to split our research into 2 separate articles to break it down nicely for you. The first article will be an analysis of PARA, while the second article will evaluate PARA’s financials. This is the second article.

PARA Financials

To find FCF, we have to look at OIBDA, management’s favoured metric.

To find OIBDA, we need to see if management can hit its revenue goals.

To assess management’s revenue targets, we need to see if management can hit its 2025 DTC subscriber target.

So here’s the breakdown of today’s article!

Breakdown

Estimating the 2025 subscriber count

Estimating 2025 revenue

Analyzing Revenue

Analyzing EBITDA

Analyzing FCF

EV/EBITDA Valuation

Conclusion

Definition of Subscribers

PARA’s subscriber number includes:

(i) Customers with access to our domestic or international streaming services, either directly through our owned and operated apps and websites, or through third-party distributors.

(ii) Our subscribers include paid subscriptions and those customers registered in a free trial, and subscribers are considered unique to each of our services, whether offered individually or as part of a bundle.

There are 2 things about PARA’s definition of subscriber that I do not l like. Firstly, the company is including free trial customers as part of their subscriber count. This is very misleading. Another thing that we have to be aware of is the potential overlap in customers among their different streaming platforms. Overlapping customers in Pluto and Paramount+ doesn’t really matter as Pluto is a FAST service while PARA+ is a subscription-based service. However, overlapping customers in PARA+ and Showtime matters as there is a possibility that PARA may combine the two streaming platforms together. If the two platforms do indeed merge, the subscriber count may have to be rebased, and that may be ugly.

Estimating 2025 Subscriber Count

Note: PARA does not breakdown its subscribers for the Others category

We know that PARA ended Q2 2022 with 43M PARA+ subscribers and 64M total subscribers. It is important to keep in mind that Pluto’s subscribers are not included in the total subscriber count. This is because it does not have subscribers, but rather MAUs (monthly active users). Pluto ended Q2 2022 with 69.9M MAUs. Please note that subscribers and MAUs are two different things and should not be combined.

Management is targeting 100M total DTC subs by 2024. Based on this, I estimate that PARA may add 16, 14, and 14M subscribers in the years 2022, 2023, and 2024 respectively. Now, let’s check if management’s estimates make sense.

Checking Management’s Expectations

Looking at PARA’s Historical Growth Rate:

PARA added 36.9M subscribers in 2021.

Thus, we think the goal to add 16M subscribers/year till 2024 is reasonable.

Looking at DIS’s Current Growth Rate:

For this comparison, we will only take reference from DIS+ and not HULU or ESPN+, as HULU started many years before WBD and ESPN+ is purely focused on sports.

Disney+ added 45M subscribers in 2021, its 2nd year of operating the streaming service. Disney+ added 12M subscribers in Q1’22. At this annualized run rate, they are set to add 48M subscribers in FY22.

Currently PARA has lesser franchises under its hood than DIS has, so we can expect PARA to grow at a slower rate than DIS.

Thus, we think that PARA will be able to hit ~16M subscribers/year by 2024.

Looking at WBD’s Current Growth Rate:

WBD’s management expects WBD+(the name for the combined service of HBO Max and Discovery+) to have 130M subscribers in 2025, which means an addition of 16.4M subscribers every year from now till then.

Currently PARA has lesser franchises under its hood than WBD has, so we can expect PARA to grow at a slower rate than WBD.

However, PARA has 30% fewer subscribers than WBD, so PARA may experience faster growth than WBD, purely based on the law of numbers.

Thus, we think PARA will be able to add 15M subscribers/year till 2024.

Deal With Walmart+

According to Consumer Intelligence Research Partners (CIRP), Walmart+ subscriptions currently stand at 11M in the U.S. If all WMT+ members use Paramount+, PARA immediately bumps its subscriber count from 43M to 54M. This will definitely be a catalyst for Q3 and Q4 earnings reports.

Under the terms of the deal, Walmart agreed to pay between $2 to $3 per subscriber per month for Paramount’s ad-supported plan, so long as the users activate their accounts, according to the people familiar with the deal. In such partnerships, streaming services typically get around half the per-user subscription revenue that they would get by selling to consumers directly. Paramount+’s ad-supported plan costs $4.99 a month.

Global Rollout of PARA+

As highlighted in my previous article, PARA+ is currently rolling out in many new countries.

Management also noted that the new launches will be within the hard bundle offer, which implies low costs for the acquisition of users (CAC) and a low churn of subscribers. This combination allows me to reasonably conclude that PARA will see superb subscriber growth in the next couple of years.

Taking the average of the 3 growth rates, and accounting for the bundling with Walmart+ and its global expansion, I think PARA will be able to add 16M subscribers/year till 2025. This slightly exceeds management’s estimates, so their target estimate is likely attainable. If true, and PARA can add 16M subscribers every year till 2025, they will have a total of 128M subscribers by 2025.

However, we must account for PARA’s misleading definition of subscribers and the possibility of subscriber numbers being reduced as duplicate subscribers are eliminated when PARA combines PARA+ and Showtime into a single streaming platform. I will assume that the number of free trial subscribers and duplicate subscribers makes up 20% of the total subscriber numbers. This means that the total subscriber count is likely to stand closer to 102M by the end of 2025.

There are currently almost 1.7B TV households in the world. Out of that, let’s assume 400M is in China. That means the market opportunity today is almost 1.3B households. Let’s further assume that only 80% of these households actually regularly use their TV and will move to an OTT service. If true, the opportunity now stands at 1B households. Jason Kilar, the former CEO of Warner Media commented: “I don’t think the ceiling is 222 million subscribers. I think the ceiling is far closer to 1 billion. You get there by giving customers a choice.” “The choice” refers to ad-tier subscription plans. If he is right, there is still a long runway for growth in streaming, and our projections are well below the theoretical limit of streaming subscribers.

Estimating 2025 Revenues

So I think that PARA will have 102M subscribers in 2025, but how much revenue does this translate to exactly?

1. DTC Revenues

PARA’s current streaming plans have the following price tags:

In my NFLX article, I estimated that NFLX 2025 global ARPU would be $13, and WBD’s global ARPU would be $11. Because PARA’s content is likely to rank behind its peers, I estimate that PARA+ can safely earn $9. However, in contrast to WBD and NFLX which are marketing their streaming platform directly to customers, PARA is more focused on bundling PARA+ with other services. This is good as it helps get convert new subscribers quickly. However, it means that PARA will have to share its revenues with partners. In its Walmart+ deal, Walmart agreed to pay between $2 to $3 per subscriber per month for Paramount’s ad-supported plan, which on its own costs $4.99 a month. This is 50% of the DTC price tag. To account for its revenue-sharing agreements, I think in the end PARA’s ARPU in 2025 may be around $7. Now let’s try to estimate PARA’s DTC revenue in 2025.

However, we need to account for revenues earned from Pluto TV, which doesn’t add its MAUs to the number of subscribers. According to Statista, Pluto TV is set to earn $1.14B in revenues this year. If I estimate Pluto TV will grow at a 10% CAGR, which is conservative based on its historical CAGR of around 75%, it should be able to earn $1.67B in 2025.

Therefore, based on my estimates PARA will likely earn revenues in 2025 amounting to 8.6 + 1.7 = 10.3B.

2. Network Revenues

An assumption I made is that Network revenues fall by 3.8%/year up till 2025. This is based on research by Statista which I elaborated on in my previous article.

Networks made 5.2B in Q2. If we extrapolate this for this year, PARA will earn a total of 20.8B in FY22. If Network revenues fall by 3.8% per year till 2025, PARA’s 2025 Network revenues will total $18.5B.

3. Filmed Entertainment

Filmed Entertainment made $1.3B in Q2. If we project this for this year, I estimate PARA will earn a total of $5.2B in 2022.

PARA has had very good box office releases this year. However, to be conservative, I don’t think we should have these expectations going forward. Instead, I will assume an annual revenue of $4B for this segment going forward.

Below are my projected financials.

Note: Gross leverage = Total debt / Adj EBITDA

“We remain focused on our goal of reaching over 100 million global D2C subscribers and generating at least $9 billion in D2C revenue by 2024.” CFO, Naveen Chopra. As you can see from the above table, my projections for DTC revenues are slightly below management’s.

Revenues

Note: Based on analyst estimates on 10 Oct 2022

Note: EBITDA above is OIBDA

Management Expectations

Despite macro tailwinds, management expects ad revenues to remain robust till the end of the year. This is because of:

“2 important new category tailwinds that we'll see probably late Q3 and certainly Q4. The first is pharmaceuticals. That came back big in the upfront. That's super important to us because it's a big category for us given our demographics and specifically the demos of CBS. And the second is political. We're expecting advertising related to the midterm to be very strong given what's going on there. And I'd note that historically, that's really a stations business and for sure, it will be a stations business this year. But also with targeting, we see IQ and Pluto playing there and therefore benefiting as well.” Bob Bakish Q2 Earnings call.

Beyond that, management has not given guidance for future revenues.

Analyst Expectations

Analysts expect future revenues to grow at 4% over the next 5 years.

Sense Check

In my previous article analysing the decline of linear TV, I estimated that traditional media conglomerates may have a growth rate of around 3.9% in the future. Since this is close to analysts’ expectations of 4%, I think the sell-side est does make sense.

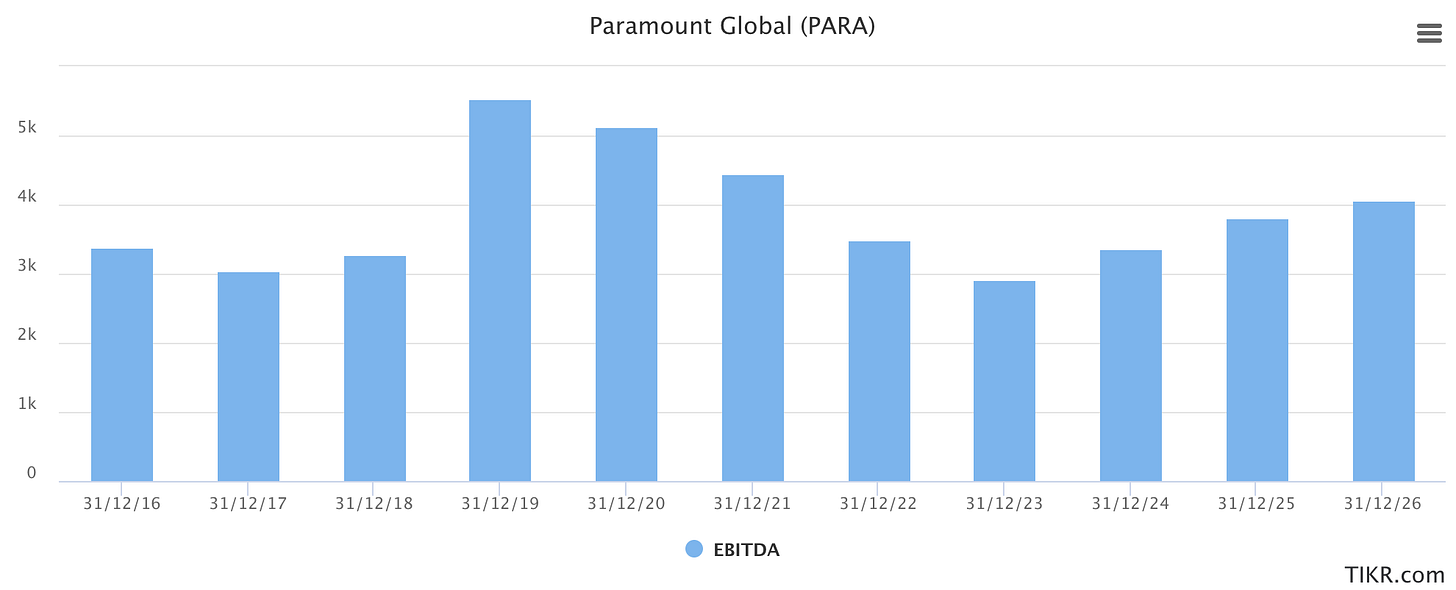

EBITDA

Management’s Definition of OIBDA

Source: 2021 Annual Report

Management Expectations

“We continue to forecast D2C OIBDA losses will be greatest in 2023 and then improve in 2024.“ Q2 2022 Naveen Chopra

“In the second half of the year, we expect TV Media OIBDA to return to modest growth on a year-over-year basis.” Q2 2022 Naveen Chopra

Analyst Expectations

Analysts expect EBITDA to grow 5.4% till 2025 and reach $3.8 billion in 2025.

Free Cash Flow

Management Expectations

Sadly, management has not given much guidance regarding future free cash flows, so we will have to rely on analyst expectations.

Analyst Expectations

Analysts expect FCF to grow 34% over the next 4 years and the company to have a FCF yield of 11% in 2026.

EV/EBITDA

PARA is currently trading at an EV/EBITDA multiple of 7.7x, compared to its 3Y historical multiple of 8x.

Comparing PARA and DIS till 2026, PARA can trade at a relative 11x multiple.

Comparing PARA and WBD till 2026, PARA can trade at a relative 10x multiple.

Comparing PARA and NFLX till 2026, PARA can trade at a relative 9x multiple.

Comparing PARA to a Linear TV company in the past.

After all, if all Linear TV operations are ported over to Streaming, Streaming will become the new Linear TV. To determine what is an appropriate Linear TV company multiple we will use the 10-year average of the legacy media conglomerates.

DIS's 10-year average historical multiple was 18x.

DISC's 10-year average historical multiple was 10x.

PARA's 10-year average historical multiple was 9.5x.

Thus, it can be argued that PARA could trade a multiple of 11x in the future.

As I find it hard to distinguish the probabilities of each multiple derived above, I shall just take the average of ~10x as my Normal Case multiple for PARA in 2025.

Based on a relative comparison with its peers, I have chosen the following 3 cases:

So the three cases are:

Normal Case Multiple: 10X

Streaming wars end and PARA ranks as the 5th largest streaming platform behind DIS, WBD, AMZN, and NFLX. Moreover, it manages to carve out a market for itself by bundling PARA+ with other 3rd party services.

The streaming business is slightly more profitable than the linear business.

Bear Case Multiple: 7X

Streaming wars continue.

The streaming business is less profitable than the linear business.

Bull Case Multiple: 14X

Streaming wars end and PARA realises that bundling its services with other 3rd party services is the right streaming strategy.

The streaming business is much more profitable than the linear business.

Using the current stock price of $19 and analyst estimated 2025 EBITDA of $3,846M with scenario analysis, weighting 80% for the normal case and 10% for the other 2 cases, combined with a final 10% margin of safety, I get a TP of $29.9 for 2025, representing a 57% upside from today’s prices (12% CAGR).

Looking at the current macroeconomic environment, it is also possible that analysts overstated 2025’s EBITDA. To be conservative, let us use a lower 2025 EBITDA estimate of $3,600M. For this case, with a margin of safety of 10%, we have a TP of $26.6 for 2025, representing a 40% upside from today’s prices (9% CAGR).

In the above 2 scenarios, I used a margin of safety of 10% compared to the 15% I used in my analysis of WBD. This is because PARA has been operating as a merged entity longer than WBD has. Because of that, PARA is already en route to the execution of its management’s plan. On the other hand, WBD is just starting to put a plan into place and thus inherently has more uncertainty.

PARA’s returns do not meet my personal active investment hurdle rate, so I will wait for PARA’s price to fall to $17 before I consider initiating a position.

Final Judgement

In my introductory article, I listed the market perceptions of PARA.

Now, let us judge if they are sound.

Massive and High-Quality content library

Based on my analysis, it is true that PARA does have a massive and high-quality content library. It seems to have a larger offering of sports content compared to WBD and equally strong movie franchises. However, PARA loses out on content spending. It is spending remarkably less than its peers, which means that it will likely not be able to build out as much content on its IPs as its competitors plan to.

Top Gun Maverick

PARA had an amazing year at the box office. It earned 6 number 1 box office hits this year. However, I don’t think it is reasonable for investors to focus on this and expect such remarkable performance in the future. In 2021, NFLX won the most Primetime Emmy Awards, but WBD is in the lead this year. Therefore, I think that investors who overly focus on PARA’s recent success of Top Gun Maverick are overly optimistic, and this may reflect in some hype in the stock.

Dividend

I honestly have no idea why PARA is paying out a dividend now. The streaming wars are only just getting started! NFLX is rolling out an ad-tier subscription later this year. WBD is combining HBO Max and Discovery+, and DIS is likely to buy over HULU. Investments into content among the different players are still ramping up. Yet, PARA still wants to pay a dividend knowing full well its content spending lags far behind its peer. Therefore, I think it is highly likely that PARA will have to cut its dividends in the future. If this happens, there is a risk that PARA’s stock price may go lower similar to how dividend investors fled from WBD after its spinoff from AT&T.

Management

I really like management’s strategy of flexibility. Firstly, they quickly adopted a 45 theatrical window before moving the content onto its streaming platform. This turned out to be successful. Management was also smart to purchase Pluto TV. As of now, DIS, NFLX, AMZN, and WBD do not have an alternative and Pluto TV is already profitable. Moreover, management also adopted the strategy of putting hit streaming exclusive Originals into theatres. As seen by the recent theatrical release of Smile, this strategy works well. Therefore, I see a management team that is agile in adjusting to change. That’s great!

Massive Debt in a higher interest rate environment

It is true that PARA has a high debt of $17B. However, 90% of it is due after 2026, so it is not something that can’t be handled.

Competitive and unprofitable nature of the streaming wars

Based on my analysis, streaming as a whole is currently underpriced as players strive to get market share. However, eventually, streaming prices will have to rise and an equilibrium will be reached. Fortunately, PARA does not have to continuously lose money while waiting for this deliverance. It can bank on its profitable TV Media and Filmed Entertainment businesses. Thus, the market’s fear of PARA is overstated. Moreover, management is leveraging partnerships with external services to be able to gain a larger number of subscribers with lower acquisition costs and lower churn rates.

Declining linear TV business

Based on my analysis, PARA’s cable business is declining, but not as exponentially as people think. It owns the number 1 most watched TV Network and the number 1 most watched Children’s Network. Moreover, its streaming business is growing faster than its linear business. Thus, the market’s fear of PARA’s cable business is unfounded.

Overall, I really like PARA. It shares many parallels with WBD. However, I think its returns based on the current price are not as tempting as WBD’s, so I will hold out on investing in it. Additionally, although its global rollout of PARA+ may lead the company to experience high near-future growth rates, I think there is a real possibility of the dividend being cut which may cause further downward pressure on price. So, beware!

What do you guys think? Leave it in the comments below!

Up Next!

You decide which company I analyse next!

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own due diligence or consult a financial advisor. Investing includes risks, including loss of principal.