Lululemon Deep Dive Part 2

Analyst: Juleon

Time to read: 15mins

First, I’d like to welcome new readers to The Retail Deep Dive. So glad to have you join us! Our mission is to analyse companies and unpack them logically for you.

This month’s deep dive is on Lululemon (LULU), one of my favourite companies.

We decided to split our research into 2 articles to break it down nicely for you.

Part 1 → focuses on the Qualitative analysis (business model, industry and competitive landscape, moats and investment theses) of the company.

Part 2 → focuses on the Quantitative analysis (financials, complete projections, and model release) of the company.

This is the second article. Let’s begin!

Disclaimer: I do not own shares of LULU.

Breakdown

Theses Recap

Revenue Projections & Cost Projections

Margin Analysis

Valuation Methodology (RV/DCF)

Theses Recap

Welcome back! In our first issue of the Lulu deep dive, we covered the qualitative aspects of the company (business model, revenue drivers, the product pipeline, the industry and competitive analysis, moats, theses, and finally the risks) - if you’ve yet to give that a read, feel free to find the 1st issue here. It’ll frame your knowledge on the company so that you can appreciate this piece more. Before we dive into the numbers, let’s recap the company moats and my investment theses.

Moat 1: Product Quality Excellence

Lulu’s highly-technical performance-wear apparel trumps the quality of peers

Moat 2: Superior Brand Loyalty

Lulu’s guests have an unbridled passion and loyalty to the brand, owing to the company’s grassroots marketing approach

Moat 3: Vertical Integration + No Wholesale Approach

Lulu’s intentional no-wholesale approach guarantees quality and exclusive distribution, justifying their premium prices

Thesis 1: Lulu’s DTC Hedge Is Exceptionally Strong

DTC sales have shown little to no normalization post the grand-reopening, and since the channel commands 2x the operating margins relative to the COS channel, a sustained push in this vertical should culminate in long-term margin accretion.

Thesis 2: Adjacent Market Expansion Entirely Feasible

Management’s aggressive push internationally and in the menswear channel has held so far held the test of time, and further penetration into the Chinese markets (which has a historical proof of concept) could elevate sales to the next level.

Revenue Projections

Just to preface so that you guys can follow along, Lululemon ends their fiscal year in January. Meaning in financial terms, the full calendar year performance for 2022 is termed FY23 since the 4th quarter ends in January 2023.

2021 full-year performance = FY22 in the model

2022 full year performance = FY23 in the model

The most recent 3rd quarter is termed Q3’23.

Company-Operated Store (COS)

The COS segment has historically accounted for the largest bulk of sales, weighing about 56% of overall sales for the past 5 years on average. This revenues are driven by the average total gross square footage of stores and comparable store sales and new store productivity. Since square footage of stores is then in turn driven by store count, a view on store count is necessary.

Source: My Model (Gumroad)

Lululemon ended their most recent quarter with 623 stores, up 49 stores (+8%) since the end of their last fiscal year 2022 (full year 2021). Management has already noted that the majority of future store growth is likely to be in the APAC markets as PRC takes up a larger chunk of sales. With PRC store count of 86 ending FY22 (71 in mainland China, 9 in HK, 5 in Taiwan, and 2 in Macau), i project this to grow to 236 by FY27, in the next 5 years. That would represent a 170%+ growth in nominal value, an average of 23% for the next 5 years. I intentionally front-loaded the growth in the earlier years.

While this is indeed aggressive, they aren’t too far from management’s own 220 stores in PRC goal within the same timeframe. I project more aggressively given that management always tends to underpromise but overdeliver, and also because I think the trend towards healthy living in China is likely more potent than most people are expecting. Growth was also intentionally front-loaded as China has finally pivoted from their zero-Covid policy.

For the North America segment, i anticipate minimal growth in the US and none in Canada (flatlined largely using historicals).

Source: My Model (Gumroad)

Overall i expect store count to jump to 817 by FY27.

For the gross square footage growth, i estimated the rates based on the average change in relation to the historical store count change. Given that management has quite a good track record with regards to same store sales, I estimate positive SSS growth leading up to FY27, with FY23 seeing +11% in SSS growth. For those that are unaware of what SSS growth, they just refer to the sales of a store in relation to its sales in that exact same store in the previous accounting period.

I expect positive growth predominantly to originate from a higher average order value (AOV) and increased traffic as consumers return to in-person shopping. To factor in the reality that the revenge shopping phase has already played out to a certain extent, I do taper growth rates downwards for future years. Regardless, consumers are still flush with cash and elevated demand should continue for some time.

Source: My Model (Gumroad)

For my overall COS estimates, i expect revenues close to $3.5B for FY23, representative of a 25% growth yoy. If we look to the 1st 3 quarter results for FY23 and annualize sales for Q4 to come up with an estimate for the full year, that would total about 3.38B, and so my estimates factor in a Q4 that outperforms Q1-3.

Direct-To-Consumer (DTC)

The strength in the DTC channel is one of the strongest factors for Lulu. While management did not explicitly break this segment down to its KPIs, I have projected sales from transaction count and an ARPU estimate. I estimate historical ARPU/AOV to be $120 which somewhat falls in line with the price of a core Lulu legging product, and expect ARPU/AOV size to grow minimally moving forward. While not every customer will have a basket size worth that amount, we know that the highest spenders at Lulu spend thousands a year.

Source: My Model (Gumroad)

Based on my DTC estimates, I expect FY23 sales to total $3.3B, +20% yoy. While far lower than the +50% yearly average the past 5Y in the DTC channel, and there has been some normalization ever since economies have reopened and people can travel, this is still quite an aggressive estimate and if hit, shows the strength of their online approach. If we look to the 1st 3 quarter results for FY23 and annualize sales for Q4 to come up with an estimate for the full year, that would total about 3B, and so my estimates factor in a Q4 that outperforms Q1-3. Besides this $3.3B est in total sales for FY23 is just a tad bit lower than estimated COS sales of $3.5B.

Other Revenues (OR)

Source: My Model (Gumroad)

Lastly, for the other revenue segment which management also does not explicitly break down, i estimate MIRROR sales to grow in the high teens for the next 2 years before normalizing down to the low teens for the following 3Y. As a percentage of overall other revenues, MIRROR sales accounted for 20%, and i expect this to dwindle slightly to 17%. For the other components within the ‘OR’ segment, i flatlined their average historical growth at 9%. Overall, I expect ‘OR’ sales for FY23 to total 770M and $1.3B by FY27.

Revenue Component Summary

Overall, I expect revenues in the next 5Y to grow at an average of +17%, lower than the +22% average in the past 5Y. The majority of topline growth is likely to still be generated from the COS segment, specifically the push into APAC through more store openings and increased reach. With regards to FY27 numbers 5 years down the road, I am anticipating management to beat their own target of a $12.5B topline by then. Management’s FY27 topline goal of $12.5B is as per their new Power of 3 growth strategy, where they expect to double FY22 numbers.

Comparison To Analyst Estimates

Source: My Model (Gumroad) + Source: Tikr Terminal

Comparing my own projections to analyst estimates, my revenue estimates are more on the aggressive side. While their FY27 revenues are projected to be higher than management’s $12.5B guidance as well but lower than mine, they seem to be expecting growth to be front-loaded in the earlier years, with FY23 revenues estimated to be higher than my own at $8B vs my own $7.6B.

Cost Projections

Moving on to cost projections, the majority of Lululemon’s cost as an apparel company is tied up in cost of goods sold (COGS) and operational expenses for the 3 different revenue channels.

Cost of Good Sold (COGS)

The cost of goods sold expense line item is inclusive of manufacturing expenses, D&A, and transportation. Transportation costs have been elevated due to supply chain issues and have been highlighted by management in their earnings call. Since D&A is part of COGS, i project COGS (excluding D&A) first, using historicals as a benchmark and elevating expense upwards to account for sustained inflation and higher transportation costs for FY23, before adding D&A back to total the actual COGS line item. While COGS as a percentage of overall sales totaled 42.3% last year to deliver a 57.7% gross profit margin, I expect this expense to be slightly elevated for the full year ending January 2023 at 44% and gross margins to compress 170bps to 56%. As such one-off costs taper off moving into the future, i then expect minimal margin accretion.

Operational Expense (OPEX)

Source: My Model (Gumroad)

For the OPEX segment, I projected it as per EBIT margins for the 3 revenue channels. I expect margins to normalise upwards as inflation tapers, and for the other segment operational margins, I broke that down into MIRROR EBIT margins and overall other operational margins (excluding MIRROR). The entire ‘other revenue’ segment is profitable on a EBIT basis, but MIRROR isn’t.

However, given the elevated marketing costs associated with the MIRROR segment as well as a front-loaded rollout strategy, I expect MIRROR to become profitable on an operational basis by FY26. MIRROR EBIT margins were -76% in FY21 before dropping to -23% in FY22. I expect this loss to continue to minimize down to the low teens before inflecting from 2025-2026. Regardless, on a broader level, this does not seem to add a lot of margin accretion given that i don’t expect the ‘OR’ segment to take up more than 10% of overall sales.

The next biggest expense line item is selling, general and administrative expenses (S,G&A) which accounted for 36% of overall sales in FY22. This is also single-handedly the biggest line item under operational expenses. This includes both the operational expenses from each of the 3 revenue channels as well as general corporate expenses, the latter of which is elevated upwards to account for inflation before tapering. However, as marketing costs somewhat normalise and come down from the recent highs due increasing competition, I also expect S,G&A expenses to relieve slightly.

Other Expenses

For the PPE schedule:

I took a D&A average of 4%

I took a CAPEX spend average of 8% for FY23 before tapering down

I intentionally elevated it to account for the further store rollout in APAC

Effective Tax Rate maintained at the historical average

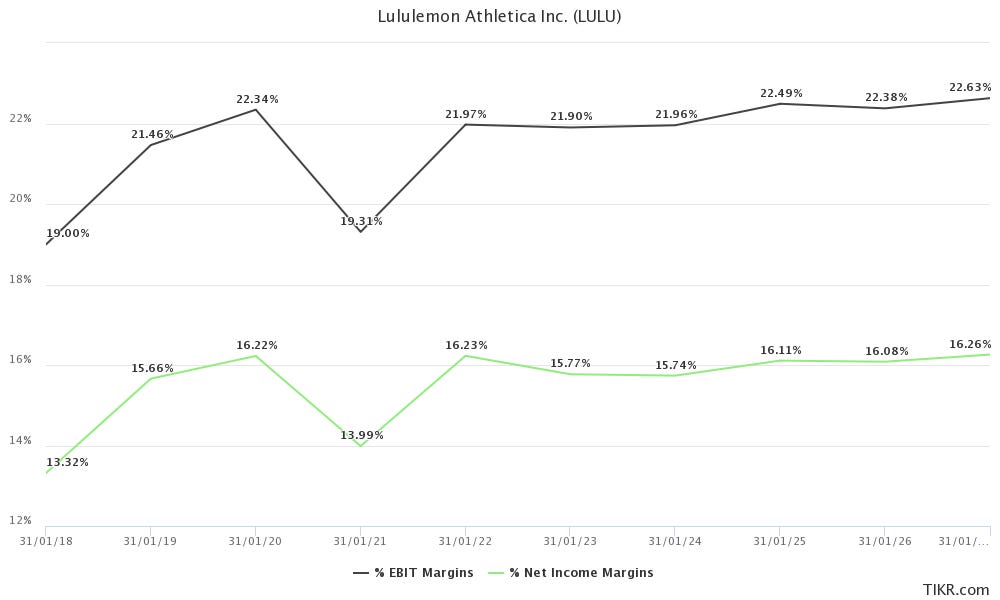

Margin Analysis

Factoring in the above revenue and cost projections, here are my corresponding margin estimates.

Source: My Model (Gumroad)

In essence, I expect margin accretion originating from inflation tapering, the DTC channel which commands higher operational margins to maintain its strong hedge, MIRROR turning profitable in FY26, and S,G&A costs to come down from elevated marketing costs and wage inflation.

Source: Tikr Terminal

Once again, comparing my estimates to analyst projections, mine are certainly on the more optimistic side. I expect management to deliver better on the topline and still rein in costs.

Valuation Methodology

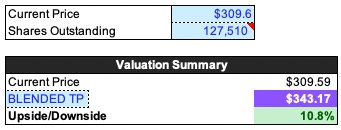

I employed a blended valuation methodology, deriving half my valuation from a discounted cashflow and the other half from relative valuations.

9.5% WACC

DCF Valuations hint at a 22% downside

Relative Valuations hint at a 43% upside, using an EV/EBIT 75th percentile exit multiple (25.2x) relative to peers

Source: My Model (Gumroad)

I believe using the 75th percentile 25.2x EV/EBIT multiple is a fair one given that Lulu has historically never been cheap, always traded higher than peers owing to their premium business and branding, and also because this multiple is conservative relative to its own historicals.

Lulu’s 5Y historical EV/EBIT mean multiple is 37.3x, and so my multiple is more than conservative, and using the median EV/EBIT multiple (21.9x) would be way too conservative and unrealistic. I also don’t expect the ‘Lulu premium’ to ever fade and so multiples used with them should always be slightly inflated.

Source: My Model (Gumroad)

Blended, I get an upside of 11% and a TP of $343. However, since the upside is too minimal with no margin of safety, and management would need to be able to deliver on both their China push and maintaining their DTC hedge, I find the investment opportunity lackluster at the current price levels. Should prices scale back to about $260 which gives me a comfortable margin of safety, I will be initiating a position.

Conclusion

Don’t get me wrong, Lulu is an exceptional business with a tested and proven model and unparalleled customer loyalty that can’t be quantified, but good businesses don’t translate into good investment opportunities, and with the depressed valuations of so many other businesses, capital can probably be allocated more efficiently elsewhere.

Model Access

To access my full investment model, you can download it on Gumroad for just $4. We’ve provided you with the full 2-part deep dive and so feel free to use this model alongside the report.

The excel file will come with 3 main sheets:

3FS

Revenue & Cost Drivers

2 Valuation Methodologies (DCF + RV)

While you already know my position on the company, the model is especially useful for those interested in accessing the historical financials and more importantly, for those that want to customize my very own assumptions to fit your own narrative. If you have a differing view than us on the assumptions used, input your own numbers into the already-built model and see the resulting target price and impact on margins.

Thank you. Till next time.