Lululemon Deep Dive Part 1

Analyst: Juleon

Time to read: 40min

First, I’d like to welcome new readers to The Retail Deep Dive. So glad to have you join us! Our mission is to analyse companies and unpack them logically for you.

This month’s deep dive is on Lululemon (LULU), one of my favourite companies.

We decided to split our research into 2 articles to break it down nicely for you.

Part 1 → focuses on the Qualitative analysis (business model, industry and competitive landscape, moats and investment theses) of the company.

Part 2 → focuses on the Quantitative analysis (financials, complete projections, and model release) of the company.

This is the first article. It’s long, so grab a coffee and let’s begin!

Disclaimer: I do not own shares of LULU.

Breakdown

Introduction (Company History)

Price Analysis & Capital Structure

Business Model, Revenue Drivers, Product Pipeline

Industry & Competitive Analysis

Company Moats & Investment Theses

Risks (Systematic + Idiosyncratic)

Introduction (Company History)

Lululemon needs no introduction, but for context i shall still provide one. The athleisure giant was founded in 1998 in Vancouver, Canada by its revolutionary founder, Chip Wilson. With more than 24 years of operational history, the company went public in 2007, raising $330M.

Just to preface so that you guys can follow along, Lululemon ends their fiscal year in January. Meaning in financial terms, the full calendar year performance for 2022 is termed FY23 since the 4th quarter ends in January 2023.

2021 full-year performance = termed FY22

2022 full year performance = termed FY23

The most recent 3rd quarter is termed Q3’23.

Lulu literally pioneered ‘athleisure’, a new term that has come to refer to a hybrid style of clothing to be worn everyday - the wear is both athletic in nature and functionality but yet donned in a leisure setting. The company’s vision is to ‘elevate the world from mediocrity to greatness’, as they aspire ‘to be the experiential brand that ignites a community of people living the sweatlife through sweat, grow and connect’.

To understand Lulu, one should not picture merely them as yet another apparel company selling a tangible yoga product, but rather a firm selling a unique lifestyle experience that many want to be a part of. Their community of followers or ‘guests’ as the company calls it, is so huge and their loyalty unmatched, and this is the real value and strength of their brand. We will delve deeper into this later on.

Price Analysis & Capital Structure

Lululemon has had a rather resilient 2022, falling roughly 20% for the full calendar year, less than its peers within the apparel sector and less than other consumers companies and indexes. The consumer discretionary index for example, fell about 30% in 2022. Some reasons for Lulu’s resilience include:

Cult-like loyalty that somewhat insulates them from a fall in discretionary spend

Generally stellar earnings that show little impact to the core business

The recent pullback was primarily caused by inventory concerns, causing the stock to fall from an intra-year peak of $485 to sub $300 levels.

Business Model & Revenue Drivers

Demographic Profiles

Lulu’s target demographic is that of a 32Y old woman, given a profile known as ‘Oceana’, and a 36Y old male known as ‘Duke’. Their products can be considered to be premium activewear and hence command a higher price point. Teenagers and young adults are not the core customer for Lulu.

Business Model & Revenue Drivers

Lululemon primarily makes money from selling apparel and footwear in their stores and online, alongside collecting other revenues from their subscription MIRROR business. Management classifies revenues according to 3 main verticals.

1) Company-Operated Stores, 2) DTC, 3) Other Revenues

Company Operated Stores (COS)

This includes all revenue derived from the sales of products within any of Lululemon’s 600+ stores. End FY22, Lulu had 574 stores worldwide, but since then, management has expanded to grow store presence to 623 stores ending Q3’23. These retail-owned stores are owned and operated by Lulu, and they include all traditional, seasonal, and experiential stores.

Experiential stores refer to the megastores that Lulu has chosen to pursue more aggressively in the near future, often featuring a mass space more than 20,000 square feet, inclusive of locker rooms, fuel bars, workout studios for guests to participate in a yoga or HIIT session conducted in-house by brand ambassadors.

KPIs for the COS segment include:

new store openings

average square footage/store

comparable same-store-sales (SSS) growth → this is the holy grail for analyzing brick and mortar retail companies

Direct-To-Consumer (DTC)

In some consumer companies, selling directly to the consumer in-stores are also considered DTC, but in Lulu’s case, this strictly refers to digital sales that customers purchase online. KPIs for this segment include:

the levels of store traffic

average order value

Other Revenues

This refers to revenue collected through all other verticals. Warehouse sales and licensed stores sales where Lulu enters into licensed agreements with partners in certain target markets also fall under this segment. This component also includes sales through pop-up locations which refer to small-scale temporary booths that Lulu sets up to test the receptiveness of a particular geographic location to their products.

MIRROR sales (both hardware + subscriptions) also fall under here. MIRROR was acquired by the company in 2020 for $500M, and monetization comes through the sales of the entry-level hardware product and the recurring monthly subscription price for guests that use the product for at-home workouts.

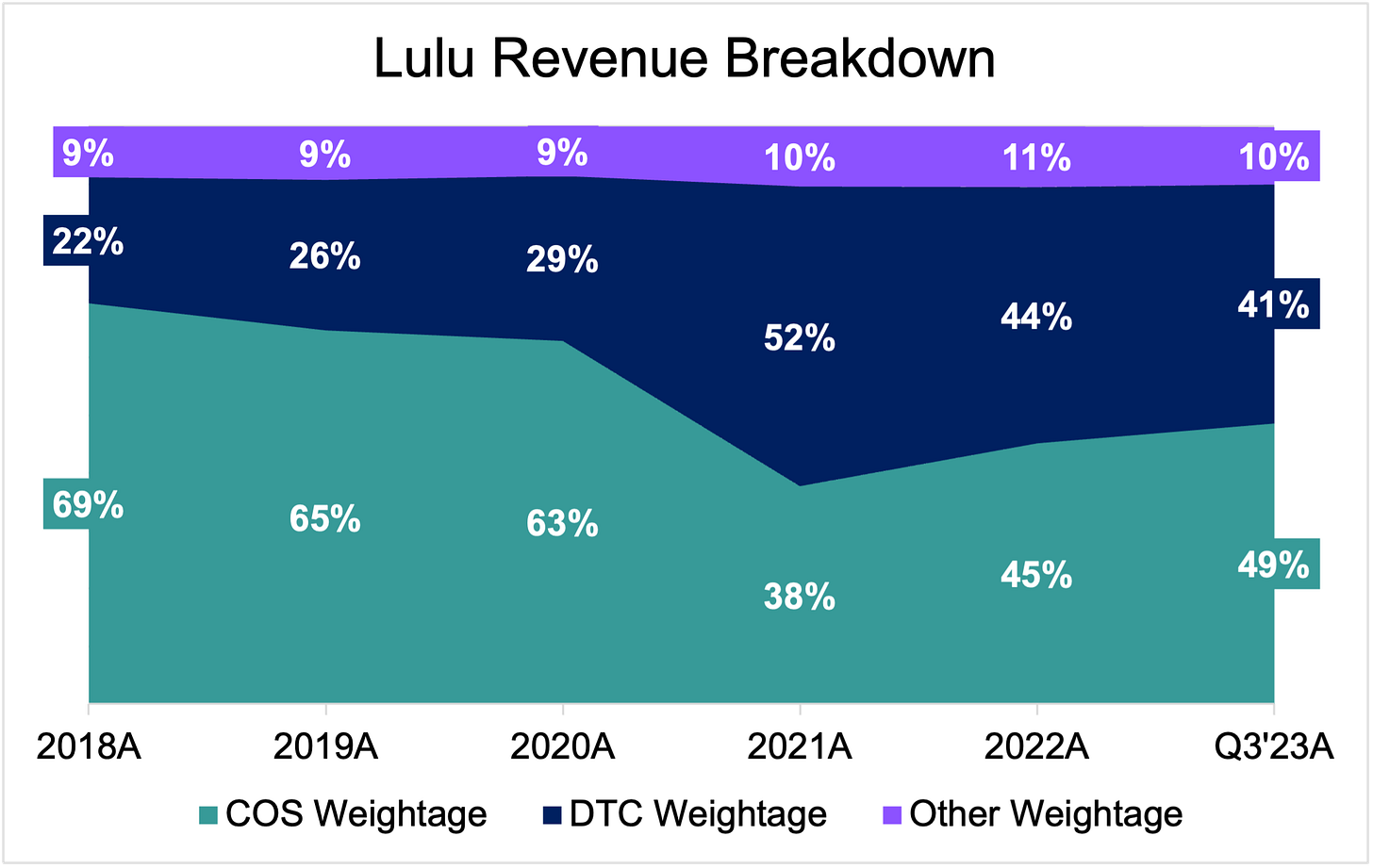

COS has always remained Lulu’s strongest sales channel, followed by DTC and ‘other revenues’. COS Weightage as a % of sales took a severe hit in 2021 due to the pandemic and the need to shutdown stores globally, but there has since been a strong resurgence as the world returns to normality. Latest Q3’23 data shows that COS sales continued to climb to 49% of overall sales for the quarter.

DTC sales continue to remain an important channel for the brand, accounting for 44% of FY22 sales with a slight normalisation in Q3’23.

While Lulu continues to rely heavily on physical retail stores to be a sales channel, they have realized the need to diversify away from it, and are investing heavily into building out their digital channel.

Store Count

Store count (ex franchise stores) has grown from 404 in FY18 to 574 in FY22, to the current 623 as per latest Q3’23 data. The majority of stores are concentrated in North America, given that US has the biggest TAM and Canada the country where Lululemon originated from. Canada’s store count plateau is likely an indication of saturation there, but US store count continues to grow at a +4% average the past 5Y.

What’s important to note, however, is management’s focus on growing store count in the international markets, where growth (denoted in purple) has averaged +28% the past 5Y (albeit starting from a lower base and hence the law of numbers skews the average percentage). Within the international segment, the concentration is no doubt in the PRC market, where store count growth (denoted in yellow) sits at an average +55% the past 5Y. As it is, the 15 PRC stores that Lulu had in international markets in FY18 represented 21% of the total international stores, but PRC presence has since grown to represent 46% of international stores. The 86 PRC stores that Lulu had in FY22 is broken down as such: (71 in Mainland China, 9 in Hong Kong, 5 in Taiwan, and 2 in Macau).

Geographic Concentration

Currently most of Lulu’s sales are concentrated in NA (both US + Canada), accounting for 85% of total sales. However, the clear downward line suggests that management is well aware of the geographic concentration and saturation risks, and are looking to APAC and EMEA to expand as the next phase of growth.

Product Pipeline

Lululemon sells quality technologically advanced products. Their products can be classified into:

Apparel - both for women and men

Footwear - solely for women for now through their debut ‘Blissfeel’ line. Men’s line to be launched in 2023.

Apparel

Under the apparel component, the company has 4 core categories, namely:

1) Yoga, 2) Run, 3) Train, and 4) OTM

On the move refers to non-performance wear, more so loungey casual leggings. This category features versatile outfits that women can wear comfortably to run errands in, travel, etc…

Yoga leggings is the core value proposition, given that that was what the company first started out with and the majority of their customers continue to be women. When Chip first introduced the Lulu leggings, his main motivation was to do so having observed a gap in the yoga industry, where women used to wear ballet and dance clothes that were too thin and transparent. Under the menswear line, Lulu’s flagship product remains to be the ABC pants (anti-ball-crushing pants), featuring a roomier crotch area to be worn for work/golf.

Apart from the core categories, other verticals include Hike, Tennis, Golf fits and a Self-Care Product line

Lulu’s self care line debuts 2 deodorants, lip balm, dry shampoo, and face moisturiser. The 5 items are gender neutral and come in both regular size and gym sizes. They will be sold at all the company’s outlets as well as their distribution partner Sephora.

Footwear

Lululemon introduced their shoe collection just this year itself, with CEO Calvin McDonald stating that:

“Footwear is the natural next step for us to expand and apply our long history of innovation in fit, feel and performance, and it represents an exciting moment for our brand,”.

Under the footwear line, Lululemon has so far released 4 styles with more planned for the year.

Blissfeel → Running shoes

Chargefeel → Cross-training shoe (both gym + running)

Restful → Post-workout slides

Strongfeel → Training shoe

Industry & Competitive Analysis

Next we shall move into the industry outlook and competitive landscape.

Total Addressable Market (TAM)

Source: Statista

The worldwide activewear market is valued at $366B in 2021, 48.5% of which is women. While the global activewear market is projected to grow at a 3.7% CAGR moving forward, the women’s market is projected to grow at 5.3%, flipping menswear by 2024, and accounting for 53.2% of the activewear market by 2027.

Looking more specifically into the market that Lulu’s core product operates in (yoga), the yoga market is projected to grow even faster relative to activewear at a 8.4% CAGR till 2028. Currently, the US is the largest yoga market with 60% market share. This is expected to dwindle from fragmentation as yoga in APAC starts to take-off, in line with Lulu’ pivot to the Chinese markets.

Going based off implied market shares, Lululemon’s 2021 market share is as such:

1.7% of the global activewear market

2.4% of the women’s activewear market

27.5% of the global yoga market

Furthermore, we know that yoga remains a hot market. The number of people practicing yoga from 2012 to 2016 increased more than 80% and even in China, yoga is starting to see further adoption (we will delve into why under the theses).

Other bullish points for the entire industry include the fact that while the overall apparel market saw its size contract 10% in 2020, activewear sales only dropped 2%, a much slower pace that is testament to its resilience. Piper Sandler also found that leggings were the top fashion trend among teenage girls.

Competitive Landscape

When it comes to Lulu specifically, I have decided to classify their competitors into either ‘international sportswear’ competition or ‘premium niche lifestyle’ brands.

International sportswear competition includes Nike, Adidas, and Under Armour

Premium niche lifestyle brands include Sweaty Betty, Alo Yoga, Fabletics, Beyond Yoga, Outdoor Voices, and Public Rec

While these companies may all seem similar, there are a few differences between them that changes the entire value proposition of the brand. While Public Rec does sell leggings, their products are more so leisure apparel and business casual. While comfortable, they are less of a functional performance wear brand (sweat-wicking materials are not their concern). Similarly, a lot of Alo’s products are cotton based. While Fabletics has their flagship VIP membership model, in terms of product quality, they too can’t match that of Lulu’s.

Company Moats

Regardless, to compete with the smaller premium niche brands, brand moat is key. To compete with the bigger boys in the international sportswear segment, a consistent high-quality product is is key. Lulu has both.

Company Moats

The way i see it, this apparel behemoth has 3 very strong moats. They include:

Produce Quality Excellence

Superior Brand Loyalty

Vertical Integration + No Wholesale Approach

Product Quality Excellence

Although many companies within the ‘athleisure space’ offer yoga pants, none of them are on the same level as Lulu. Lulu has superior technical expertise which originates from 1) strong R&D efforts and 2) a concentrated reliable supplier base.

The company’s high quality is a function of its emphasis on innovation, as well as the use of tech that they then incorporate into products to achieve the highest performing tactical wear. Lulu’s patented ‘Luon’ material consists of 81% Nylon and 19% Lycra, and provides an extra layer of comfort. Its super soft material and thick cut provides for a hug sensation, to be used for light activity and not heavy performance needs. The LYCRA® fibre used in the construction of fabrics also adds shape retention and keeps the leggings from pilling. Because of its lightweight design, performance-wear pants still maintain their high-breathability and sweat-wicking functionalities.

At Whitespace, the company’s in-house innovation lab, Lululemon also constantly researches and tests new products and materials, focusing on blending design, function and feel. Other fabric innovations include:

Luxtreme, a sweat-wicking spandexy and slick stretch fabric that Lululemon claims fits “like a second skin”

Everlux, designed to dry super fast and keep its wearer cool in the sweatiest workout classes

Nulux, a lightweight fabric meant to make you “feel like you’re wearing nothing”

Even as Lululemon has expanded its product offering into new categories, including casual-wear, outerwear and menswear, it has kept its focus on technical design and quality. This wide variety of high quality fabrics also allows Lulu to then create multiple versions of the same product, designed specifically for different use cases like seen below.

Lulu also breaks down their products according to fabric sensations:

Relaxed (away from the body)

Naked (close to the body but not restrictive)

Held-In (slightly tighter)

Hugged (even tighter)

Tight (full-compression)

Lulu also pays exceptional attention to detail, tailoring each category specifically for its assigned use case. Their ‘align’ pants for yoga has no zippers and features a minimal design. However, their running leggings have a more of a sporty streamlined design with reflective details and zippers. The reflective details are at the bottom inside seam and are a built-in safety protection for those that run at night.

Furthermore, Lululemon has a largely exceptional record when it comes to product consistency (except for the 2013 legging recall for being too see-through), primarily due to their reliance on a very concentrated supplier base that has proven themselves worthy. Lululemon has less than 40 vendors across the world, the majority of which are in Vietnam and Cambodia.

5 of their top volume manufacturers accounted for 56% of total products

The top volume manufacturer itself accounted for 15% of products

While this could be a potential concentration risk itself, their selective approach has ensured that they only work with the best of partners who can guarantee consistency at the highest product level.

These reasons culminate in a highly functional product that has won over the hearts of consumers, and not because of anything else (ethos/price point…). While some may argue that others can easily replicate Lulu’s material composition with a slight tweak to create an entirely new product with a somewhat similar quality (and many have tried), customers always default to Lulu and their brand strength has stood the test of time. If you still aren’t sold on this idea, hear from customers themselves.

BOF: In this BOF case study, a customer highlighted Lulu’s surprising attention to detail that many don’t notice it, and in terms of quality, regardless of the similarity in fabric composition, she always goes back to Lululemon.

Superior Brand Loyalty (both customers + employees)

There are plenty of athleisure brands, but none of them have been able to influence the consumer and pull them over to the same extent that Lulu has. The resulting cult-like loyalty is something unparalleled in the realm of the apparel industry, and is what also justifies Lulu’s ability to price their products at the upper end of the spectrum, with no corresponding fall in demand in all types of macroeconomic conditions. (just look at what management did last year. As other brands all rushed to cut guidance amidst the deteriorating consumer sentiment, Lulu raised guidance). This loyalty is Lulu’s true success factor, and has been gradually built overtime.

Lulu isn’t a product, but a lifestyle. It is a lifestyle that needs to be told.

The main channel that Lulu builds their cult-like following is through grassroots marketing. They recruit local yoga instructors to be brand ambassadors, and in exchange provide them with their branded clothing. These ambassadors are called in to conduct yoga sessions for the company, some that are done in-stores itself as part of the experiential approach that the company has adopted. Lulu also then conducts photoshoots with these ambassadors, and blow their portraits up onto huge canvases to be displayed, effectively helping many small-time influencers make it on a big-level. Many of these instructors also run their own studios, and customers of theirs are then introduced to the brand this way. Lulu stores are also intentionally built from floor to ceiling with glass so that locals passing by their cross-fit stores can ‘experience’ the lifestyle on offer through a mere peak and glance.

The company also often times holds large scale events and HIIT workouts to further develop their brand stickiness, and while this was more so concentrated within NA, they have now duplicated their success in APAC. While the grassroots method can’t be replicated in every region Lulu is in, they have seen substantial success in some Tier-1 Chinese cities like Beijing and Shanghai.

The above are images from Lulu’s Unroll China 2016 event which saw hundreds of guests participate in. Even if yogis have not heard of Lulu before, their participation in such events increases Lulu’s brand awareness, allowing them to reap the rewards of their organic marketing. On digital formats, they market these events through #thesweatlife.

The use of grassroots marketing also allows Lulu to save substantially on marketing costs, and stick to their low-reliance on celebrity endorsements and brand deals since inception. For example, Cowen’s Kernan stated that:

Forbes ~ We note that LULU’s customer acquisition costs are extremely low relative to customer lifetime value – as the brand spends less than any peers on marketing.

Although no explicit marketing expense has been provided by management, their spend is definitely significantly less than that of Nike, who spent close to 10% of revenues on marketing and co-branding deals last year. Despite a heavier emphasis on celebrity endorsements recently, specifically to push out their menswear products, these are still tier-2 celebrities and college athletes, which speaks volumes. Moving forward, it is highly likely Lulu keeps to their cheaper marketing vertical.

Apart from such mass efforts, Lulu also undertakes additional efforts to prioritize the treatment of customers. For example (seen in the image above), in-stores, Lulu employees will ask for your name and write in on a whiteboard on your changing room door to sort of ‘allocate’ that room to you. This personalisation input - similar to the likes of Starbucks - builds the bond with the customer and leaves them with the message that ‘Lulu cares’.

While rising competition from Amazon’s private-label Lulu Dupes have been a threat to the company’s success, it seems that younger customers are the ones giving in to such dupes and not Lulu’s core older demographic who are more loyal. Furthermore, because of such constant efforts through events to engage with customers, they are sold into a lifestyle offering that many want to be a part of and quantitative data proves a brand stickiness 2nd to none.

According to a UBS report, Lulu US has a net promoter score (NPS) score higher than any other major US athletic brand except Nike. For those that are new to NPS, it is largely considered to be one of the main KPIs to quantify brand loyalty arising from customer satisfaction. While the NPS does have its limitations, other data also point to strong stickiness. The UBS global athletic wear survey indicates Lulu’s 59% repeat purchase intent is higher than any other brand.

Apart from customer satisfaction, Lulu also trumps peers when it comes to employee satisfaction. Glassdoor analysis suggests that Lulu engenders strong loyalty not from employees, with morale ranking #2/58 brands.

A large part of this employee satisfaction is also to be attributed to Lulu’s corporate culture. Chip imbued his company with an intense sense of self-development. Employees were pushed to attend webinars on self-development, attend landmark forums, earning its ‘cult-like’ status. While this culture may be considered extreme and toxic by some, (especially when associated with the ‘Lulu Murder Case’), much of their training is based on merit. Lulu employs a very decentralized hierachy. Store managers for each location are given the full discretion to manage store events and decide the overall merchandise layout.

Compensation plans were also intentionally set up to be much more rewarding relative to peer companies in the same industry. Lulu also pays employees one of the highest wages in the retail space, further motivating them to commit to the vision and realize its cause. This was all part of Chip’s servant leadership.

Vertical Integration + No Wholesale Approach

The last moat that Lulu has is their largely ‘no’ wholesale approach. In consumer based companies that attain a large portion of their sales through brick and mortar retail sales, most companies will tend to prioritize reach and scale. They partner with 3rd parties and sell wholesale to other businesses in bulk so that items can then be displayed in big box sporting retailers and reach is maximized. While this maximizes volume to a certain extent, the downside is the lack of control over quality and pricing.

Lulu cutting out 3P retailers from the very beginning was largely because of Chip’s experience with Westbeach (one of his very first companies) where he struggled to turn a profit because the cost of his wholesale business eroded all the money made at his own stores. The vertical retail model meant that many other smaller players found it harder to breach into the market and undercut Lulu’s market position.

Purchase of Lulu products are almost entirely impossible through big box sporting retailers, as Lulu has always kept careful control over its distribution. They have very limited wholesale partners if any, which incurs less risk of markdowns on their partner’s side. This exclusivity in terms of shopping channels thus guarantees price control and the associated premium with the brand that then follows.

While some may not think of this as a moat (as any company can choose to not do wholesale), it is a moat and for this very simple reason. The only other way to grow and maximize scale would be to expand own store presence. That, however, takes a lot of time and capital that most other brands just don’t have. Lulu has the funds to consistently expand and the difference with them is that they choose to forego reach for quality, and they can afford to do so. Many other designer brands also don’t do wholesale, yes, but within the activewear and athleisure space, that is rare.

In a similar vein, Lulu has also eschewed the use of discounts from the very beginning. Lulu’s products rarely ever go on discounts. Between the Black Friday and Cyber Monday leading up to Christmas, where other retailers were relying on steep discounts to clear stock-keeping units (SKUs), 90% of Lulu’s goods were sold at full price. For those that are unaware of what SKUs are, they are just an assigned terminology to distinct products within a retailer’s inventory (sort of like a variation).

That said, Lulu does have a ‘we made too much’ segment on their company website, where items that have been excessively produced are also marked down and go on sale. Regardless, their signature black align pants are always out of stock and never go on sale which confirms management’s conviction in their core items within inventory.

Moat Conclusion

As such, all of these 3 moats, specifically the absent wholesale approach and discounts coupled with its elevated product quality, justifies Lulu’s ability to charge higher prices than peers. This edge is further reinforced through the fanatic community of followers cumulated over the course of 20 years, which has more or less ‘guaranteed’ customers keep to their Lulu leggings purchases despite heightened competition from new disruptors like Alo, Fabletics, and Public Rec.

Investment Theses

Thesis 1: Lulu’s DTC Hedge Is Exceptionally Strong

Like any other consumer/brick and mortar company, Lulu had to bank on their online channel to get them through the pandemic in FY21 and FY22. The difference is that Lulu was early into DTC long before the pandemic, and their good positioning was the sole factor that saved them when COS were shut for months on end.

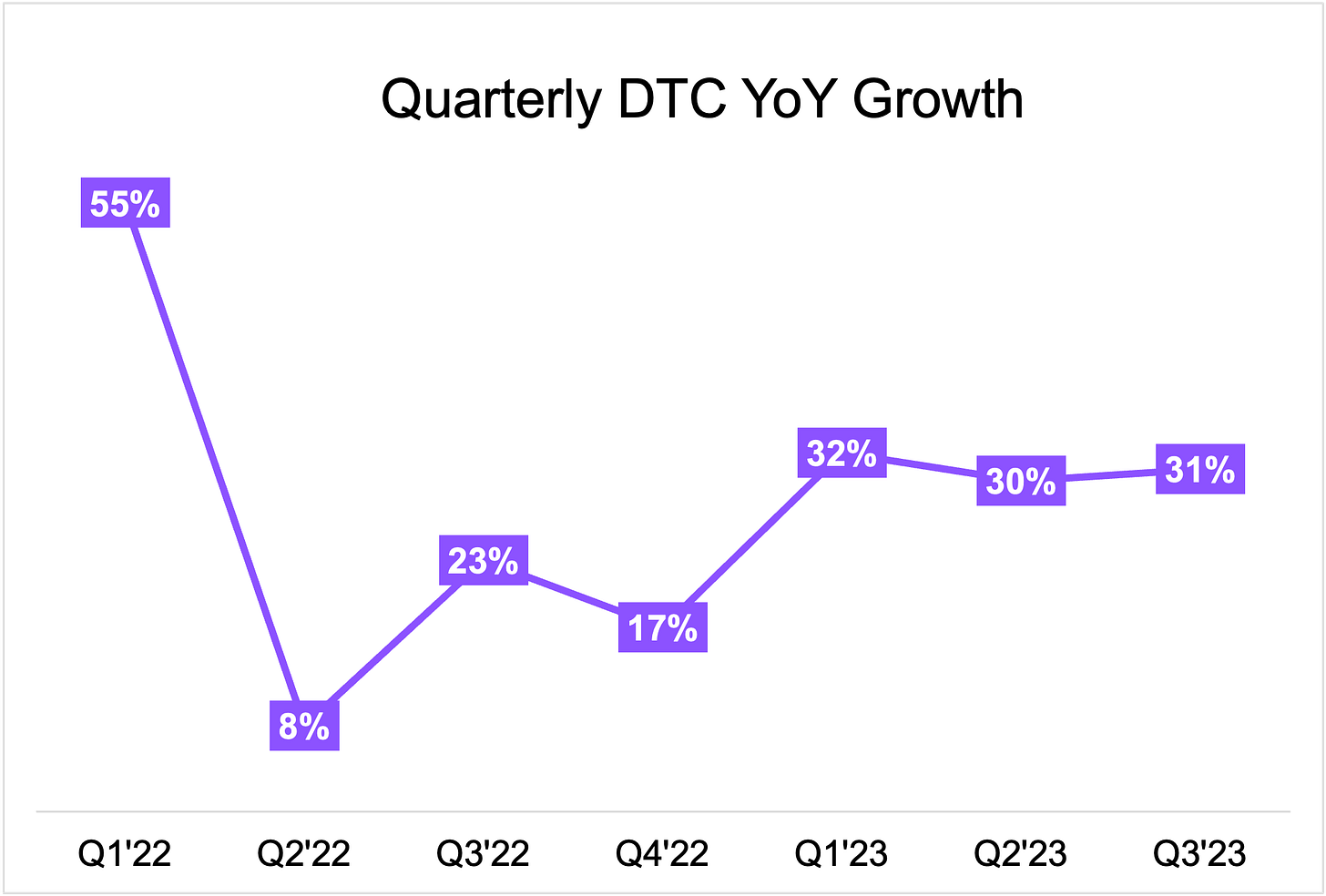

DTC sales took up 20-30% of pre-Covid era, but jumped to 52% in FY21. Although this is somewhat expected as consumers were forced to shop online rather than in-stores (hence the artificially inflated 100+% yoy growth in FY21), what has been shocking and a surprise to analysts is the strength of the lack of normalization in the DTC channel post-reopening. Even with COS opening up for business once more, DTC sales have scaled back far less than many have expected, which is a testament to the strength of Lulu’s digital approach and ability to close customers online.

YTD for the first 3 quarters of their 2022 fiscal year ending Jan 2023, DTC sales for Q1, 2, and 3 stood at $721M, $775M, and $767M, which total $2.26B in revenues. On a normalized basis, assuming DTC sales for Q4 is the exact same as Q3, Lulu is on track to post DTC revenues for the full year slightly over $3B, representative of another ~9% yoy growth. This in itself is a entirely conservative estimate given that Lulu’s DTC sales are always the highest in Q4 (evidently because of holiday shopping).

For 2020 fiscal year, Q4’21 DTC revenues were $899M, 88% higher than the $478M posted in Q3’21. In the 2021 fiscal year, Q4’22 revenues were $1,048M, 79% higher than the numbers just 1 quarter earlier ($586M in Q3’22).

Hence, it is likely DTC revenues for the last remaining quarter for the 2022 fiscal year ending January is higher than Q3’22 DTC revenues, and as a whole, DTC revenues are on track to post yoy growth well into the double digits. In fact, I even expect DTC sales to come in at a ~20%+ yoy growth for the full year (shown in my model). Even if we disregard QoQ growth to not account for seasonal fluctuations and look at quarterly YoY growth, there has been little pullback in DTC sales, with yoy growth rates in the 30’s range.

2011 vs 2017 vs 2021 Lulu DTC Website Snapshot

We also know that management is well aware of the need to maintain a strong DTC vertical as a hedge to their brick and mortar retail stores, and this change in emphasis seems to be a function of the pandemic implications as well as a change in leadership. When we leverage the wayback machine to look at the changes in Lulu’s website overtime, the changes are drastic and indicative of further investment into their online platform. The 1st image is a snapshot in 2011, the 2nd in 2017, and the 3rd the current day Lulu website. The user experience on their website has improved tremendously to create a more seamless checkout experience, and that could also be another reason the DTC platform so sticky and effective in leading to sales conversions.

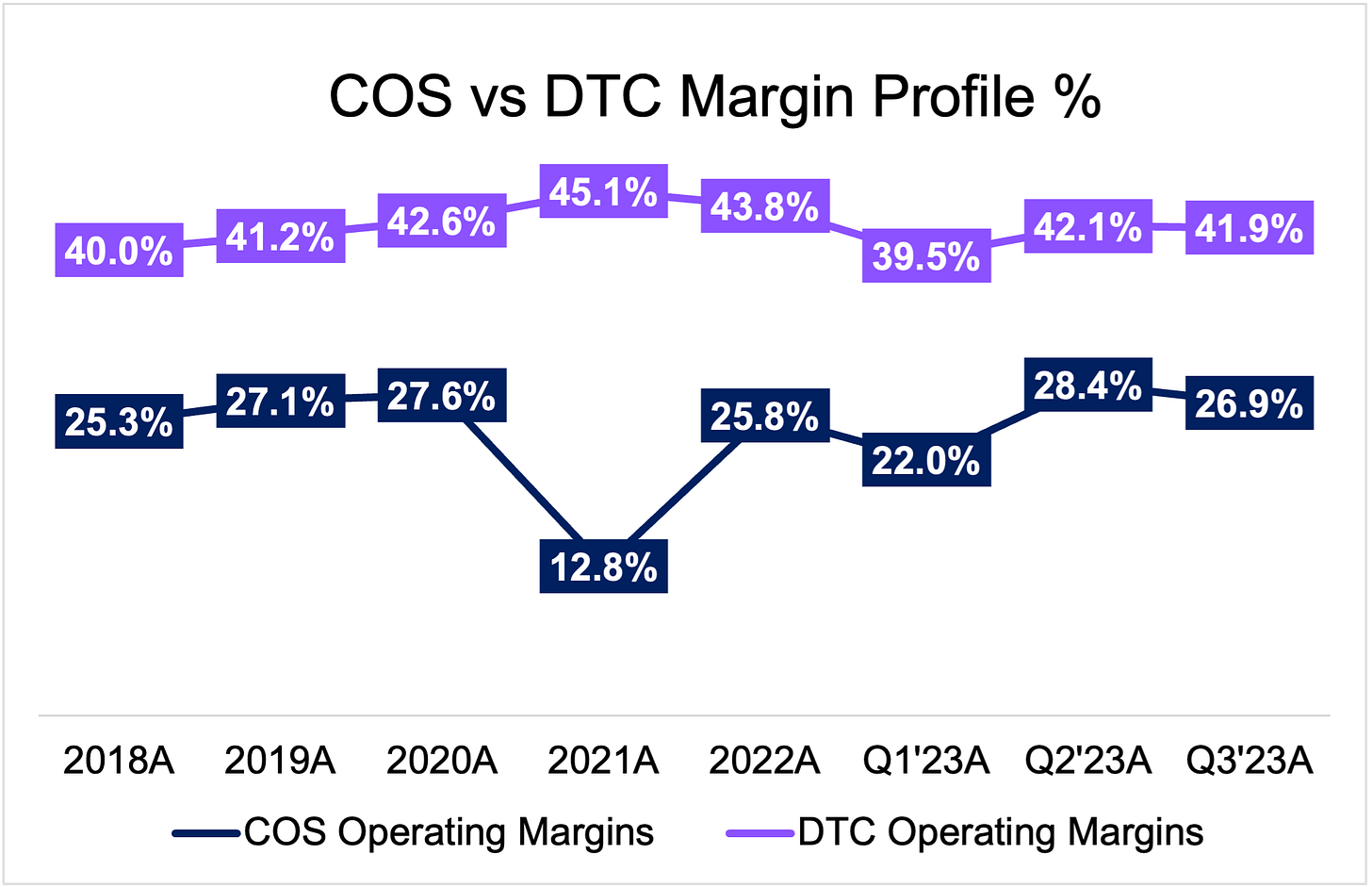

With a resilient DTC platform and interest in furthering their DTC stack, this should lead to eventually lead to gradual margin accretion due to the higher margin nature of DTC relative to the COS platform. When we look to the operating margin (EBIT) profile for COS sales vs that of DTC sales, we can see that the DTC channel commands margins 1.8X higher than COS on average. As DTC sales continue to grow and maintain a large portion of overall sales, this should lead to margin expansion.

Thesis 2: Adjacent Market Expansion Entirely Feasible

The 2nd theses relates to Lulu’s ability to push into adjacent markets (both geographical and product markets).

Lulu’s Long-Term Growth Strategy

Under the previous Power of Three strategy unveiled in 2019 with a 3-5Y timeframe, management laid out the goal to:

2X Men’s Revenues

2X DTC Revenues

4X International Revenues

So far, management under Calvin McDonald has delivered in doubling the men’s and DTC revenues within 3 years, 2Y ahead of schedule. International revenues haven’t yet quite reached the 4X milestone, but management expects to achieve the target by this end FY22.

Under the new 5Y growth plan laid out in their analyst day in 2022, management has more or less duplicated the previous strategy, with an end goal by 2026. The new plan also features goals for the same 3 pillars, product innovation, omni-guest experience, and market expansion. They are targeting revenues of $12.5B by FY26.

Geographical Expansion

As part of their market expansion, Lulu plans to push further into the APAC and EMEA markets, and away from NA where they have some sort of a saturation and cap to growth. Management still expects to deliver double-digit growth in NA, but APAC, specifically China remains their biggest target market for the next phase. To determine the feasibility of this, we need to determine if there is a lacking market and the likelihood that Lulu can pull off the same success they had in NA in China where there is a difference in culture and practices.

While brand awareness is strong in NA, it is clearly falling short in the international segment, specifically in China where brand awareness among women is only 11%, 59 percentage points behind that in Canada. Although China’s population size trumps that of Canada, the data points to a clear addressable market. Whether a push there will culminate in success is another matter, but one I believe will play out in their favour and here’s why.

Lulu’s push into China is entirely reasonable against a backdrop of a growing Chinese yoga market. According to the latest Spring Summer Fitness Consumption Report published by JD, sales of equipment for yoga practices, such as whale back-benders, yoga shoes, BOSU balls, and yoga bags, have seen year-on-year increases of 868%, 816%, 110%, and 104% respectively, driven primarily due to the digitalisation of the fitness industry. The development of ‘Healthy China 2030’ is also central to the Chinese government’s agenda, and goes to show that a more balanced life is gaining traction in China which should play nicely into demand for Lulu’s products.

Lulu is also no stranger to the Chinese yoga market. They first entered China in 2014 as China’s sportswear boom was starting to take off through popup stores. Their first flagship stores came into existence end 2016, and through the grassroots marketing events mentioned above via ‘Unroll China’, they have been gaining serious traction. The Unroll event in China 2017 was sold out overnight.

Lulu has also made intentional efforts to adapt to the Chinese markets, tailoring their products to appeal to locals. For example, Lulu created the ‘asian fit’. The Asia Fit range is a petite fit and has "narrower waistbands, are slightly longer down the hip, have a better fit on the knee and calf and a shorter inseam.” Ex CEO Potdevin ruled out the need to introduce an entire new selection of products for the APAC markets and instead chose to stick by the curation method. Furthermore, Lulu which rarely holds discounts as part of their company strategy made an exception by introducing discounts in a bid to adapt to the Chinese culture.

When Lulu first entered the Chinese market, they also chose to partner with Tmall and held livestreams on WeChat events instead of scaling through their own DTC platform. After partnering with TMall in November of 2015, the online sales of Lululemon in China increased up to 350%. In 2016, TMall yearly sales for Lululemon increased by 50%, and in 2017 the Tmall business increased 175% fuelled by more than doubling our traffic coupled with higher conversion. Through the digital format, Lulu also markets their products primarily through their 4.5M Weibo followers.

Management is also committed to further expanding store presence in China and this region will be the prime source of regional expansion.

Source: The growth of the Chinese mainland will be powered by five pillars to showcase how the company's global-local model plays, Andre Maestrini, executive vice-president of Lululemon's international business, said at an investors' day that charted the course for the company's strategy over the next five years. Calling the Chinese mainland "the first source of growth" for international business, Maestrini said the company is looking to triple stores to 220 in 2026 from the current 71. This would feature a combination of flagship stores with full lineups and community-based stores featuring core products. The strategy would unfold by building up presence across relatively affluent first-tier cities like Beijing and Shanghai before penetrating into tier-two cities.

Should Lulu really scale store presence to 220 in the mainland by 2026, their total international store count will be in a similar range as that in the US which currently stands into the 300s.

Chinese Market Headwinds

While such ambitions are bold, some have cast doubt on whether Lulu can really double down on the Chinese market and take their presence to the next level. China’s Gen Z grew up on social commerce, and 2021 social commerce sales have breached into the trillions of dollars. Accounting for 6% of total retail sales, that figure has now doubled to 13%.

Social commerce is also something relatively new and ‘unknown’ to western brands, evident in the clear divergence in penetration in China vs the US. Furthermore, while western peers have tried to jump on the bandwagon and introduce social commerce events, there has been little success, particularly among premium brands. While Lulu is indeed a ‘premium athleisure’ brand, i doubt this will be a threat to their success.

Gen Z’s are embracing social commerce, but Lulu’s core customer is a middle-aged millennial. ‘Luxury’ customers want a more memorable and personalized approach, and Lulu’s grassroots marketing creates a sense of belonging that can and has won them over. This experience will also be further built through the megastores Lulu plans to introduce, which could even grow into 10% of all their entire retail store footprint according to Celeste Burgoyne, Lulu’s executive VP of retail for the Americas.

While it remains to be seen whether Lulu can achieve their 220 store count target in China, it does seem possible and likely. There are some headwinds in cultural and individual differences, but management has proven their clear awareness of the need to tweak their existing ‘success formula’ in NA to appeal more effectively to Chinese consumers.

Menswear Feasibility

Lulu has long been known as the brand that tailors exclusively to women via their flagship skinny black leggings. However, across the years, management has done more and more to part ways with the brand association to feminity, and has started to introduce more products for men. While women sales continue to be the bulk of revenue and will no doubt always be the case (my view), their existing efforts has manifested in reducing product concentration risk. Women sales have dropped 4 percentage point across the past 5Y and men’s sales gained 5 percentage points to represent 25% of all sales in the last fiscal year (full year ending 2021).

This in itself is a big feat. Many men seems to agree that as a guy walking through a Lulu store for the first time, ‘you feel as though all your testosterone was checked at the door’ - I for one can attest to this. Give this humorous piece by GQ a read for more insight.

When we look deeper, it seems that management is taking a different approach trying to distance themselves from activewear in the men’s segment, likely in a bid to differentiate themselves from incumbent activewear heavyweights like Nike and Under Armour. Instead, they seem to be focusing on casual-wear (sweaters, track jackets) that men can wear both to the office and to the bar. Their appeal lies in the combination of comfort and style as seen in the flagship ABC pants. While the pants is smart enough to wear to work, they ultimately feel like sweatpants.

More importantly, to judge the feasibility of this menswear push, we need to understand how Lulu has come to serve men and the differences between spending habits of men and women. When it comes to apparel, men buy less frequently, at lower price points, and largely based on need. Women buy more frequently and more on impulse and emotion, which is partly the reason they are willing to weather the higher price points. Given the higher price points of Lulu’s products, males seem to be more hesitant buying their products online, and according to some expert calls, that seems to be chief reason why Lulu’s retail stores are a key entry channel for men.

Interestingly enough, the data also corroborates the above speculation. Almost half of all men who purchase Lulu products have been introduced to the brand through a woman. Women buy the products for their boyfriends, husbands, sons, or friends, or men themselves buy it after tagging along with a female partner.

About 40 percent of our men’s product sales today are to women,” says Stuart Haselden, Lululemon’s COO.

With this in mind, it is clear that women are the bridge introducing men to Lulu’s products, and so the key to success lies in their co-located store approach. Management has also shown commitment to this cause, shuttering all their men’s only stores, and choosing to not pursue any standalone men’s concepts anymore. And so in line with their new 5Y plan to double men’s revenues to over $3B, the expansion of COS in both saturated NA markets and the international segment is key and to be factored in when projecting store openings.

Others (MIRROR)

Lulu acquired MIRROR in 2020 for $500M, and sales from this vertical fall under ‘other revenues’. MIRROR is a personalized remote exercise tool that Lulu believes will help them further their mission to get customers to sweat with them and their products. As per the analyst day presentation, when guests sweat more, they spend 15% more. Monetization for this channel comes from the entry level hardware (actual physical MIRROR like device) + recurring monthly subscriptions on their app from the ‘pinnacle membership experience’.

When guest subscribe to the membership, they get:

Access to 10,000+ classes across 50 fitness categories

Access to instructors and studio partners (live classes / pre-recorded workouts)

Discounts to real-live classes and programs offered by Lulu studio partners

Early access to Lulu’s new products and experiences

Despite competition from Apple fitness and Peloton’s all-access pass, these are MIRROR’s differences / edges over its peers:

MIRROR has the largest library of content and breadth of classes

Live classes. Peloton too has live classes, but not Apple fitness to my knowledge

Daily new classes

50+ genres, Apple has 11

While this segment is still unprofitable on an operational basis despite revenues crossing $100M, I see a lot of cross-selling opportunities if Lulu primarily uses MIRROR as a data aggregator play, collecting information about what guests really want and wear so that sales and production can be optimised. The whole point of mirror is for it to be that extra additional feature that helps make the overall brand experience more sticky and hence, drives loyalty and customer retention, thereby leading to a higher average spend per guest. As it is, allowing customers the option to purchase the device sorta brings Lulu ‘permanently’ into their homes.

Perhaps Lulu intends to dress MIRROR instructors up in the latest products, leveraging this ‘organic’ marketing vertical to push the latest products right in front of customers eyes (at the comfort of their own homes), eventually getting customers to spend more with them. Perhaps there will one day be the option for customers to click and see the very products instructors are wearing, and ‘shop it off their bodies’. No one really knows but the possibilities seem endless.

However, it is unlikely that this ever becomes a major revenue channel for Lulu. MIRROR’s $85M sales (mid of full year sales taken given acquisition halfway) in 2021 only represented 1.9% of overall sales, and 2022’s mid-year guidance of $127.5M is only 2% of total sales.

Risks (Systematic + Idiosyncratic)

Like any other company, Lululemon is subject to risks, both macro (systematic) events that affect the entire market and risks specific to them (idiosyncratic). I will cover the main risks I think Lulu is susceptible to.

Quality shortfalls (idiosyncratic)

One of Lulu’s moats is their exceptional product quality which partly justifies their premium prices. However, there have been certain instances where quality has fallen short of expectations, leading to mass recalls. The 2013 recall pulled back 17% of their flagship Luon skinny black leggings after customers complained that the fabric was too thin and hence see-through. While Lulu worked to replenish their inventories quickly, the way they handled the situation was also plagued with controversy, when they asked women to bend over to prove their yoga pants was really sheer. However, while such product quality issues do surface every now and then, the loyalty customers have for the brand insulates them from such rare one-off events.

Management Issues (idiosyncratic)

Issues with management have arisen from controversial statements in the past, especially when Chip was still part of the company and board. To see the full list of remarks, you can reference them here. Employee turnover at the top also remains choppy, with multiple senior level changes in a short period of time. Apart from Wilson, successive CEOs (Robert Meers, Christine Day, and Laurent Potdevin), have all been with the company for 5 years or less, before departing for various reasons. While current day executive Calvin has done a good job with Lulu’s 2 key future levers (international and menswear expansion) as well as introducing the self-care line having worked at Sephora previously, it remains to be seen whether he can maintain a longer stint at the company.

Macro Impacts on Discretionary Spend (systematic)

Lulu’s items are relatively expensive, and can be classified as a luxury discretionary spend. In times of macroeconomic recessionary fears, consumers tend to cut back on such items and channel income towards necessities like healthcare, staples, and utilities. However, that being said, compared to the rest of the apparel industry, Lulu’s inherent customer base (higher-income earners) tend to be less affected from such events. Furthermore, there has been little evidence of a cutback in spending in 2022. As mentioned earlier on, while other companies were dialing back forecasts and cutting guidance, management swam against the tide and increased revenue guidance, signalling the confidence they had in demand for their products, specifically their leggings they term a ‘core seasonless product’ within inventories.

Let’s Wrap Up!

Lulu is a remarkable business, with a tried and tested business model. While many who walk past their stores think of them as just another legging apparel company, Lulu is instead really a very strong lifestyle brand. They sell a lifestyle that customers want in on, and over the years have built a community of like-minded followers so loyal, many deem them to be a cult.

The company’s moats are their (product quality excellence, superior brand loyalty, and no wholesale approach) that has all cumulatively created that premium feel that then justifies their product pricing. While I am confident in their DTC approach and the subsequent margin accretion that will follow, as well as their push further into APAC, I am more hesitant on their menswear push, specifically management’s expectations to bring this up to about 40% of overall sales.

Regardless, the business is an exceptionally well run one with a brand strength so strong, it could likely sustain sales for years to come with little to no innovation.

Next Up!

Next I will be analyzing Lulu’s financials, giving my complete revenue and cost projections, and releasing my model. I like Lulu’s business but not their stock, primarily because of valuation reasons, but let’s leave that for the next piece.

What are you waiting for? Subscribe to receive the next drop! See you then.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own due diligence or consult a financial advisor. Investing includes risks, including loss of principal.