Time to read: 40 min

First, I’d like to welcome new readers to The Retail Deep Dive. So glad to have you join us! Our mission is to analyse companies and unpack them logically for our readers.

This month’s deep dive is on Disney (DIS), another media behemoth.

We decided to split our research into 2 separate articles to break it down nicely for you. The 1st article will focus on an analysis of DIS, while the 2nd article will evaluate DIS’s financials.

This is the first article. It’s long, so grab a large cup of coffee!

Disclaimer: I own shares of WBD and PARA.

Breakdown

History, Market Perceptions, Price Analysis

Business Model & Revenue Breakdown

Analysis of DIS’s Content Library

Analysis of Strategy

Analysis of Management

Conclusion

History

DIS needs no introduction - it’s the biggest media conglomerate in town, with its 100th anniversary coming up next year. The company has produced some of the greatest films of all time and many of us have grown up watching their classics.

Market Perceptions

Note: These are based on my perceptions of what other analysts focus on when they cover DIS.

Based on my research, the number of “Hate it” factors and “Love it” factors are more or less balanced. In this analysis, I aim to analyze both the bull and bear views of DIS and come to my own conclusion as to whether they are sound or not.

Price Action

DIS’s stock currently trades at $88, down 55% from its all-time high in March 2021. Some reasons for this massive decline include :

Reason 1: Strong competition in the streaming space

Reason 2: Poor macroeconomic outlook & sentiment

Reason 3: Worsening financials

Capital Structure

Currently, DIS enterprise value is more than 35% larger than NFLX, 66% larger than WBD and 800% larger than PARA.

Business Model

As a legacy media conglomerate, DIS has a diversified business model. It produces and distributes shows through many channels. On top of that, DIS has a prominent Hotels and Parks business too. Excluding the Hotels and Parks business, you can say that DIS has the same business model as WBD and PARA, the other two of which are also trying to transition from Linear to Streaming.

Revenue Breakdown

Management has categorized revenues into 2 streams:

Disney Media and Entertainment Distribution (DMED) - in purple

Parks, Experiences and Products (PEP) - in blue

For 2022, its breakdown is as follows:

Note: In 2020 DIS changed its revenue breakdown structure.

DIS’s DMED segment consists of 3 business units. They are DTC, Linear Networks, and Sales & Licensing. On the other hand, the PEP segment consists of 2 business units, Parks & Experiences and Consumer Products. Now, let’s analyse the DMED segment more closely.

1. Linear Network

DIS’s Linear Networks unit includes its traditional domestic and international television channels. This includes ABC, Disney, ESPN, FX and National Geographic channels. DIS also has a 50% stake in A+E Television Networks which includes a variety of cable channels such as A&E, HISTORY and Lifestyle.

In 2022, Linear Networks made up 33% of DIS’s total revenue, which makes it DIS’s largest revenue engine. Revenues come mainly from fees its charges affiliates for the right to broadcast and advertise on its channels.

Market Share

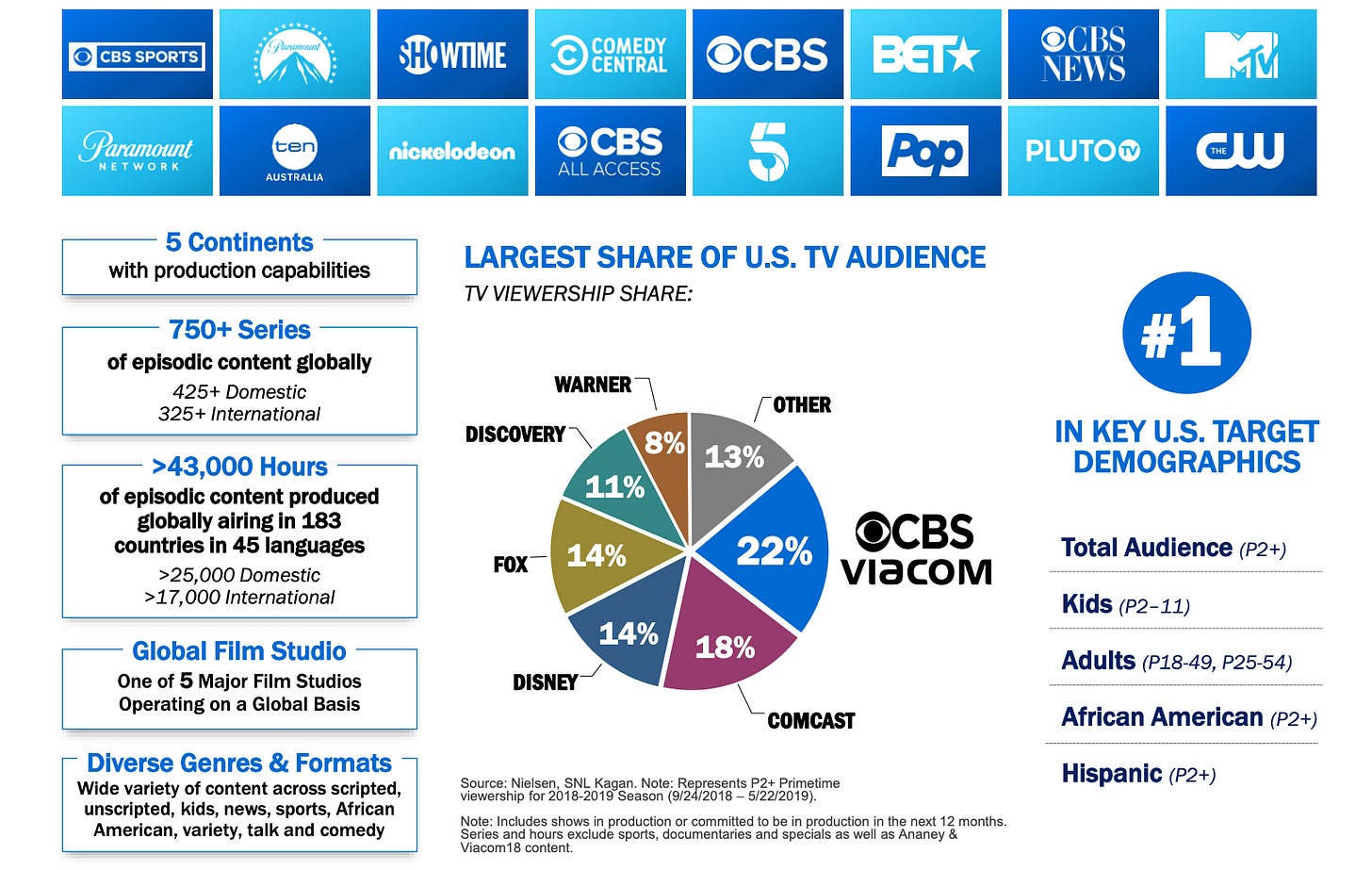

Source: Viacom VBS Merger presentation

I could not find any recent statistics on the current cable market share breakdown so I shall use data from Viacom and CBS merger presentations and deduce my conclusions from there. In 2019, DIS had the 4th largest US TV market share of 14%. Since then, we know that Disney acquired most of the assets Fox owned. We also know that Discovery and Warner merged to form WBD. This means that today’s market share will look something like this:

PARA (22% Market Share)

DIS (21% Market Share) - (I am assuming DIS acquired at least 50% of Fox's market share)

WBD (19% Market Share)

COMCAST (18% Market Share)

While it does seem that DIS has the 2nd largest TV market share, WBD and COMCAST are not far behind.

Margins

The big increase in Linear TV revenue from 2019 to 2020 was probably due to the effects of the Twentieth Century Fox (TCF) acquisition. That being said, given the trend of Linear TV customers cutting the cord in favour of streaming, it is surprising that revenues have not deteriorated significantly since 2020. However, as the trend of cord-cutting increases, it is important for investors to continue to track the decline of the Linear Network business. The Linear TV segment is profitable and has operating margins of 30%. Now, let’s analyse the next business segment.

2. Content Sales/Licensing and Others

Revenues from this segment are earned from (largest to smallest segment revenue contributor):

Sales/licensing of film and television content to third-party television and subscription video-on-demand (TV/SVOD) services

Theatrical distribution

Home entertainment distribution (DVD, Blu-ray discs and electronic home video licenses)

Music distribution

Staging and licensing of live entertainment events on Broadway and around the world (Stage Plays)

In 2022, Content Sales/Licensing made up 10% of DIS’s total revenue, surprisingly meagre.

Margins

Prior to the pandemic, this unit’s revenues had been growing and margins were consistently around 25%. However, after the pandemic revenues and operating income have cratered and have yet to recover.

According to management the result for 2021 is because:

TV/SVOD Distribution: Less content available to sell to 3rd parties because of COVID-19 disruptions. Moreover, DIS shifted from licensing our content to third parties to distributing it on our DTC streaming services.

Theatrical Distribution: Theater closures and capacity restrictions in many territories.

Home entertainment distribution: 36% lower unit sales and 5% lower average net effective pricing.

According to management the result for 2022 is because:

TV/SVOD Distribution: Impact from the shift from licensing our content to third parties to distributing it on our DTC streaming services.

Theatrical Distribution: It mostly recovered, but is still experiencing slight COVID disruptions.

Home entertainment distribution: Lower unit sales despite the benefit of more new release titles in the current year. Net effective pricing was comparable to the prior year.

Therefore, while it seems that Theatrical Distribution (the 2nd largest revenue contributor to this segment) is likely to make a complete recovery in the next couple of years, the change in TV/SVOD Distribution (the 1st largest revenue contributor) and Home Entertainment Distribution (3rd largest revenue contributor) is more likely to be structural in nature. This makes sense. With Streaming on the rise, fewer people would be willing to rent DVD/s or digital movies. This suggests that the results we saw in 2021 and 2022 are not anomalies, but the new norm. That being said, WBD and PARA still have a profitable Licensing business to help fuel their own DTC transition. Now, let’s analyse the next business segment.

3. DTC

DIS’s Direct-To-Consumer (DTC) segment consists of revenues earned from its various streaming platforms Disney+, Hulu, ESPN+, and Star+. In 2022, this segment earned 23% of total revenues.

This business unit primarily generates revenue from subscription fees on DTC streaming services, affiliate fees and advertising sales. Significant expenses include operating expenses, selling general and administrative costs and depreciation and amortization. Operating expenses include programming and production costs (including programming, production and branded digital content obtained from other Company segments), technology support costs, operating labour and distribution costs.

Now, let’s explore each of DIS’s streaming platforms.

1. Disney+

Disney+ is DIS’s flagship streaming platform. From here onwards, I will refer to it as DIS+. Content on DIS+ includes movies and TV shows from Marvel, Star Wars, Disney Classics, Pixar, etc. Starting in December, DIS+ will be available in 2 tiers: Basic Plan, which has ads($7.99), and the Premium Plan($10.99), which has no ads. In 2022, DIS+ subscribers grew to over 164 million.

No. of Disney Plus subscribers worldwide (in millions)

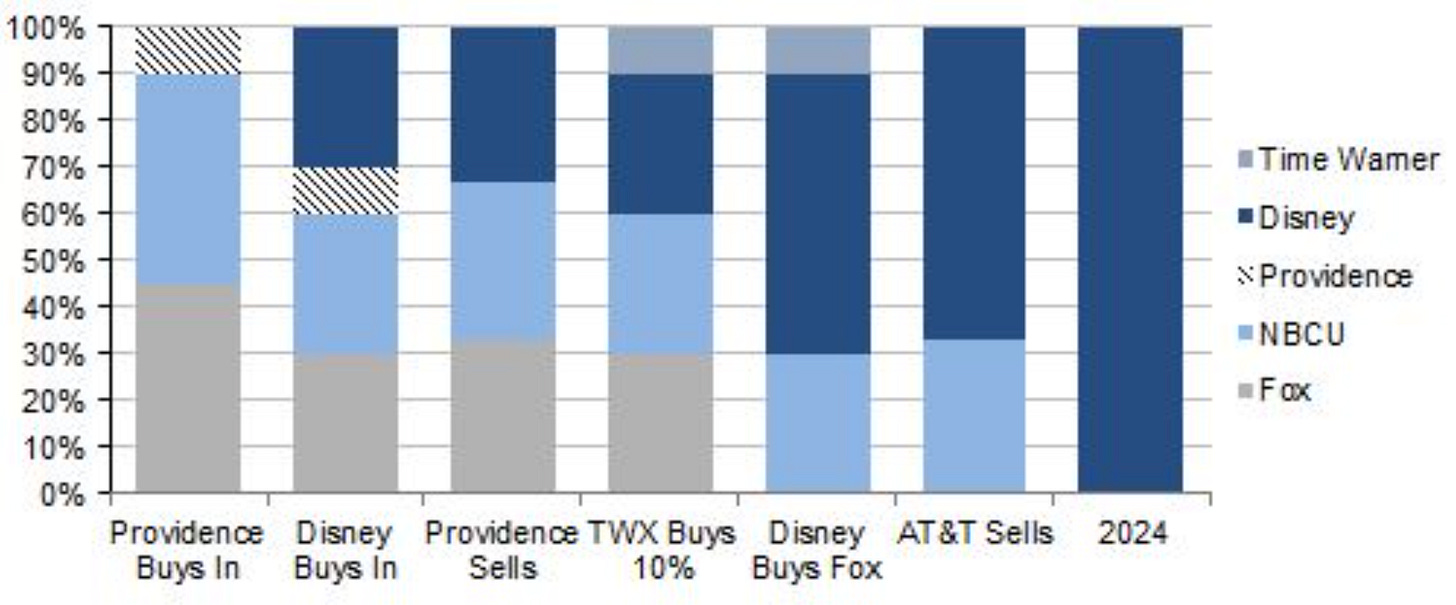

2. Hulu

Hulu is DIS’s oldest streaming platform. In fact, it was launched only 1 year after NFLX. Hulu was initially established as a joint venture between News Corporation, NBC Universal, Providence Equity Partners, and later The Walt Disney Company, serving as an aggregation of content from their respective television networks. Over time, DIS began to own a larger and larger percentage of Hulu. Today, DIS owns 67% and has full operational control of Hulu with CMCSA owning the remaining 33%. Moreover, DIS has a put/call agreement with NBCU, which provides NBCU with the option to require DIS to purchase NBCU’s interest in Hulu and DIS the option to require NBCU to sell its interest in Hulu to DIS. This agreement begins in January 2024. The figure below shows how Hulu’s ownership changed over time.

Hulu’s owners over time

Hulu is available in 3 different tiers as illustrated below.

Hulu is not your run-of-the-mill streaming service. Unlike many other streaming services, you can also pay for premium add-ons individually for things like TV Channels. This makes the streaming platform an excellent cable-cutting alternative. Hulu includes original programming and content from Disney, Fox, BBC America, Showtime, TLC, CBS, ABC News, Animal Planet, Complex, Freeform, FX, and others. Despite never expanding beyond US territories, it remains one of the top streaming services with an extensive library of movies, shows, and even Live TV.

Some of you may be wondering what is the point of DIS having two streaming platforms both Hulu and DIS+. DIS has done this so that DIS+ can house more kid-friendly content in line with its brand, while Hulu houses the company’s more mature content. (good)

One question I had was: Since Hulu is a US-only service, where does DIS house its mature content for its international subscribers? This is where things start getting slightly complicated. The company houses mature content for its international subscribers under the Star hub, which is itself in the international DIS+ app. So basically, it combines the international version of Hulu called Star together with DIS+ shows in one app. (good)

No. of Hulu's paying subscribers in the United States (in millions)

Hulu’s no. of subscribers has been growing steadily over time, however, it seems to have started reached a plateau. This makes sense considering the growth of other competitors on both the streaming and Live TV fronts. Conservatively, I doubt Hulu will add substantial new subscribers going forward.

3. ESPN+

ESPN+ is DIS’s streaming platform for sports programmes. It is the leading sports streaming service. Though ESPN+ has its own lineup of live sports, on-demand shows, and exclusive programs, the service does not include access to the regular ESPN cable channel. Currently, a subscription to ESPN+ costs $9.99 per month. ESPN+ subscribers have been growing steadily and stand at 24.3 million as of 2022.

No. of subscribers to streaming service ESPN Plus (in millions)

4. Star+

Time for more definitions. It is important to distinguish between STAR+ and STAR. They are not the same thing. STAR+ is a streaming service available only in Latin America. On the other hand, STAR is a content hub within the international Disney+ streaming service that launched on February 23, 2021. The hub is available in a subset of countries where DIS+ is operated. As mentioned before, STAR is the international version of Hulu. This is because management argued that the Hulu brand was not as well known as the STAR brand outside of the US. Star+ subscribers are not officially disclosed. Star+ makes up only a small chunk of overall DTC, so I will not elaborate on it any further. Now let’s analyse DIS’s streaming market share.

Market Share

The “market share” above is calculated based on how much interest JustWatch customers have in each streaming platform. Based on the chart above, DIS+ has the 3rd largest market share, while Hulu has the 5th largest share, while ESPN+ is too small and so is considered under Others. Based on this chart, DIS+ is experiencing the fastest growth rate, whilst Hulu looks like it is starting to lose subscribers. Let’s look at other data points.

The “market share” above indicates how much of total consumer time is spent on each streaming app across all TV platforms only. Based on the chart above, Hulu and DIS+ have a combined market share of 6%. This is not too far away from NFLX. Now let’s analyse the DTC unit economics.

Margins

DTC revenues have been increasing while operating income has been decreasing. In fact, operating income margins decreased from -10% in 2021 to -21% this year. According to management, “the decrease at Direct-to-Consumer was due to higher losses at Disney+ and, to a lesser extent, lower results at Hulu and higher losses at ESPN+.”

To combat the negative operating income, management needs to focus on increasing subscriber count or ARPUs by 21% (assuming no additional operating costs), and that they have done. Management increased the DIS+ subscription prices by ~35% in December. Although I don’t expect a 35% increase to flow straight into operating income, it does means that investors can probably expect the segment to achieve profitability in the near future, given no unusual scale in expenses.

4. Parks, Experiences and Products

The Parks, Experiences and Products segment primarily generates revenue from the sale of admissions to theme parks, the sale of food, beverage and merchandise at DIS’s theme parks and resorts, charges for room nights at hotels, sales of cruise vacations, sales and rentals of vacation club properties, royalties from licensing intellectual properties and the sale of branded merchandise. Revenues are also generated from sponsorships and co-branding opportunities, real estate rent and sales, and royalties from Tokyo Disney Resort. Significant expenses include operating labour, COGS, infrastructure costs, depreciation and other operating expenses. Infrastructure costs include information systems expenses, repairs and maintenance, utilities and fuel, property taxes, retail occupancy costs, insurance and transportation. Other operating expenses include costs for such items as supplies, commissions and entertainment offerings. Now let’s take a look at DIS’s market share for this business unit.

Market Share

It seems that DIS has the largest Parks market share. However, Comcast (CMCSA) the owner of Universal Studios is not lagging very far behind. According to CMCSA CEO, “We’re – clearly, there’s one other company, Disney, that has a fabulous parks business. We’re gaining share.”

Now let’s take a look at DIS’s market share for this business unit.

Margins

Pre-pandemic revenues and operating profits have been growing consistently with profit margins consistently at or above 20%. Even in the pandemic years of 2020 and 2021, operating income was barely negative, signalling the strength of this business segment. In 2022, the Parks business recovered stronger than ever. This was fuelled because of pent-up demand and increasing prices on admission tickets.

Although 2022 results paint an optimistic picture, the PEP business line is mature, so I am not expecting much revenue growth to happen for this segment. Nonetheless, it can aid the company’s transition from Linear to Streaming. This is a pillar that WBD and PARA lack.

Coffee Break!

Does the business interest you?

Is the business understandable for a retail investor?

How has the business changed over time?

Is this business within a retailer’s circle of competence?

Can a retailer easily see and understand trends in the business?

Analysis on Content

To assess a streaming company’s content portfolio, we have to consider 4 things in the following order of importance:

The acquisition strength of its content

The amount spent on content

The stickiness of its content

Current subscriber satisfaction

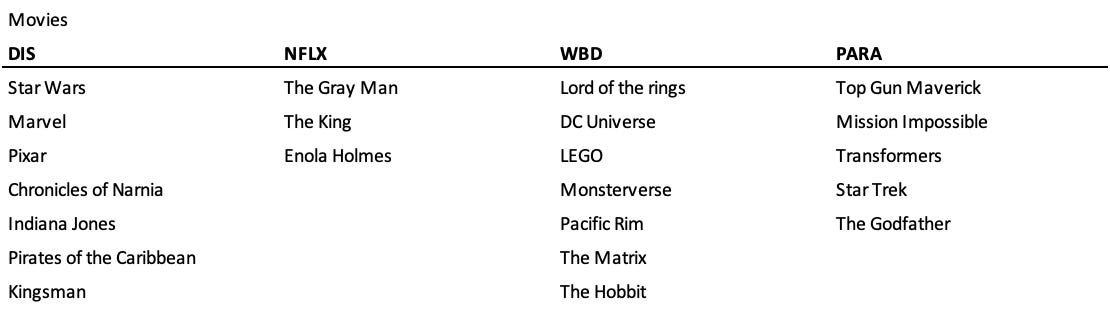

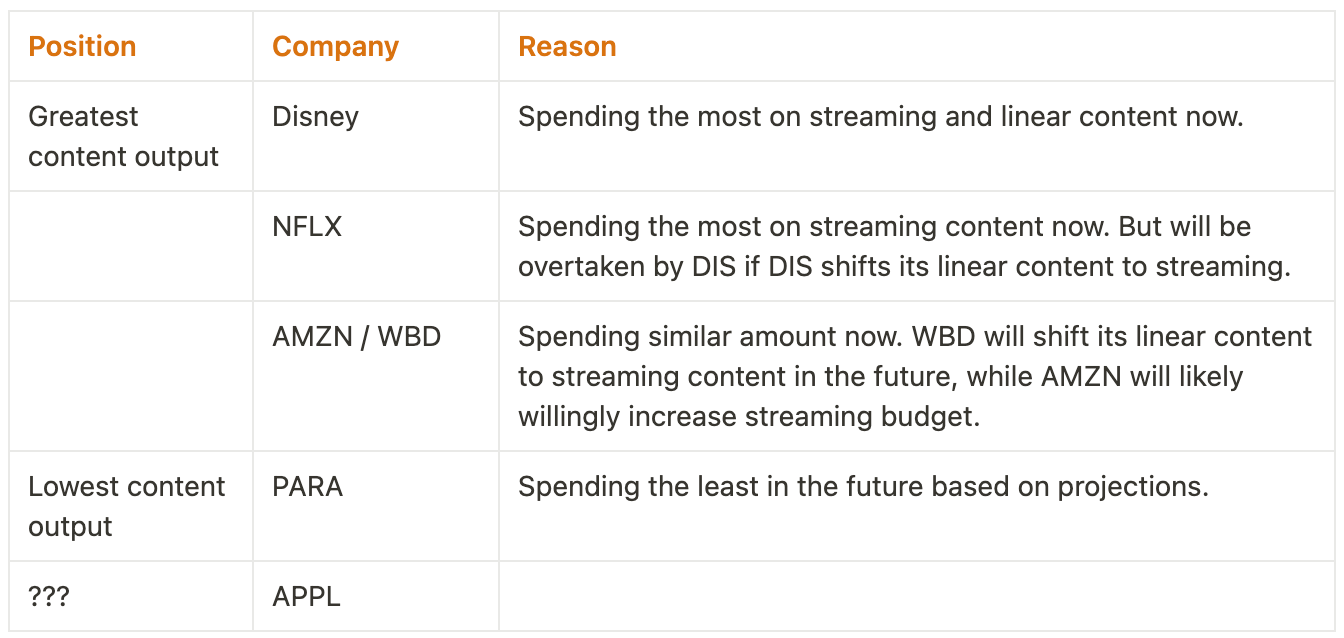

Ideally, we want a company with a content library that has high acquisition strength, good customer satisfaction, a low subscriber churn rate and spends prudently on content. Now, let’s find out if DIS has these four characteristics. I have collated the major franchises of each streaming company in the tables below.

1. The acquisition strength of its content

Acquisition strength is the ability of shows to generate excitement and draw in interests of a large number of people. These are shows like Star Wars. Marvel, Game of Thrones and Mission Impossible. Since the streaming wars are still heating up, it is important to analyse whether a company can attract new subscribers to its platform over its competitor’s platforms. I have decided to use the number of branded movie and TV franchises as the KPI. In this metric, Disney definitely takes the 1st spot. I would rank WBD in second place, followed by PARA in third place and NFLX in last place. However, I do think that the difference between WBD, PARA and NFLX is minute.

Therefore in terms of acquisition strength in 5 years time, I rank them in order of:

2. The amount spent on content

Here’s a collation of the content spending among the different streamers.

Annual Content Spend (Bn)

Streaming spending refers to spending used solely to make Original content exclusively for streaming services. DIS’s spending on content has accelerated since 2019 due to its acquisition of TCF as well as the launch of Disney+. In terms of total content spend, Disney is far ahead of its competitors. The company spent an insane $33B on content this year, with $15B allocated to streaming. However, if we were to narrow our comparison to streaming-specific spending, NFLX spent the most, a whopping $19B.

However, traditional media conglomerates have adopted the strategy of putting their linear TV shows and theatrical releases onto their streaming platforms as well. This means that DIS is potentially spending more on DTC content compared to NFLX, while WBD is not far behind.

There is a limit on the number of shows people can watch because of time, relationship, and work constraints. Streaming companies should be mindful of this ceiling when producing shows to keep subscribers entertained. In a previous article, I deduced that the DTC content spending for each player will eventually stabilize at around $25B each.

DIS has already exceeded my expectations of the ideal amount of spending, leading me to conclude that DIS only has to optimise its spending now. That’s great, given that the rest of its competitors have to continue increasing spending to reach the ideal level of $25B.

Therefore in terms of content spending in the near future, I rank them in order:

3. The stickiness of its content

Sticky content is important to reduce the churn rate. The churn rate is a measure of the number of subscribers that leave a streaming service. Having a low churn rate is important to ensure stable revenue generation and to allow the subscription model to be economical. Streaming services can reduce churn by focusing on episodic content, or by bundling sports, news and other services with movies and TV series.

Looking at the content tables above, we can see that NFLX has the highest TV drama-to-movie ratio. On the other hand, PARA has the lowest TV drama-to-movie ratio. DIS and WBD rank somewhere in the middle. This may be the reason why NFLX has a lower churn rate compared to its peers.

Sports content is imperative in making the content provider more sticky. Sports guarantee a built-in audience. In terms of sports coverage, DIS is the best. It owns ESPN which is the most popular sports coverage channel. PARA comes in second with the CBS sports channel. It has rights to NFL, Champions League, Serie A, College basketball, PGA Championship, and Masters. WBD comes in at 3rd place with its Eurosport and Turner networks that have rights to NBA, NHL and MLB. In this regard, many of the other streaming competitors are at a disadvantage. NFLX, Amazon Prime, and Apple TV all do not have their foot in the realm of sports. I gave the above ranking based on how popular the sports they have the rights to are.

Like sports, news helps to further reduce churn. Because of its ever-changing nature, people continuously have to keep up to date with new news, and that is why news has very low churn. PARA, WBD and DIS can reduce their churn by incorporating their news channels into their streaming services. In terms of the strength of their News offerings, WBD which owns CNN comes in the first place, followed by DIS and then PARA. NFLX, Amazon and Apple tie for last place with zero news exposure.

Therefore in terms of churn rate in 5 years time, I rank them in order of:

4. Current subscriber satisfaction

According to the survey below, in terms of overall satisfaction, HBO Max currently takes the lead, followed by DIS+, Hulu, NFLX, PARA+, AAPL, and then AMZN. We can also see that only NFLX lost significant customer satisfaction from 2021 to 2022. DIS+ gained ground while Hulu lost a portion of satisfaction points.

Below is another survey done by Whip Media that asked subscribers which streaming service they would keep if they only had one choice. NFLX is currently the most popular service, followed by HBO Max, Hulu, DIS+, AMZN and then PARA+. NFLX found itself losing 10%, while Hulu lost 4%. On the other hand HBO MAX, DIS and PARA+ found themselves gaining ground.

It seems that DIS+ has strong customer satisfaction and is even gaining ground. However, it seems that although Hulu has strong customer satisfaction too, it is losing ground to other competitors such as HBO Max and PARA+.

Content Library Analysis Conclusion

Based on our analysis above, I estimate that DIS will likely have the strongest content library in 5 years.

I find it hard to distinguish PARA, NFLX and AMZN. This is because while PARA has more well-known franchises, sports and news content, NFLX is spending so much more than PARA. AMZN is a wild card. Because it bundled Prime Video with numerous other services, its subscription is very attractive to customers. However, with the company pursuing growth in so many other verticals, it is hard to determine how much funds it will eventually pour into streaming.

Coffee Break!

Analysis on DIS’s strategy

By now investors should realize that for traditional media companies to survive in the streaming space they should cater to the widest possible audience. As such the ideal company should have 3 streaming services:

An SVOD service without ads

To cater to those customers who want the newest content without any ad disturbances.

An SVOD service with ads

To cater to those customers who want the newest content but are cost conscious.

A Free Ad-Supported Streaming (FAST) service

To cater to those customers who want free content.

PARA’s Pluto TV has shown us that this service is both highly demanded and profitable!

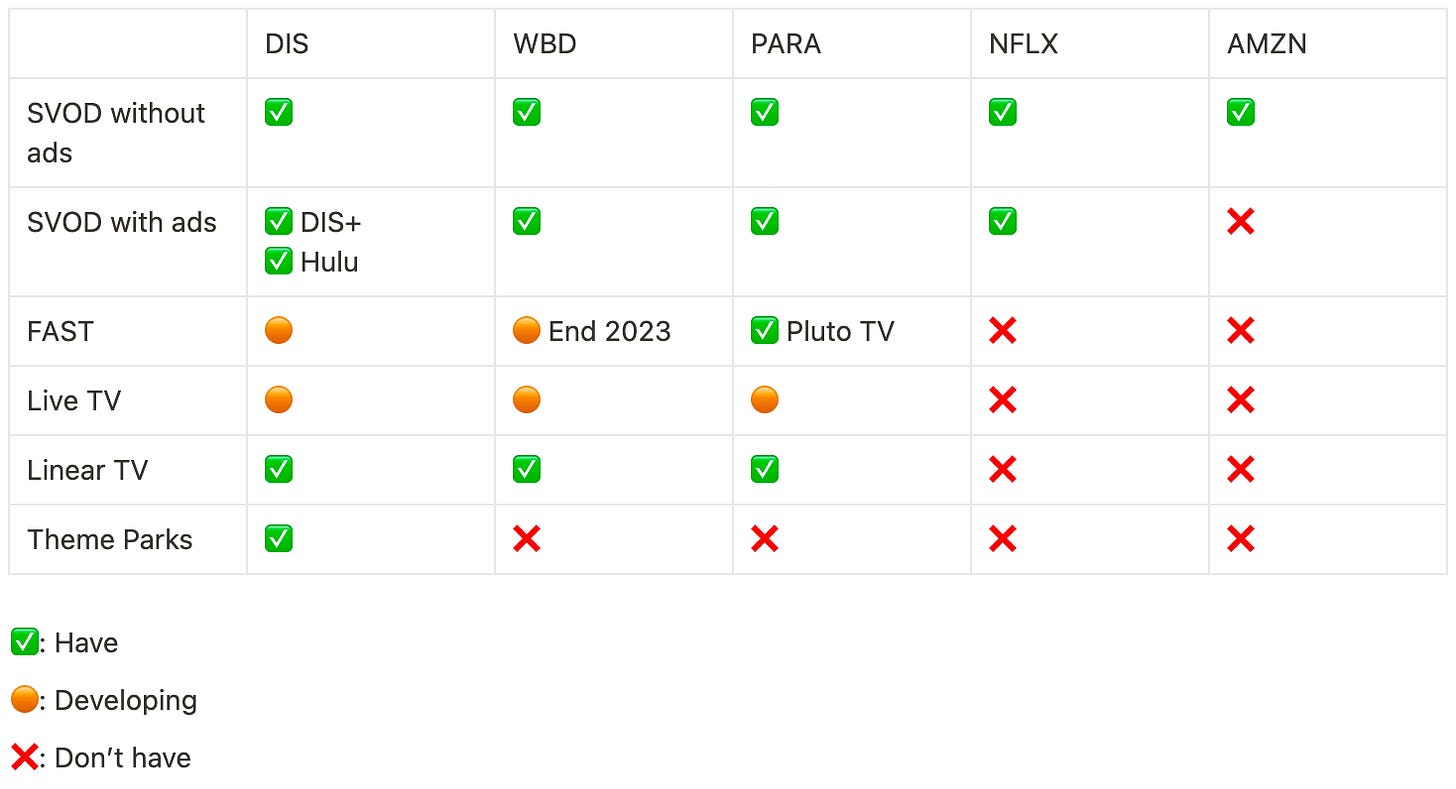

With this ideal company in mind, let’s analyse DIS and its competitors.

By the end of this year, DIS, WBD, PARA and NFLX will all have an ad-tier subscription option. PARA is the only company with a FAST service for now. Given that it has already proved profitable, I’m sure competitors will follow in PARA’s footsteps and launch their own FAST services too. In fact, WBD has already hinted at releasing its FAST service sometime next year. Both DIS and WBD have deep enough content libraries to have their own FAST service, however, NFLX and AMZN do not. Thus, I do not expect NFLX and AMZN to have a FAST service anytime soon. If the subscription streaming model proves to be uneconomical in the future, companies like DIS will have the option to fall back on their FAST streaming model, unlike NFLX and AMZN.

Other Strategies

Here is a collection of other strategies that DIS has and can implement if necessary.

1. Theatre first then streaming

Like its competitors, DIS has chosen to release its blockbuster in theatres first, before moving them onto DIS+. WBD and PARA are also already employing the same strategy. This strategy not only allows the company to maximise revenues but also allows box office hits to help market the company’s streaming platform.

2. Taking popular streaming content and putting it into theatres (Not in effect yet)

One strategy that DIS’s rival PARA has employed is to take hit streaming Originals and put them into theatres. Putting movies into theatres requires expensive marketing campaigns to make the desired returns on investment. Previously, studios could not be sure whether movies they released into theatres will be hits or flops, as only a small circle of people would review and give feedback on the movies before their release. However, this changes now. For example, DIS can use its streaming platform as a testbed for the reception of its Originals and gather data on the movies. Movies that resonate well with their streaming audience, have a higher chance of succeeding at the box office and so are deemed more worthy of the expensive marketing costs to put a movie into theatres. In short, it allows a better return on investments.

3. Funnel customers through the different streaming platforms (Not in effect yet)

For example, when a viewer is watching a free show on DIS+, he might be shown the trailer of a series on Hulu, et cetera. DIS has a good opportunity to cross-sell its streaming services to viewers.

4. Crackdown on password sharing (Not in effect yet)

Like NFLX, should the need ever arise, DIS can crack down on password sharing as well.

5. Bundle DIS+ with other services (Not in effect yet)

If subscriber numbers ever reach a ceiling, DIS can always pull the lever of bundling DIS+ with other services. For example, In August 2022, Paramount inked a deal with Walmart (WMT). The deal will see Walmart+ members gaining access to Paramount+ Essential Plan subscription, while its own membership pricing would stay the same at $98 per year. This deal is beneficial for WMT because provides WMT with a more competitive offering to rival that of Amazon Prime. For PARA, the deal gives it a moat amidst an increasingly crowded streaming landscape.

6. Ultra-flexible subscription tiers (Not in effect yet)

For example, DIS could add a feature that allows viewers to give a one-time payment to binge-watch a TV series that usually releases episodic content. Chinese streaming services like IQIYI and WeTV already employ this strategy.

7. Sports gambling (Not in effect yet)

DIS’s previous CEO, Bob Chapek has hinted at entering the sports betting market.

8. Instead of subscription-based, change to a consumption-based model (Not in effect yet)

If the need ever arises, DIS could change from a subscription-based model to a consumption-based model. Instead of charging viewers a monthly fixed rate, DIS could charge them based on time spent watching movies on their platform. This pricing will be attractive for those customers who like churning through the different streaming platforms.

Management Strategy Analysis Conclusion

With its ad tier rolling out this month, DIS is in a good position relative to its competitors. There are many possible strategies the company can execute to boost profitability should the need ever arise. However, it is wise to remember that acquiring a customer through a bundle is only part of the challenge. The real goal is to turn those bundle subscribers into active users. You need the eyeballs to earn the advertising revenue, which these cheaper subscription tiers rely critically upon.

Analysis on Management

DIS CEO Bob Chapek was recently fired and ex-CEO Bob Iger took over as CEO again. In this section, I will try to analyse DIS’s management team through recent company developments. Because of the nature of the subject, my arguments here are purely subjective.

1. Terrible movies hint at internal management problems

I acknowledge that I am not a movie critic, however, I as an avid movie watcher, think I am at least qualified to give my opinions on the matter.

DIS may have the strongest IP, however, that has not stopped it from butchering its recent movie releases. Its new Marvel movies lack novelty and have scored poorly at the box office. DIS’s recent movie “Strange World” officially ended Disney Animation's CinemaScore rating streak by scoring lower than any film in 31 years. This may hint at internal management problems within DIS.

2. Florida incident hints at a management team not focused on shareholders

When the Parental Rights in Education Act in Florida was passed, former DIS CEO Bob Chapek initially declined to comment on the bill. However, following an outcry among staffers, Chapek swung hard in the opposite direction. He criticized the law and even publicly called out DeSantis. Below is an excerpt from an interview with Bob Chapek.

Interviewer: We're a few months out from the controversy in Florida ... But given a little time and distance, when you look back on what happened with the governor and the tax benefits for Disney, what do you think you did right? And what do you think you did wrong? What are the lessons you've drawn from that?

Bob Chapek: I think the lesson is, the lesson that we probably always knew, which is at Disney, it's all about the cast. If you think about the nature of why people have great Disney memories, remember the end benefit is memories -- magical memories that last a lifetime. The reason they have those, yes, it's about the castle and yes, it's about the great attractions or they really enjoyed that churro on Main Street. But really, what they remember more than anything is guest-cast interactions. And so if that's the secret sauce for making those magical memories, when I ran parks for, gosh, I don't know what it was like 7 years, almost, I would say 99% of the letters I got were about guest-cast interactions, not about attractions. Literally, it was almost every single one. So if that's the key to a great guest experience, and we're all about the guest and the audience and maximizing their experience, then you have to make sure that the cast is at the center of everything that you do.

I may be reading too much into this, however, here are my opinions. This incident tells me that Bob Chapek allowed employee pressure to sway his decision-making which led to the detriment of shareholders. The fact that Chapek even said “make sure cast is at the centre of everything we do” instead of shareholders, may signal the misalignment of his priorities. This may further indicate that decision-making within Disney is largely driven by sentiment instead of what is actually good for the company. I sincerely hope this is not the case, and Disney will not be the next Twitter that pampered employees to the detriment of shareholders.

Coffee Break!

Let’s Wrap Up!

As I mentioned at the start, here are the market perceptions of DIS.

After my analysis, here are my perceptions of DIS.

I have shifted the “declining traditional linear business” from Hate It to Indifferent, as although Linear is a declining business unit it is contributing significantly to the company’s bottom line. Thus, for now, I am happy that Disney has this business unit. Additionally, I have also shifted “Large DTC spending” from Hate it to Indifferent, as although Disney’s spending does seem large in comparison to its peers, it is at the level I think DTC companies need to spend to generate sufficient content. This means that Disney will unlikely have to increase spending further, meaning profitability is close by. I have shifted “Bob Iger” from Love it to Indifferent, as although Disney thrived well under him in the past, it was mostly thanks to acquisitions. Now that the media space has consolidated, acquisition opportunities have become more scarce. Moreover, it is also important to remember that Iger hand-picked Chapek as his successor and we all know where that led. If Iger does not have a better succession plan after his next 2-year tenure in the company, Disney may face further management problems.

Overall, I think DIS is a business that is easy to understand and lies within most retail investors’ circle of competence. Unlike WBD and PARA whose lives solely depend on a successful transition from Linear to Streaming, DIS has a very profitable Parks business that can cushion this tumultuous transition. In this sense, investors should expect and be happy to pay a premium for DIS.

Up Next!

I will be analyzing DIS’s financials. Has DIS’s current stock price accurately priced in its risk and reward? What are you waiting for? Subscribe to receive this important next drop!

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own due diligence or consult a financial advisor. Investing includes risks, including loss of principal.