Warner Brothers Deep Dive Part 2

Analyst: Joshua

Time to read: 20 min

First, I’d like to welcome new readers to The Retail Deep Dive. So glad to have you join us! Our mission is to analyze companies with exciting prospects and unpack them logically for our readers.

This month’s deep dive is on Warner Brothers Discovery, a new media behemoth, and a strong streaming player.

We decided to split our research into 2 separate articles to break it down nicely for you. The first article will focus on an analysis of WBD, while the second article will evaluate WBD’s financials. This is the second article.

Disclaimer: I currently own shares in WBD.

WBD Financials

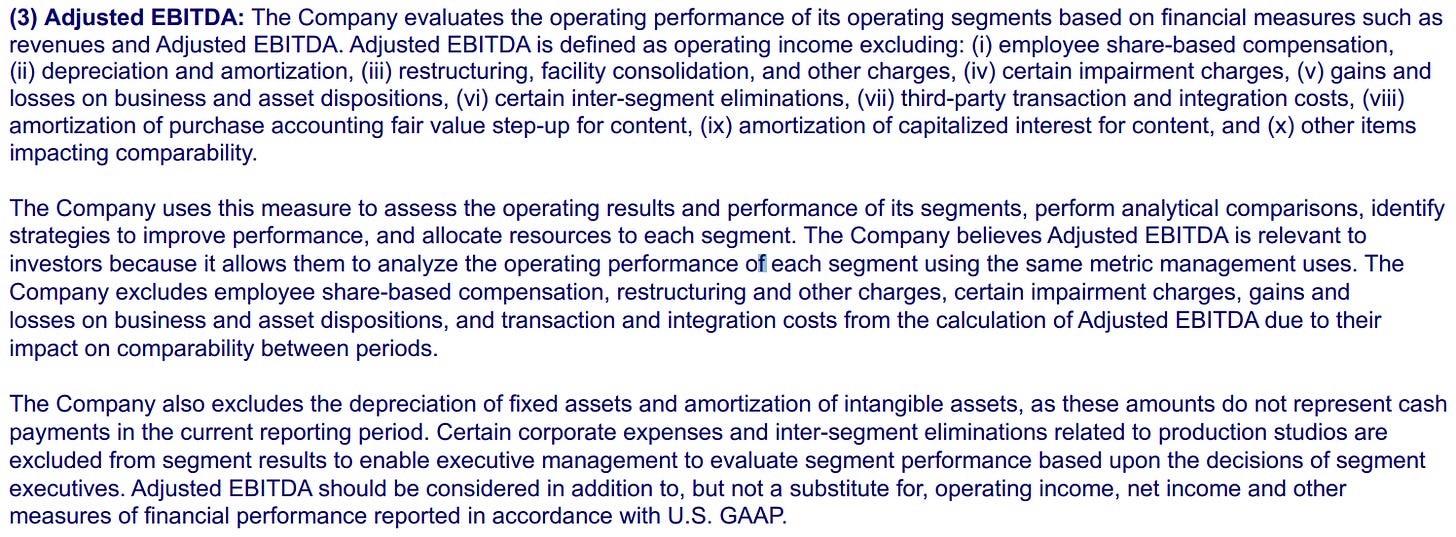

To find FCF, we have to look at adjusted EBITDA, management’s financial north star. This is because management set their FCF goals based on specific conversion rates of their expected adjusted EBITDA.

To find adjusted EBITDA, we need to see if management can hit its revenue goals.

To assess management’s revenue targets, we need to see if management can hit its 2025 DTC subscriber target.

So here’s the breakdown of today’s article!

Breakdown

Estimating the 2025 subscriber count

Estimating 2025 revenue

Analyzing Revenue

Analyzing EBITDA

Analyzing FCF

EV/EBITDA Valuation

Conclusion

Estimating the 2025 subscriber count

Definition of Subscribers

The subscriber number includes:

(i) a retail subscription to discovery+, HBO or HBO Max for which we have recognized subscription revenue, whether directly or through a third party, from a direct-to-consumer platform;

(ii) a wholesale subscription to discovery+, HBO, or HBO Max for which we have recognized subscription revenue from a fixed-fee arrangement with a third party and where the individual user has activated their subscription; and

(iii) a wholesale subscription to discovery+, HBO, or HBO Max for which we have recognized subscription revenue on a per-subscriber basis.

The subscriber number excludes:

(i) individuals who subscribe to DTC products, other than discovery+, HBO, and HBO Max, that may be offered by us or by certain joint venture partners or affiliated parties from time to time; (ii) a limited number of international discovery+ subscribers that are part of non-strategic partnerships or short-term arrangements as may be identified by the Company from time to time (such subscribers may also be referred to as “non-core”

Thankfully, management’s definition of “subscriber” makes sense, so we don’t have to do our own adjusting.

Estimating WBD’s 2022 subscriber count:

Due to a change in subscriber definition, WBD’s Q1 2022 subscriber base was rebased from 100.5 million to 90.4 million. In Q2 2022, WBD added 1.7 million subscribers bringing its total subscriber count to 92.1 million. If we extrapolate this, WBD will end 2022 with 95.5 million subscribers. I think this is conservative as House of Dragons will likely draw in many subscribers in Q3, so I’ll artificially bump this number up to 100 million.

However, there is one risk to take note of. Currently, WBD’s subscriber count consists of subscribers from HBO Max, HBO, and Discovery+. There certainly are overlaps between these subscriber bases, and when WBD combines HBO Max, and Discovery+ into a single platform next year, it will definitely, have to rebase subscriber numbers once again. Moreover, we need to expect that a large proportion of Discovery+ plus subscribers are currently simultaneously subscribed to HBO Max. If I were to assume this percentage at 80%, it means that WBD’s unique number of subscribers actually stands at 80.8 million at the end of 2022.

Estimating WBD’s 2025 subscriber count:

Management expects to have 130 million subscribers in 2025. This means an addition of 16.4 million subscribers each year. Let’s see if this estimate is reasonable.

Checking management’s expectations

Looking at NFLX's growth rate in 2016.

We chose to use NFLX’s growth rate in 2016 because WBD currently has the same number of subscribers NFLX had in 2016.

From 2016 to 2020, NFLX was able to add an average of 24 million subscribers each year.

However, today’s streaming space is more competitive than in 2016.

Thus, we think that WBD will be able to add 15 million subscribers each year till 2025.

Looking at DIS growth rate today:

Like WBD, Disney+ was also late to the streaming game.

For this comparison, we will only take reference from DIS+ and not HULU or ESPN+. This is because HULU started many years before WBD, and ESPN+ is purely focused on sports.

Thus, it would make sense to compare WBD’s growth to Disney+ growth as they both started around the same time and both offer similar types of content.

Disney+ added 45 million subscribers in 2021.

Disney+ added 12 million subscribers in the first quarter of 2022. This means that if they continue at this pace, they will add 48 million subscribers this year.

Currently, Disney+ has more developed franchises (Marvel, Star Wars) under its hood than WBD has, so we can expect WBD to add subscribers at a slower rate than DIS.

Thus, we think that WBD will be able to add 20 million subscribers each year till 2025.

Looking at the PARA growth rate today:

PARA+ launched in March 2021

In 2021, PARA+ added 33 million subscribers

In Q1 2022, PARA+ added 6.8 million subscribers. In Q2, PARA+ added 3.7 million subscribers.

This means that if they continue at this pace, they will add 17.9 million subscribers this year.

Currently, WBD+ has greater franchises under its hood than PARA+ has, so we can expect WBD+ to grow at a faster rate than PARA+.

However, WBD+ is already 50% larger than PARA+, so WBD+ may not experience as fast growth as PARA+.

Thus, we think that WBD+ will be able to add 15 million subscribers each year till 2025.

Notes: Pluto TV is not included in the PARA total

Taking the average of the 3 growth rates, WBD will be able to add 16.6 million subscribers per year till 2025. This matches management’s expectations closely, and I believe it may be possible for the company to actually beat this expectation.

There are currently almost 1.7 billion households in the world. Out of that, let’s assume 400 million is in China. So that means the market opportunity today is almost 1.3 billion households. Let’s further assume that only 80% of these households actually regularly use their TV and will move to an OTT service. If this is the case, the opportunity now stands at 1 billion households. Jason Kilar, the former CEO of Warner Media commented: “I don’t think the ceiling is 222 million subscribers. I think the ceiling is far closer to 1 billion. You get there by giving customers the choice.” “The choice” refers to ad-tier subscription plans. If he is right, there is still a long runway for growth in the streaming market. Our projections of WBD are well below the theoretical limit of streaming subscribers.

Estimating 2025 revenues

So it seems that management’s 2025 target of having 130 million subscribers make sense. How much revenue does this translate to exactly?

1. DTC Revenues

Turning to ARPU, WBD reported a current ARPU of $7.66 globally, comprised of $10.54 domestically and almost $3.69 internationally. We can expect further ARPU to grow because of the following factors:

The new combined streaming platform can command a higher ARPU

A shift by new management “away from heavily discounted promotions that were part of the gross ads focused strategy of the past to a more balanced approach that optimizes revenue as well as subscribers”

Increasing prices across all competitor’s streaming services

In our NFLX article, we estimated that NFLX 2025 global average ARPU would be $13. Since WBD’s content library is stronger than NFLX, we can assume that WBD will safely be able to earn $11. Now let’s try to estimate WBD’s DTC revenue in 2025.

2. Network Revenues

I make the assumption that Network revenues will fall by 3.8% per year up till 2025. This is based on research by Statista which I elaborated on in my previous article.

Networks made $5.7 billion in Q2. If we project this for this year, I estimate WBD will earn a total of $22.8 billion this year. If its Network revenues fall by 3.8% per year till 2025, it will mean that WBD’s 2025 Network revenues will stand at $20.3 billion.

3. Studio Revenues

Studios made $2.8 billion in Q2. If we project this for this year, I estimate WBD will earn a total of $11.2 billion in 2022.

We can expect studio revenues to increase, as WBD starts releasing more Warner Brothers movies into theatres, and selling content to other media companies.

Below are my projected financials.

Note: Gross leverage = Total debt / Adj EBITDA

Revenue

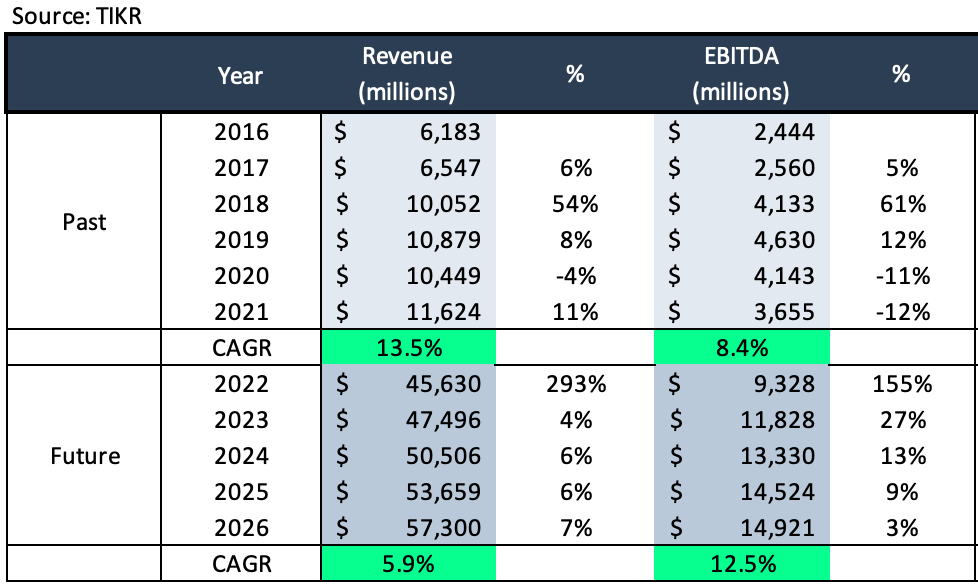

Note: Based on analyst estimates on 6 Sept 2022

Note: Above is adjusted EBITDA

Management Expectations

Management expects Q3 2022 Global ad revenue to decline by a high single to low double digits. The reason is because of some tough prior year comps, specifically the Summer Olympic Games, 2 NBA Eastern Conference finals games played in early July last year, as well as the sale of Chilevisión. Additionally, management is seeing softer demand because of the less favourable macro environment. Beyond that, management has not given guidance for future revenues.

Analyst Expectations

Analysts expect future revenues to grow at 5.9% over the next 4 years.

Common Sense Check

In my previous article analysis of the decline of linear TV, I estimated that WBD may have a growth rate slightly above 3.9%. Since this number is not far from 5.9%, I think analyst estimates for revenue make sense.

EBITDA

Management Expectations

Note: EBITDA above is adj EBITDA

Note: FCF Conversion rate = FCF / Adj EBITDA

“Our financial North Star will be EBITDA driven by solid top-line growth and greater cost efficiency from the combination of these 2 products. We expect peak EBITDA losses for the D2C segment will occur this year in 2022 as we do the heavy lifting around technology, personnel, and integration ahead of the planned relaunch starting next summer.” Management expects adjusted EBITDA to range between $9 billion and $9.5 billion for 2022.

The company estimated that EBITDA for global streaming will hit $1 billion by 2025 with the streaming business breaking even by 2024. This is based on its expectations of having 130 million subscribers.

Management forecast 2023 core profit to be $12 billion.

Analyst Expectations

Analysts expect EBITDA to grow at a rate of 12.5% for the next 4 years and reach $14.5 billion in 2025.

FCF

Management Expectations

I generated the table above based on excerpts from management’s earnings call listed below.

“We expect to generate a free cash flow of around $3 billion after cash cost to achieve in 2022. On that basis, I am expecting net leverage at year-end to be approximately 4.8x.” Q2 Earnings Call

“Turning to our outlook for 2023. Based on the full-year impact of our 2022 corrective actions and $2 billion to $3 billion of synergy realization in 2023, we expect adjusted EBITDA to be at least $12 billion. We expect to convert approximately 1/3 to half of our adjusted EBITDA into free cash flow in 2023 as we make progress towards our long-term target of approximately 60%.” Q2 Earnings Call

“We will continue to dedicate virtually all free cash flow generated to debt reduction until then (2024)… We had $53 billion of total debt at the end of Q2, including $6.5 billion of term loans. Importantly, our debt financing is generally long-term with an average maturity of more than 14 years and a 4.3% average interest rate and equally importantly, interest rates for the vast majority of our debt are fixed. We have no remaining payments due in 2022, and we currently have $1.3 billion due in 2023 and $4.3 billion due in 2024.” Q2 Earnings Call

Analyst Expectations

Analysts are more optimistic than management and expect FCF to grow at 34% over the next 4 years and the company to have a FCF yield of 29% in 2026!

Common Sense Check

Analyst expectations for FCF growth are more optimistic than management. However, they are not very far apart and seem reasonable to me. Both management’s and analyst FCF do not include cash outflow for repayment of debt. However, in both cases both management and analysts expect FCF to be more than enough to pay down its expiring debt of $5.6 billion in 2023 and 2024.

EV/EBITDA Valuation

WBD is currently trading at an EV/EBITDA multiple of 25x. However, this current multiple is misleading, as management has stated that it expects peak EBITDA losses this year, and the LTM EBITDA does not represent WBD’s EBITDA but Discovery’s EBITDA. Thus, we should not place emphasis on its current multiple but come up with a reasonable multiple by looking at its peers for reference.

Comparing WBD and DIS up until 2026, it can be argued that WBD can trade a multiple of around 13x relative to Disney.

Comparing WBD and PARA up until 2026, it can be argued that WBD should trade at a multiple of around 10x relative to PARA.

Comparing WBD and NFLX up until 2026, it can be argued that WBD should trade at a multiple of around 10x relative to NFLX.

Comparing WBD to a Linear TV company in the past.

After all, if all Linear TV operations are ported over to Streaming, Streaming will become the new Linear TV. To determine what is an appropriate Linear TV company multiple we will use the 10-year average of the legacy media conglomerates.

DIS 10-year average historical multiple was 18x.

DISC 10-year average historical multiple was 10x.

PARA 10-year average historical multiple was 9.5x.

Thus, it can be argued that WBD could trade a multiple of 11x in the future.

As I find it hard to distinguish the probabilities of each multiple derived above, I shall just take the average of ~11x as my Normal Case multiple for WBD in 2025.

Based on a relative comparison with its peers, I have chosen the following 3 cases:

So the three cases are:

Normal Case Multiple: 11X

The streaming war ends, and WBD emerges as one of the winners

The streaming business is slightly more profitable than the linear business

Bear Case Multiple: 7X

The streaming war continues

The streaming business is less profitable than the linear business

Bull Case Multiple: 15X

The streaming war ends, and WBD emerges as the second-biggest streaming platform

The streaming business is much more profitable than the linear business

Using the current stock price of $13 and analyst estimated 2025 EBITDA of $14,524 million with a scenario analysis, weighting 80% for the normal case and 10% for the other 2 cases, combined with a final 15% margin of safety, I get a TP of $41 for 2025, representing a 227% upside from today’s prices ( 34% CAGR).

Looking at the current macroeconomic environment, it is also possible that analysts overstated 2025’s EBITDA. To be conservative, let us use a lower 2025 EBITDA estimate of $13,000 million. For this case, with a margin of safety of 15%, we have a TP of $35 for 2025, representing a 213% upside from today’s prices ( 30% CAGR).

Final Judgement

In my introductory article, I listed the market perceptions of WBD. Now, let us judge if they have sound.

Massive and High-Quality content library

Based on my analysis, it is true that WBD does have a massive and high-quality content library.

Massive Debt in a higher interest rate environment

Based on my analysis, it is true that WBD has a massive debt of $47 billion. However, it is not something that is can’t be handled, so does not pose a bankruptcy risk. Thus, the market’s fear is irrational.

Competitive and unprofitable nature of the streaming wars

Based on my analysis, streaming as a whole is currently underpriced as players strive to get market share. However, eventually, streaming prices will have to rise and an equilibrium will be reached. Fortunately, WBD does not have to continuously lose money while waiting for this deliverance. It can bank on its profitable Networks and Studios businesses. Thus, the market fear for WBD is overstated.

Declining linear TV business

Based on my analysis, WBD’s cable business is declining, but not as exponentially as people think. Its streaming business is growing faster than its linear business. Moreover, it owns the best cable networks around that have some of the highest viewership retention rates. Thus, the market’s fear of WBD is unfounded.

Mismanaged DC universe

Based on my analysis, previous management failed to develop its DC franchise. However, today’s WBD management has stated that they are developing a 10-year plan for the franchise. Moreover, as Marvel, has started moving into its phase 4 MCU, people have started to get bored and tired of it. All the more reason, that people may become more attracted to the DC universe.

In conclusion, it seems to me that most of the market’s fears regarding WBD are unfounded. The stock price is at levels that may offer investors good returns. As always use my analysis as a springboard for your own due diligence, and not as a recommendation to buy or sell a stock. With that, my deep dive into WBD comes to an end! Hope you enjoyed it!

Up Next!

I will be analyzing Paramount (PARA) next. How does it compare against WBD? Subscribe to not miss out on our next drop!!!

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own due diligence or consult a financial advisor. Investing includes risks, including loss of principal.

solid article glad to be first to comment- thank you for your work! solid and reassuring analysis. One point to consider to further anchor the value opportunity higher would be to purely value both the video game business and the ip library. i’ve seen rational valuations for both that substantiate 30B and 90B enterprise values respectively- not counting most of the actual revenue streams in the valuations. i think it’s a safe bet even with bad macros for 2-3 years for this to be a 80-120$ stock...once management proves it’s mettle and ability, multiples and earnings should climb -quickly!

ps 1 decimal point (213pct not 2183) typo:”also possible that analysts overstated 2025’s EBITDA. To be conservative, let us use a lower 2025 EBITDA estimate of $13,000 million. For this case, with a margin of safety of 15%, we have a TP of $35 for 2025, representing a 2183% upside from today’s prices ( 30% CAGR)