Time to read: 20 min

First, I'd like to welcome new readers to The Retail Deep Dive. So glad to have you join us! Our mission is to analyze technology and consumer discretionary companies that have exciting prospects and unpack them in a logical way for our readers.

This month's deep dive is on a company often dubbed as the META of television! It is a company so loved by Cathie Woods that she has been adding to her position throughout the recent market pullback. That company is none other than Roku, the largest TV operating system in the US.

Breakdown

The article today will elucidate the following segments:

Stock Price

Definitions & Concepts

Revenue Breakdown

Acquisitions

Analysis of The Roku Channel

Analysis of the Roku OS

Analysis of the Roku TV

Analysis of Roku's push into advertising

Analysis of Roku's first mover advantage

Financials

Relative Valuations

Introduction

Stock price action

Roku’s stock price currently trades at $82, down 82% from its all time highs in July 2021. Some reasons for this massive decline include the negative sentiment from Netflix losing subscribers, the unprofitable nature of the company in an inflationary environment, and increasing competition from Google and Amazon.

Thesis

In this Roku Deep Dive, I endeavor to:

Understand Roku’s business model

Anticipate how Roku’s future will look like

Value Roku relatively

Definitions & Concepts

Revenue Breakdown

Roku categorises its revenues into 2 streams, Platform and Player revenues. For 2021, its breakdown is as follows:

Platform Revenue

Platform revenue is Roku's biggest and highest margin revenue segment. It consists of:

1) Streaming

Roku earns from all 3 streaming business models.

Roku earns from digital advertising using its One View Platform. The One View Platform is Roku's technology for tracking viewers. The technology gathers data on a viewer's behaviour and interests and then places targeted ads into the shows that the viewer is watching.

Roku also earns from revenue-sharing agreements with content streaming services. For example, if I decided to sign up for Netflix and watch it on my Roku TV, then Roku would receive a small percentage of the subscription that I pay to Netflix. This revenue is recurring in nature. However, if the user is already a Netflix subscriber before purchasing a Roku TV, Roku does not get a cut.

Roku also earns from users purchasing one-off content. For example, if a user wants to rent The Batman for $10, Roku may take a cut of $1

2) Licensing OS to TV OEMs

As of now TV OEMs that manufacture TV's for Roku compensate Roku if a viewer uses a Roku TV. This means that if a customer where to buy a Roku TV manufactured by TCL, TCL will pay a small commission for this sale to Roku.

3) Placing branded buttons on its remote

Roku allows companies to buy buttons on Roku's TV remotes. For example, Netflix pays Roku for a dedicated Netflix button on the Roku remote. This allows users to quickly launch the Netflix app on the Roku TV with a single tap on the Netflix button. Roku charges $1 per branded button per remote to content publishers.

4) Priority positioning on the OS homepage

Roku allows OTT companies to buy space on the TV's homepage. This helps promote the OTT company's shows. For example, Disney may pay Roku to place Disney+ shows on the homepage of Roku TV.

Player revenue

Player revenue is Roku's second revenue stream. It is made up of hardware sales which includes sales of Roku's streaming box, speakers and sound bars. It is a low margin business with anticipated further declines in margins. This is because Roku is willing to take losses on this segment to acquire customers for its higher margin platform advertising operations.

Platform revenue VS Player revenue trends

The proportion of Platform revenue to Player revenue has continued to increase over the years. This is good news because Platform revenue has much higher gross margins than Player revenue. As expected, the table below shows how total gross margins have been improving over the years.

Acquisition

Neilsen’s Advanced Video Advertising

Roku acquired Neilsen’s Advanced Video Advertising in March 2021. Under the deal, Roku obtained Nielsen’s automatic content recognition (ACR) and dynamic ad insertion (DAI) technology. This was a pivotal step for Roku in advancing its ad business. Traditionally, Linear TV advertisers would use the shotgun advertising model, where the same ad will be played across the country for all audiences regardless of demographic. Advertisers would then hope that their ads resonated with at least some viewers. As many of you suspect, this advertising model is sub-optimal in an era where social media companies use targeted individualised ads, with capabilities to measure engagement activity.

With this acquisition, Roku will have the capability to replace ads on Linear TV programs with its own targeted, individualised ads. For example, if Roku notices you are binge watching a beauty TV show using its "automatic content recognition" technology, it may show you ads on beauty products instead sports goods using its "dynamic ad insertion" technology. As the first company to revolutionise the TV advertising space, Roku has essentially set itself on the path to become the Facebook of streaming platforms. With this capability, Roku can track all the content its viewers watch on its OS, and provide ads across all the streaming platforms (Netflix, Disney, HBO) should they choose to partner up with Roku. I applaud this visionary move from management.

Dataxu

Roku acquired Dataxu in December 2019. Dataxu sells automated bidding and self-serve software so that marketers can manage ad campaigns across digital platforms using data science and advanced media planning tools for television and streaming platforms. With Dataxu, Roku can offer an integrated platform for advertisers to bid, manage and measure ad efficacy. This move can be likened to Facebook setting up its advertising tool for marketers to use a decade ago.

Moreover, with Dataxu, Roku can also automate its own actions of purchasing and managing ad space on the open web. Some of you may be wondering why Roku would want to buy ad space on other operating systems like IOS/Android/Windows/Mac? This is because Roku can use its data on viewers from its OS platform to create targeted ads, then follow the user across to these other platforms and keep peppering them with ads. For those who value privacy and autonomy this may seem scary, however, its is in reality what Meta and Google are already doing. From a business perspective though, this is very lucrative.

Analysis of The Roku Channel

The Roku Channel is a streaming service by Roku where all its shows are free for all Roku customers. Think of this as Roku's version of Netflix. The Roku channel builds its content by licensing content and opportunistically acquiring content. Currently, it has more than 10,000 free shows and movies. A majority of these are licensed content from external media conglomerates, while a minority of the shows are Roku Originals. Roku Originals is Roku’s push into the content creation space and is a relatively new initiative. On May 20, 2021, Roku debuted 30 “Roku Originals”, which were content acquired from Quibi. In the future, Roku expects to release more than 50 Originals in 2022 and 2023.

Roku monetizes The Roku Channel solely through advertisements. Advertising revenue earned from licensed content is shared with content providers depending on the monetization model agreed upon. On the other hand, advertising revenue earned from Originals is fully kept by Roku.

The two types of monetization models Roku engages with its content providers are:

The Roku Channel is used as a sandbox for Roku to test and improve upon its advertising capabilities. My guess is that once Roku has mastered ad targeting, it will offer this feature to the other streaming services on the Roku OS. Perhaps, Netflix may strike a deal with Roku to manage Netflix’s ads for its ad streaming tier in the future.

The streaming wars are heating up. To stay competitive, the majority of the streaming players will be forced to offer cheaper ad-tier subscriptions. I think management’s hidden play is that by owning the best TV ad delivery system, Roku will be in the best position to attract all the different streaming players onto the Roku OS. This in turn will allow Roku to use its revenue to build its own content to a level where The Roku Channel can compete with the current streaming kings.

Bull Points (+)

Bull Point 1: The Roku Channel gives consumers a reason to purchase a Roku TV over a competitor's TV

Roku's two biggest competitors are Google and Amazon, and they are both ramping up investments in the smart TV space. Unlike Roku, Google TV and Amazon TV do not yet offer a channel that provides free content for viewers. Thus, the free Roku Channel is a strong selling point for consumers who wish to get their money’s worth.

Bear Points (-)

Bear Point 1: Who's to say Google and Amazon will not offer their own subscription free channels?

Amazon has Prime Video that currently operates only on a subscription model. However, it already owns much more content than Roku. Looking at Netflix's entrance into offering cheaper ad subscription tiers, it will not be a surprise if Amazon follows in its footsteps. If Amazon were to create a free channel on its Amazon TV, it would immediately be more competitive than The Roku Channel.

On the other hand, Google owns YouTube. As an avid tv drama watcher, I know that there are many studios already releasing their tv shows for free on YouTube. Should Google decide to create a dedicated free channel on its Google TV, The Roku Channel will also face stiff competition.

Bear Point 2: By developing The Roku channel, Roku is not remaining company agnostic, which may breed competition between itself and its streaming partners.

Having once broken off from Netflix, Roku prided itself as remaining platform agnostic. When the Roku Channel first launched, it featured only content licensed from external media conglomerates. Back then, Roku focused on distribution and stayed true to its mission to be a good partner for both legacy tv companies and streaming companies. However, once Roku started buying over studios to create its own Original content for The Roku Channel this claim went up in dust.

By creating its own content, it seems that Roku has created multiple conflicts of interest with both legacy TV companies as well as streaming companies. I see a company that is trying to maximize profits. That is not a bad thing per se, however, when you don’t have a competitive advantage (more on this later on), profit maximisation is a dangerous move. Right now, Google TV is the only true agnostic platform as it does not develop its own content.

Analysis of Roku's TV OS

Roku sells its streaming sticks and Roku TVs to get as many people onto the Roku OS as possible. When Roku first launched there was little prevalence of smart TVs. There was no platform that seamlessly integrated all the streaming offerings into one operating system. In those days, Roku OS did provide value to viewers.

Bear Points (-)

Bear Point 1: Roku may lose revenue from licensing OS to TV OEMs

As mentioned above, Roku currently receives compensation for licensing its OS to TV OEMs. Google has followed Roku’s playbook and partnered with Sony and TCL for its own line of Google TVs. Even more recently, at CES 2022 Google announced new partnerships with Hisense and Skyworth. Instead of demanding a fee from the TV OEMs, Google has done the total opposite of Roku and is instead paying TV OEMs to use Google OS. According to 9to5mac “A source familiar with the matter says that Google TV pays around $10-15 per unit to partners.”

No wonder the TV OEMs are happy to partner up with Google. This move by Google could possibly erase Roku's OS licensing fees, and even result in additional costs as Roku may have to pay the TV OEMs instead.

Bear Point 2: Better OS from Google TV and Amazon TV

It is highly likely that Google and Amazon can create better TV OS than Roku. Google’s OS will be able to integrate into the larger Google ecosystem allowing customers to enjoy a more seamless experience. Amazon’s OS may be able to integrate with the many other electronic devices its sells. Moreover, Google and Amazon can incorporate their AI assistants, Google Assistant and Alexa. The vision for the future has always been for people to live in a smart home, where devices integrate with one another. It certainly seems to me that Google’s and Amazon’s OS have to potential to realize this vision, while Roku’s OS growth prospects seem lacking in comparison. Therefore, from a viewer's perspective, Google and Amazon OS seem to offer more value.

Analysis of Roku TVs

When Roku first launched the Roku TV, it chose to work with the less popular Chinese TV makers. For these TV manufacturers, using Roku OS on their TVs gave the TV more functionality. For Roku, partnering with Chinese OEMs allowed them to produce more affordable TVs than the competition like Samsung, LG, etc. Because of its affordability, Roku TVs had a market fit with middle-income families. Large-scale distributors like Walmart and Target liked this and started distributing Roku TVs in their stores. Roku TVs were immediately popular as they were of decent quality, had good functionality and, most of all were affordable.

Bear Points (-)

Bear Point 1: Google and Amazon have also partnered with the same Roku TV manufacturers

Google and Amazon have started partnering with the exact same manufacturers that Roku made contracts with. Google's partnerships have already been mentioned earlier. Amazon, on the other hand, has engaged TCL to help manufacture its Fire TV’s. Below is a screenshot I took from Amazon.com.

By partnering with the same Chinese TV OEM's, Google and Amazon are now able to produce affordable smart TV's just like Roku has. This means that Roku TV's may no longer have a price advantage over its competitors. On top of that, it is likely that Google and Amazon TV's will have more functionality than Roku TV's in the near future. Roku is already selling its TV's at little or no margins, so I doubt they will be able to draw customers over. It seems that if Roku is unable to differentiate its TV's, it will definitely have trouble acquiring customers. This in turn will dampen advertising dollars and cause margins to fall.

Analysis of Roku's advertising capabilities

Roku has been acquiring companies specializing in advertising to create its own holistic ad platform for marketers. Today, Roku is the only company that has a fully developed ad platform for TV advertising. This is certainly something to be excited about! As I mentioned above, some people think Roku could be the Meta of TV's! However…

Bear Points (-)

Bear Point 1: Both Google and Amazon are still stronger in advertising

Personally, I think Google can serve better-targeted ads. Google owns two of the largest search engines: Google and YouTube. Armed with these search engines, Google is able to have more precise information on customers needs and wants than Roku ever can. Thus, Google has the potential to serve superior targeted ads to viewers. Furthermore, Roku’s current growth pitch is that they will be able to track viewers on its platform which means that they are looking to track viewers using YouTube and Google on the Roku TVs. I can easily see Google preventing this in the name of privacy. From Google’s perspective, keeping its users data strictly on its own platform has a two fold benefit: It helps protects its user’s data, which is a win for users and its ensures that only Google is able to see this data, which is a win for Google.

Amazon is also entering the advertising space, and I presume that Amazon will also have a superior ad targeting solution compared to Roku. This is because Amazon is also a search engine of sorts. With data from the e-commerce side of the business, Amazon will know exactly what a viewer wants to purchase. Amazon can use this high quality data to also deliver superior ads to its viewers.

It appears that although Roku has developed competency in developing ads, it is not something its competitors lack. In fact, its competitors have the potential to create superior advertising products.

Analysis of Roku's first mover advantage

Roku has the largest market share in the US. One reason is because Roku has a distribution advantage over Amazon. Walmart and Target are direct competitors with Amazon, so they will happily sell Roku TVs in their stores over Amazon Fire TV's. However…

Bear Points (-)

Bear Point 1: Google TV already has a larger market share overseas

Google has been dipping its toes into the TV market for years already and has a larger market share of TV OS worldwide. This is clearly indicated in the first chart below. The second chart confirms this data, and we can clearly see how Roku has a negligible market share in every other region apart from North America.

In 2021, Google reported that it had 80 million active devices worldwide on its TV platform. This is almost ~60% higher than both Amazon and Roku. Therefore, although bulls claim that Roku has the first mover advantage in advertising capable smart TV's, it is Google who really is the first mover.

Bear Point 2: Amazon TV has better distribution at an international scale.

I mentioned how Roku seems to have a better distribution advantage over Amazon in the US retail stores. However, Amazon has a unrivalled international distribution scale. What this means is that Amazon TV's can potentially gain international market share faster than Roku can. Therefore, it appears to me that Roku does not actually have a first mover advantage.

Summary of strength analysis

A few years back Roku did offer an unparalleled proposition to customers. The Roku TV was affordable, had integrated all the streaming services and also had a free Roku Channel. However, it seems that Roku has reached an inflection point, and in this current future, Roku’s value proposition to customers and to investors looks severely lacking when compared to its competitors.

Google and Amazon are also creating their own lines of cheap smart TV’s, with potentially more powerful OS's. Additionally, they can easily replicate The Roku Channel.

From a data standpoint, Google and Amazon have access to so much more quality data compared to Roku. This means that Roku's competitors can generate higher margin advertising revenues.

From a distribution standpoint, Google is already ahead in the international TV OS market and Amazon has a serious international distribution advantage.

In the face of such strong competitors, I think that Roku will face stiff competition in selling its TV's in the coming years. If Roku is unable to sell its TV’s, there is really no point in considering advertising revenue, as there will be no eyeballs to advertise to. This is something we must account for when valuing Roku's intrinsic value.

Financials

Revenue Growth

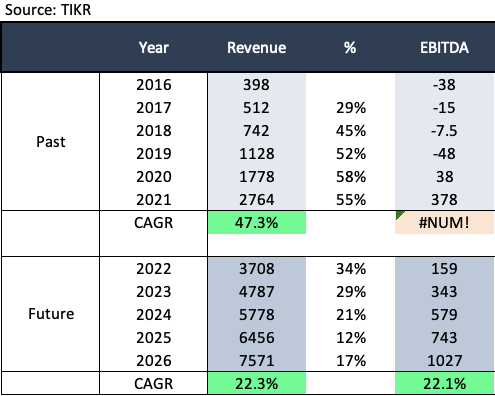

Revenues have grown at CAGR of 47% over the past 5 years. Moreover, analysts expect revenue to grow at 22% over the next 5 years. However, taking into account the increased competition from Google and Amazon and the better product that Roku’s competitors can potentially have, I expect revenue to grow at a slower rate than analyst estimates. On top of that, due the unfavourable inflationary environment, we can also expect companies to spend less on advertising. Thus, I expect Roku to only grow revenues at a rate of 15% over the next 5 years.

EBITDA Growth

Analyst expect EBITDA to grow at a rate of 17% for the next 5 years. However, taking into account a potential slowdown in revenues, I expect EBITDA to grow at a slower rate of 12% for the next 5 years as well.

Margins

Roku is only just beginning to implement its acquisition of Dataxu and Neilsen’s Advanced Video Advertising technologies into its advertising technology stack. This means that there is still room for Roku’s gross margins to improve in the near future.

Operating margins have improved across the years. It was -10.0% in 2016 and currently stands at 4.9%.

Net profit only became positive in 2021, and it currently stands at 8.8%.

Free Cash Flow

Free cash flow only turned positive in 2020. Analysts expect FCF to grow at 27% over the next 5 years. However, due to the reasons explained above, we should anticipate Roku to only grow Free cash flows at a rate of 20% for the next 5 years.

Net Debt / EBITDA

Roku’s Net Debt/EBITDA ratio for 2021 stands at -3.69x. This is good, as it indicates that Roku should be able to handle its debt obligations in this inflationary environment.

Valuations

An EV/Sales relative valuation is used in the analysis below.

EV/Sales

Roku is currently trading at an EV/Sales multiple of 3.3x. It’s average historical multiple over the past 3 years stood a 16x. For reference, Google currently trades at 5x, with an average historical multiple of 6x. Amazon currently trades at 2.5x, with an average historical multiple of 4x.

Comparing between Roku and Google up until 2026,

We can see that both are estimated to have revenue growth rates around 14-15%.

We can see that ROKU has a slower EBITDA growth rate of 12% compared to GOOG 14%.

We can see that ROKU has a higher FCF growth rate of 20% compared to GOOG 15%.

We can see that ROKU may have a higher gross margin of 60% compared to GOOG 55%.

Thus, it can be argued that ROKU can trade a multiple of around 4x.

Comparing between Roku and Amazon up until 2026,

We can see that both are estimated to have revenue growth rates around 14-15%.

We can see that ROKU has a slower EBITDA growth rate of 12% compared to AMZN 17%.

We can see that ROKU has a lower FCF growth rate of 20% compared to AMZN 65%.

We can see that ROKU has a higher gross margin of 60% compared to AMZN 40%.

Thus, it can be argued that ROKU should trade at a multiple of around 2x.

ROKU is closer in comparison to GOOG rather than AMZN as they are both more software based companies. As such, a greater weighting will be given to the multiple derived from GOOG(80%) rather than with AMZN (20%). Hence, it seems warranted that ROKU trade at a multiple close to 3.6X in the future.

So the 3 cases are:

Normal Case Multiple: 3.6X

Worst Case Multiple: 2X

Best Case Multiple: 5X

For this worst case scenario, I assume that Roku is not able to differentiate its OS from Google TV OS and Amazon TV OS adequately, and hence will start loosing market share. Roku will face an outflow of customers, and no matter how well Roku improves its ARPU, its Platform revenue will decrease in relative to its Player revenue. This means that total gross margins may be affected, affecting Roku's profitability.

For this best case scenario, I assume that Roku is able to differentiate its OS from Google TV OS and Amazon TV OS adequately, and so is able to continue at acquiring customers. Thus, with a steady inflow of customers, Roku can continue improving its Platform revenues, and improve the profitability of the firm.

Using the current stock price of $80 and estimated 2025 EBITDA of $6.5B with a scenario analysis, weighting 80% for the normal case and 10% for the other 2 cases, combined with a final 10% margin of safety, I get a TP of $141 for 2025, representing a 71% upside from today’s prices ( 14% CAGR).

Looking at the current macroeconomic environment, it is also possible that analysts overstated 2025’s EBITDA. To be conservative, let us also consider the possibility that 2025’s EBITDA will be 20% lower than analyst estimates. In this case 2025’s EBITDA will be $5.2B. For this case, with a margin of safety, we have a TP of $118 for 2025, representing a 43% upside from today’s prices ( 9% CAGR).

For both these models, the returns do not meet my target hurdle rate of 15% per year. Personally, I do not like the stiff competition that Roku's product will face, and so will I will be staying away from Roku for now.

Management Ownership & Insider Buying

High insider ownership

Anthony Wood owns around 13% of Roku shares. Since it is founder led, it may indicate that Roku is a business run with a long-term vision. Generally, because of the long-term vision, most founder led businesses result in significant returns for long-term shareholders.

No insider buying

We focus more on insider buying than insider selling, as it is more indicative of the attitude of insiders towards the company’s business. So far, it does not seem like there has been any noticeable insider buying activity.

Risks

There are certain risks to the investment.

Share Dilution: I do not see room for Roku to improve its OS on the customer satisfaction front. The only way I see is to improve the content offering on The Roku Channel. However, this means that Roku must engage in costly content acquisition. If the company does this, its is likely that they will have to take on debt or do a share offering.

Summary

Roku’s OS may not be competitive against Google and Amazon.

Roku’s pitch as an agnostic platform is a lie as it has started producing its own content.

Roku’s OS offers little benefits to consumers but seeks only to monetise them.

Let's wrap up

Roku is a visionary company for seeing the opportunity to revolutionize the TV ad industry, and I admire the company's steps in building out its advertising capabilities. However, its seems to me that Roku is not the best candidate for the task. Providing value to customers is vital to keep them on your platform. Google, Apple, and Amazon all do this very well with their huge ecosystems that consistently make things more convenient for consumers. I do not see this in Roku’s offering. I see Roku only focusing on monetization without improving its product for consumers. Furthermore, there is nothing Roku does that its competitors can do equally as well or even better. I will be staying away from this company for now. However, if Roku can acquire, be acquired, or partner with another company to improve Roku’s value add to consumers, I will definitely reanalyze my position.

Up next!

In our next article, we will be analyzing the King of streaming - Netflix. Is King about to make a comeback, or is he going to lose his crown? What are you waiting for? Subscribe to not miss out on the next tantalizing drop! You can do it at the top right of this tab!

One last thing!

It takes us weeks of research to produce our articles. If you found value in this read, it would mean the world to us if you would support us on Twitter @ResearchGriffin! We would love for you, to join our community! Where’s the fun in investing alone? Thank you so much for your support!

Our calls so far

Transparency

The current holdings in my portfolio are shown below. If you want a live update of my portfolio, check out JoshuaHD. I showcase this for transparency’s sake so that you as a reader can make an informed decision of any bias I might have. This is not a model portfolio. I strive to make mistakes in order to learn from them. Do not make my mistakes, but learn from them!

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own due diligence or consult a financial advisor. Investing includes risks, including loss of principal.