Time to Read: 10 min

First, I’d like to welcome new readers to The Retail Deep Dive. So glad to have you join us! Our mission is to analyze companies that have exciting prospects and unpack them in a logical way for our readers.

This month’s deep dive is on a company whose name has become a verb and whose product is loved by many worldwide. That company is none other than Netflix, the King of streaming.

We dug deep on this one, and boy, our research revealed so much to us that we decided to split our research into separate articles to break it down nicely for you. This article is the last of 5 articles analyzing Netflix. If you'd like to see our previous articles, click here. Here's the outline for this month's deep dive:

Article 1: Understanding NFLX's revenue breakdown and acquisitions

Article 2: Analysing NFLX's content library.

Article 3: Analysing NFLX's push into gaming and advertising

Article 4: Analysing NFLX's subscription prices and the crackdown on password sharing.

Article 5: Valuations

Without further ado, let’s get right into it!

Breakdown

The article today will elucidate the following segments:

Estimating 2025 Revenue

Analyzing Financial Metrics

Management Ownership and Insider Trading

Risks

Relative Valuation of NFLX

Estimating 2025 Revenue

Growth in subscriber count can come from:

An organic increase in streaming subscriber count

Implementation of advertising

Crackdown on account sharing

How many subscribers can NFLX add?

Netflix’s growth has materially stalled. In Q1’22, the streaming giant reported losing 200K subscribers, the first in 10 years. It also reported that it expects to lose 2 million subscribers this year. This means that NFLX will end 2022 with a subscriber count of 220 million. Its closest competitor Disney is not far behind with a total subscriber base of 205M today. It is also likely that WBD has a unique subscriber count of 90M (excluding overlap in Discovery+ and HBO Max subscribers).

It remains to be seen if the maximum subscriber base remains capped at 220M. If NFLX manages to clamp down on 30% of the 100 million shared accounts, this means that the company can organically add 30 million subscribers. My assumption is that the addition of these 30 million subscribers will begin in the middle of 2023 and be fully realized by 2025. I.e. an addition of 10 million subscribers per year.

If NFLX were to implement an ad tier, it is highly likely that they would be able to attract many new viewers. However, it is very likely that NFLX will only roll its ad tier in the middle of 2023. Thus, I will assume that NFLX will be able to add 10 million subscribers per year based on its ad tier subscription.

If we follow these assumptions, NFLX will add 10 million subscribers in 2023, 20 million subs in 2024, and 20 million subs in 2025, bringing its total subscriber base in 2025 to 270 million. This is safely within the theoretical limit of the total number of potential subscribers. There are currently almost 1.7 billion TV households in the world. Out of that, let’s assume 400 million is in China. This means the market opportunity today is almost 1.3 billion households. Let’s further assume that only 80% of these households actually regularly use their TV and will move to an OTT service. If this is the case, the opportunity now stands at 1 billion households. Jason Kilar, the former CEO of Warner Media commented: “I don’t think the ceiling is 222 million subscribers. I think the ceiling is far closer to 1 billion. You get there by giving customers the choice.” “The choice” refers to ad tier subscription plans. If he is right, there is still a long runway for growth in the streaming market. Our projection for NFLX is well below the theoretical limit of streaming subscribers.

How much ARPU can NFLX make?

In our article on Advertising Analysis, we estimated that Netflix could earn an ARPU of $13/month on its advertising tier. If you would like to find out why I arrived at this number, refer to my previous article.

Here are three cases of subscriber mix NFLX may have in the future based on a total of 270 million subscribers in 2022.

Case 1: Maintain most current paid subscribers

Assuming NFLX has a global average monthly paid-tier ARPU of $11.10

Assuming NFLX has a global average monthly ad-tier ARPU of $13.

200 m paid-tier subscribers

70 m ad-tier subscribers

Case 2: Some current paid subscribers hop over to ad tier

Assuming NFLX has a global average monthly paid-tier ARPU of $11.10.

Assuming NFLX has a global average monthly ad-tier ARPU of $13.

170 m paid-tier subscribers

100 m ad-tier subscribers

Case 3: Many current paid subscribers hop over to ad tier

Assuming NFLX has a global average monthly paid-tier ARPU of $11.10.

Assuming NFLX has a global average monthly ad-tier ARPU of $13.

135 m paid-tier subscribers

135 m ad-tier subscribers

I believe case 3 has the highest probability of occurring. Thus, my estimate for 2025 revenue is ~$39 billion. This is lower than current analyst consensus estimates of 43.3 billion.

Management Ownership & Insider buying

Low insider ownership

Reed Hastings owns around 1% of NFLX shares. This is not a very significant position when compared to Anthony Wood who owns 13% of Roku.

Insider buying

I focus more on insider buying than insider selling, as it is more indicative of the attitude of insiders towards the company’s business.

Reed Hastings, co-CEO, made the most recent significant insider purchase. In Jan 2022, he bought roughly US$20m worth of shares at US$387 each. That is 222% greater than the current share price of $174. This implies that he still believes in the company’s growth potential.

Risks

There are certain risks to the investment.

Gaming investments may not pay off. There is a chance that NFLX’s pivot into games will not help reduce its subscriber churn. Moreover, investment into games may take away from NFLX's investments in developing its Originals to compete against its competitors.

Discretionary spending for all households will be cut as high inflation takes its toll on the economy. This will likely mean that advertisers will cut ad spending. However, it could also mean that people may give up vacation, and pay for Netflix instead.

The timeline for when the clampdown on password sharing and the implementation of ads is unknown. I currently estimate it to only take effect towards the end of 2023, meaning we will only see its impact on NFLX financial statements in 2024. If NFLX is unable to bring these two features in by 2023, my estimates will be greatly affected.

Financials

Revenue Growth

Revenues have grown at a CAGR of 27.5% over the past 5 years. Moreover, analysts expect revenue to grow by 10% over the next 5 years. However, taking into account the increased competition from DIS, WBD, and AMZN, I expect revenue to grow at a slower rate than analyst estimates. On top of that, due to the unfavorable inflationary environment, we can also expect companies to spend less on advertising, meaning NFLX's potential advertising revenues may be dampened in the short term. Thus, I expect NFLX to only revenue at a rate of 7% over the next 5 years. This means that NFLX would have a revenue figure of $37.5 bn in 2025. This matches our revenues projected based on subscriber count and ARPU in the earlier section.

EBITDA Growth

Analysts expect EBITDA to grow at a rate of 15% for the next 5 years. However, taking into account a potential slowdown in the growth of revenues, I expect EBITDA to grow at a slower rate of 12% for the next 5 years as well.

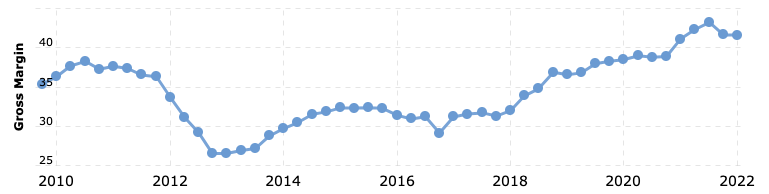

Gros Margin

Netflix gross margins have been improving consistently over the past years, and currently stands at 41%.

FCF

Analysts expect FCF to grow at 72% over the next 5 years. However, due to the reasons explained above, we should anticipate NFLX to only grow Free cash flows at a rate of 50% for the next 5 years.

Net Debt/EBITDA

NFLX Net Debt/EBITDA ratio for 2021 stands at 1.74x. This is not terrible and indicates that NFLX is can handle its debt obligations in this inflationary environment.

Valuation

I used EV/EBITDA relative valuation in my analysis below.

EV/EBITDA

Note 1: The figures above are all analyst estimates.

Note: The figures for WBD are actually DISC. WBD is yet to release its earnings for the merged entity. Thus, for accuracy’s sake, I will exclude it in the analysis below.

NFLX is currently trading at an EV/EBITDA multiple of 14x. Its average historical multiple over the past 3 years stood a 50x. For reference, DIS currently trades at 20x, with an average historical multiple of 32x. PARA currently trades at 8x, with an average historical multiple of 8x.

Comparing NFLX and DIS up until 2026,

We can see that NFLX has higher revenue growth of 10% compared to DIS 7%.

We can see that NFLX has a slower EBITDA growth rate of 15% compared to DIS 17%.

We can see that NFLX has a higher FCF growth rate of 72% compared to DIS 54%.

We can see that NFLX may have a higher gross margin of 43% compared to DIS 40%.

Assumption 1: NFLX will have a weaker content offering in the future compared to DIS based on our content analysis in a prior article.

Assumption 2: NFLX gaming division will make only a slight impact on its subscription revenues by 2025.

Thus, it can be argued that NFLX can trade a multiple of around 17x relative to Disney.

Comparing NFLX and PARA up until 2026,

We can see that NFLX has higher revenue growth of 10% compared to PARA 4%.

We can see that NFLX has a higher EBITDA growth rate of 15% compared to PARA 7%.

We can see that NFLX has a higher FCF growth rate of 72% compared to PARA 31%.

We can see that NFLX may have a similar gross margin of 43% compared to PARA 43%.

Assumption 1: NFLX will continue to have a stronger content offering than PARA in the future based on content analysis in a prior article.

Assumption 2: NFLX gaming division will make only a slight impact on its subscription revenues by 2025.

Thus, it can be argued that NFLX should trade at a multiple of around 13x relative to PARA.

Comparing NFLX to a Linear TV company in the past.

If NFLX's gaming bet does not pay off, NFLX's business will be solely content production. It makes sense for us then to use a Linear TV company multiple for NFLX in 2025. After all, if all Linear TV operations are ported over to Streaming, Streaming will become the new Linear TV. To determine what is an appropriate Linear TV company multiple we will use the 10-year average of the legacy media conglomerates.

DIS 10-year average historical multiple was 18x.

DISC 10-year average historical multiple was 10x.

PARA 10-year average historical multiple was 9.5x.

Thus, it can be argued that NFLX could trade a multiple of 12x in the future.

As I find it hard to distinguish the probabilities of each multiple derived above, I shall just take the average of ~14x as my normal case multiple for NFLX in 2025.

So the three cases are:

Normal Case Multiple: 14X

Bear Case Multiple: 11X

For this worst-case scenario, I that NFLX will find itself having the same multiple as a Linear TV company in the past. I also will assume that Disney, Amazon, and WBD will have overtaken NFLX in the number of subscribers as their potential content is more holistic and contains many other bundled services which reduce churn.

Bull Case Multiple: 17X

For this best-case scenario, I assume that NFLX will be able to produce content that can compete with DIS and WBD content library. On top of that, NFLX’s gaming bet would have paid off and helped the company reduce the churn of customers.

Using the current stock price of $174 and analyst estimated 2025 EBITDA of $10,800 million with scenario analysis, weighting 80% for the normal case and 10% for the other 2 cases, combined with a final 10% margin of safety, I get a TP of $268 for 2025, representing a 22% upside from today’s prices ( 5% CAGR).

Looking at the current macroeconomic environment, it is also possible that analysts overstated 2025’s EBITDA. To be conservative, let us use a lower 2025 EBITDA estimate of $9,400 million. For this case, with a margin of safety of 10%, we have a TP of $229 for 2025, representing a 4% upside from today’s prices ( 1% CAGR).

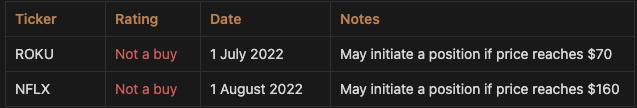

Let’s wrap up

Netflix is truly a visionary company that transformed the TV space forever. Although it is currently the king of streaming, the chances of competitors stealing its crown are high. If NFLX doesn’t find new avenues of growth, it will just be another content producer company like its competitors in the past. These returns based on my model are lower than my personal target hurdle rate of 15% per year. Thus, I will not be starting a position in Netflix yet. However, if NFLX does reach a price of $160, I may consider starting a position.

Up Next!

In our next article, we will be analyzing Warner Brother’s Discovery. What are you waiting for? Subscribe (top right!) to not miss out on the next tantalizing drop!!!

Wait a minute!

It takes us weeks of research to produce our articles. If you found value in this read, it would mean the world to us if you would support us on Twitter! We would love for you, to join our community! Where’s the fun in investing alone? Thank you so much for your support!

Our calls so far

Transparency

The current holdings in my portfolio are shown below. If you want a live update of my portfolio, check out JoshuaHD. I showcase this for transparency’s sake so that you as a reader can make an informed decision of any bias I might have. This is by no means a model portfolio.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own due diligence or consult a financial advisor. Investing includes risks, including loss of principal.