Time to Read: 10 min

First, I’d like to welcome new readers to The Retail Deep Dive. So glad to have you join us! Our mission is to analyze companies that have exciting prospects and unpack them in a logical way for our readers.

This month’s deep dive is on a company whose name has become a verb and whose product is loved by many worldwide. That company is none other than Netflix, the King of streaming.

We dug deep on this one, and boy, our research revealed so much to us that we decided to split our research into separate articles to break it down nicely for you. This article is the 4th of 5 articles analyzing Netflix. If you'd like to see our previous articles, click here. Here's the outline for this month's deep dive:

Article 1: Understanding NFLX's revenue breakdown and acquisitions

Article 2: Analysing NFLX's content library.

Article 3: Analysing NFLX's push into gaming and advertising

Article 4: Analysing NFLX's subscription prices and the crackdown on password sharing.

Article 5: Valuations

Without further ado, let’s get right into it!

Breakdown

The article today will elucidate the following segments:

Analysis of Netflix’s crackdown on password sharing

Analysis of Netflix’s chances of increasing subscription prices

Analysis of Netflix’s data mining capabilities

Analysis on password sharing restrictions

Netflix has a serious password-sharing problem! Here are some statistics:

A 2019 MoffetNathonson survey found that 27 percent of US Netflix users watched using the paid subscription of someone in their household, while another 14 percent used a password shared with them from a friend or family member from outside their home. In total, 41 percent of US Netflix users aren’t paying for their own accounts.

The Guardian reports that around 27% of Netflix subscribers in the United Kingdom share their account passwords with other households.

Netflix itself stated that 100 million households globally were sharing passwords to their account with others and that Canada and the United States accounted for 30 million of them.

Let's assume that Netflix will only clamp down on only the accounts where passwords are shared outside the household. If we take this figure to be 20% of the 100 million accounts where passwords are shared with others, it means that Netflix can potentially increase its subscriber base by 2o million. If the Global ARPU is $11.50, this translates to a revenue gain of $2.8 billion. This represents a 9.5% "instant" increase over Netflix's 2021 revenues of $29.5 billion, with no long-term costs. Amazing!

Actions taken

Thankfully, Netflix has started exploring methods to crack down on password sharing. In March 2022, Netflix explored two new sharing features that will let users share their accounts outside their household for an extra price. It tested this feature for users in Chile, Peru, and Costa Rica.

The first feature is called Add an Extra Member. This feature will let members of the Standard and Premium plans add up to two sub-accounts for people who live outside their homes. Each account gets its own profile, personalized recommendations, and login credentials. This feature will cost members 2,380 CLP in Chile, $2.99 in Costa Rica, and 7.9 PEN in Peru. This is around $2 USD.

The second feature is called Transfer Profile to a New Account. It is basically a migration feature to allow people currently sharing accounts to migrate to their own account whilst preserving the account content, viewing history, and personalized recommendations. This is not an incentive for subscribers to move accounts but rather provides subscribers with a frictionless way to do so.

Bull Points (+)

Bull Point 1: Ending password sharing is feasible for Netflix.

Netflix competitors have already been cracking down on password sharing. Disney's Hulu service has for years used your location to verify that you were using their service in your home and not sharing it with someone elsewhere (you have 5 sign-ins from outside your house on a fixed device each year for the Hulu Live service).

If Netflix wanted to, it could easily track its viewer's location, IP address, and other information to prevent account sharing. However, it hasn't mentioned anything about undertaking such drastic measures. My guess is that Netflix won't punish users for continuing to share their accounts but rather will gently try to convince them to use individual accounts. This will take time, but it definitely will bode better for Netflix's brand.

Bull Point 2: Ending password sharing brings its viewers peace of mind.

Most people share accounts to reduce their personal subscription costs to Netflix. When you split the cost amongst friends, you pay less for the service. However, a problem arises for the main account holder - inconvenience. He has to consistently remind his friends to contribute whenever the subscription fee is due. This is a problem that Netflix can help alleviate with the introduction of the “Add an extra member” feature. With this, you can share your account with your friends for a reduced cost for each individual and Netflix can do the work of collecting the fees from each individual recurringly. The main account holder no longer has to facilitate the collection of fees from his friends, saving him the hassle. Thus, ending password sharing does not only benefit Netflix, but also the users of accounts that are being shared. That is why I believe this feature will be embraced by at least some account sharers.

Bull Point 3: Netflix’s pivot into gaming, will further incentivize users not to share accounts.

Games are a different ball game from movies. Unlike movies that can be easily shared, game progress cannot. Progress in a game is very personal and is tied to one’s sense of accomplishment. Thus, gaming accounts are unlikely to be shared. As Netflix continues to integrate games into its subscription, I predict that people will prefer to maintain full authority over their own accounts. Of course, this depends on whether Netflix can produce quality games.

Let’s wrap up

Netflix's crackdown on password sharing brings both benefits to itself and to its customers. On top of that, it is feasible and makes a meaningful impact on both its top line and bottom line. This positive development will have to be taken into account in our valuation of Netflix. Based on our analysis so far, it is conservative to conclude that NFLX's move to clampdown on password sharing can add an "instant" 9.5% to its top line. Now, let us analyze if NFLX can increase its subscription prices.

Analysis on increasing subscription prices

To see whether NFLX can increase its subscription prices there are 3 things we need to consider:

Current prices of its plans relative to peers

Size of its content library

Quality of its content library

Pricing Plans

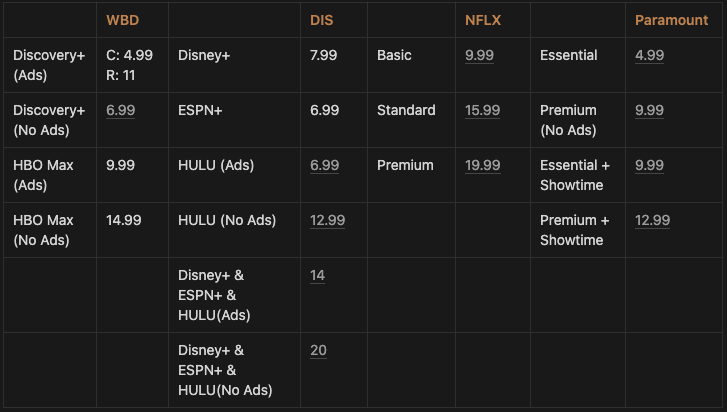

Currently, NFLX has 3 subscription plans: Basic, Standard, and Premium. I have collated its prices and its competitor's prices in the table below.

Streaming company library size

The two tables below give us some insight into NFLX content library size and quality relative to its peers.

Note: Does not differentiate by original shows

Comparing NFLX and Disney+

NFLX has more than 4x the number of movies and 6x the number of TV shows as Disney+.

NFLX also currently produces higher quality TV shows than Disney+ now.

Thus, we can conclude that NFLX should be more expensive than Disney+. Therefore it makes sense that NFLX basic plan is priced at $9.99 while Disney+ is priced at $7.99.

Comparing NFLX and HBO Max

NFLX has more than 1.8x the number of movies and 3x the number of TV shows as HBO Max.

The number of higher-quality TV shows that HBO Max produces is not far off compared to NFLX.

Thus, we can conclude that NFLX should be slightly more expensive than HBO Max. This is not the case as NFLX basic plan is priced at $9.99 while HBO Max No Ads is priced at $14.99. Therefore, it is possible that NFLX could potentially increase its price to $11.99 or $12.99.

Comparing NFLX and Amazon Prime Video

Prime video is part of a $14.99 Amazon Prime subscription

Based on the first table, Prime video has more than 7x the number of movies and 1.5x the number of TV shows as NFLX has.

But based on the second table, NFLX has almost double the number of TV shows as Prime video. Thus, I cannot reach a conclusion on which entity has a larger library of content.

That being said, we can clearly see that NFLX produces more higher-quality TV shows than compared to AMZN.

However, we must acknowledge that Prime comes packed with other important services like free delivery and free music streaming that the other streaming services do not have.

Based on this, I think we can conclude that NFLX should cost slightly less than Prime Video. Therefore, it makes sense that NFLX basic plan is priced at $9.99 when compared to Prime membership of $14.99

Therefore, I can conclude that NFLX will find it challenging to increase prices for its subscription further, as competitors are already offering very competitive prices for viewers.

Let’s wrap up

Based on relative comparison to its peer's offerings, I think it will be challenging for NFLX to increase prices for its subscription tiers any time soon. Therefore, in our growth forecasts, we will assume that Netflix subscription plans will stay at the same price in the near future, and any growth in revenues will be mainly attributable to growth in subscribers or a higher ARPU from advertising. Now, let’s analyze NFLX data capabilities.

Analysis on Data & Recommendation Engine

Netflix’s foray into employing data science started long ago. In 2006, Netflix announced the Netflix Prize, a $1,000,000 prize to the first developer of a video-recommendation algorithm that could beat its existing algorithm Cinematch, at predicting customer ratings by more than 10%. On September 21, 2009, it awarded the $1,000,000 prize to the team "BellKor’s Pragmatic Chaos." Since then, NFLX's usage of its data has come a long way.

Bull Points (+)

Bull Point 1: NFLX has the best Greenlighting and Recommendation Engine right now.

NFLX was the first company to engage in the streaming model, and so has been the first to master data mining. With this data NFLX has:

Made better decisions on what content to produce and what not to produce.

Engaged users on its platform for longer.

Netflix has created a state-of-the-art Recommendation Engine to keep viewers engaged on its platform for longer. The Netflix Recommendation Engine (NRE) is made up of algorithms that filter content based on each individual user profile. The engine filters over 3,000 titles at a time using 1,300 recommendation clusters based on user preferences. In essence, it uses Machine learning and data science to personalize the experience for you based on your history of picking shows to watch. For instance, viewers who like a particular actor will be shown snapshots of a show with that particular actor. You can read more about it here. It’s so accurate that 80% of Netflix viewer activity is driven by personalized recommendations. According to Business Insider Australia, Netflix believes its personalized recommendation engine is worth roughly $1 billion in cost savings per year. Having a successful recommendation is crucial as NFLX only has a 90-second window to help viewers find a movie or a TV show before they leave the platform and visit other services. Netflix’s choices about greenlighting original content also aren’t random. They’re based on data fed into its Greenlighting Engine. According to Lighthouse Labs, the streaming giant’s original content is successful 93% of the time. As illustrated by the number of award-winning shows that NFLX has created, I believe that Netflix truly has the best Greenlighting Engine and the best Recommendation Engine as of now.

Bear Points (-)

Bear Point 1: However, Netflix may not have the strongest data in the future.

NFLX’s data is not a moat. DIS and WBD are producing more and a much larger variety of content than NFLX is, so it is very likely, that they will eventually be able to mine larger amounts of data and curate their content just like NFLX does. If you combine all of Disney’s streaming services together (Disney+, HULU, ESPN+), Disney has a total subscriber count of 205 m. This is not far away from NFLX’s 220 m count. There is no reason that Disney’s data quality and quantity would be too far away from NFLX’s. As for Prime Video, it officially rolled out in 2016, only 3 years after NFLX engaged in streaming. Thus, my guess is that their own Greeenlighting Engine and Recommendation Engine are not very far behind NFLX’s. Moreover, AMZN can even pull data from its e-commerce platform to supplement its data on its streaming service. Therefore, I cannot give a premium to NFLX’s valuation for its great Greenlighting and Recommendation Engines today.

Bear Point 2: All Netflix's data is in the hands of Amazon.

Many do not know that Netflix is one of the largest Amazon Web Services users and could be spending around $9.6 million per month for AWS. In fact, Netflix has not been shy about informing the public about its usage of Amazon Web Services. The streaming giant fully migrated its content over to Amazon Web Services in 2016, a project that took 7 years to complete.

I am not saying that Amazon will use Netflix’s data, and there are certainly policies and measures in place to prevent this. However, it shows us how strong Amazon is. It is a vertically integrated giant! It owns the database to store movies, studios to produce movies, and the platform to distribute movies. I will definitely be analyzing Amazon in the future!

Bear Point 3: Netflix’s Greenlighting Engine may not be the reason its shows are so popular.

Some bears argue that the reason why Netflix shows are so popular is not because of its data, but rather because of its "binge" model. The reasoning is as follows: shows that are binge-able are less likely to experience viewership dropoff, as viewers can satisfy their cravings in one go. Thus, binge-able shows are more popular than non-binge-able shows even if both of them have the same quality. Therefore, bears think that NFLX’s shows will be less popular if it were to ever release its shows with intervals in between. However, I will not place too much emphasis on this argument. To me, a good show is a good show, and people will be willing to wait for weekly episodes.

Let’s wrap up

I believe that NFLX currently has the best Greenlighting and Recommendation Engine, which has allowed the company to produce many award-winning shows and engage its viewers really well. However, I will not give NFLX valuation a premium because of this, as I think that it is not a moat. NFLX’s competitors are not greenhorns in the content production space and I am sure that they will eventually develop their own competency in using their own data.

Up Next!

In our concluding article tomorrow, we will share our final insights and valuation of NFLX. This piece will be exclusively available for subscribers only.

Subscribe (top right) to receive it now!

Wait a minute!

It takes us weeks of research to produce our articles. If you found value in this read, it would mean the world to us if you would support us on Twitter! We would love for you, to join our community! Where’s the fun in investing alone? Thank you so much for your support!

Transparency

The current holdings in my portfolio are shown below. If you want a live update of my portfolio, check out JoshuaHD. I showcase this for transparency’s sake so that you as a reader can make an informed decision of any bias I might have. This is by no means a model portfolio.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own due diligence or consult a financial advisor. Investing includes risks, including loss of principal.