Time to Read: 10 min

First, I’d like to welcome new readers to The Retail Deep Dive. So glad to have you join us! Our mission is to analyze companies that have exciting prospects and unpack them in a logical way for our readers.

This month’s deep dive is on a company whose name has become a verb and whose product is loved by many worldwide. That company is none other than Netflix, the King of streaming.

We dug deep on this one, and boy, our research revealed so much to us that we decided to split our research into separate articles to break it down nicely for you. This article is the 3rd of 5 articles analyzing Netflix. If you'd like to see our previous articles, click here. Here's the outline for this month's deep dive:

Article 1: Understanding NFLX's revenue breakdown and acquisitions

Article 2: Analysing NFLX's content library.

Article 3: Analysing NFLX's push into gaming and advertising

Article 4: Analysing NFLX's subscription prices and the crackdown on password sharing.

Article 5: Valuations

Without further ado, let’s get right into it!

Breakdown

The article today will elucidate the following segments:

Analysis of Netflix’s pivot into gaming

Analysis of Netflix’s move to create an ad subscription tier

Analysis on Gaming

From Netflix's recent acquisitions, we can clearly see that Nextflix is trying to pivot strongly into gaming. Other evidence of Netflix’s moves into gaming include:

In June 2018, Netflix announced a partnership with Telltale Games to release games that used simple controls through a television remote on the Netflix app. The first game, Minecraft: Story Mode, was released in November 2018.

In July 2021, Bloomberg reported Netflix had hired Mike Verdu to help lead its video game division. Before Netflix, Verdu served as an executive at EA and Facebook, working on mobile gaming at the former and developer relationships for Oculus at the latter.

Netflix officially launched mobile games for Android users on November 2, 2021, and for IOS on November 7, 2021. Some games in NFLX’s collection require an active internet connection to play, while others will be available offline.

To date, Netflix has released 16 games including two titles tied to its TV show “Stranger Things.” Later this month, the company plans to debut “Into the Dead 2: Unleashed,” its first first-person shooter, which plunks players into the middle of a zombie apocalypse. Netflix has stated that they intend to add more games to this service over time.

Let us now analyze whether moving into the gaming market is a wise decision for NFLX.

Bull Points (+)

Bull Point 1: Gaming is the preferred form of entertainment for younger generations.

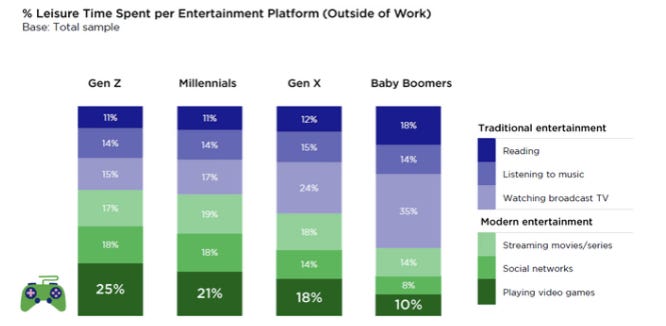

In its 2022 Digital Media Trends Survey, the consultancy firm Deloitte found that among Gen Z consumers, video games are the preferred form of digital entertainment, with older consumers preferring movies and TV shows. The chart below shows how younger generations are spending more time gaming compared to watching TV. Notice how gaming is stealing away consumers from streaming?

Since younger generations are spending more time on gaming instead of watching movies, it is crucial that Netflix reinvent itself to cater to this new generation. From this view, it certainly makes sense that Netflix has been investing in gaming.

Bull Point 2: Mobile Games has the largest TAM and is the fastest growing market.

There are 3 gaming markets: Mobile, PC, and Console. According to Newzoo, a gaming analytics company, mobile gaming is currently the largest gaming market and the fastest growing one too. The chart below shows how mobile has grown at a CAGR of 26% over the past 9 years while PC and Console gaming have each only grown at a CAGR of 11%. Mobile gaming brought in an estimated nearly $80 billion in 2020 revenue, compared with PC gaming making only $37 billion, and Console gaming — such as the Nintendo Switch, Sony’s PlayStation, and Microsoft’s Xbox — totaling $45 billion.

The reason why Mobile gaming generates the most revenue is because mobile games offer users the accessibility and convenience of playing video games whenever and wherever they like, during a break from work, on the train, or waiting in line. Mobile gaming has traditionally pulled in a more diverse audience due to the relatively low barrier to entry since so many people worldwide own a cellphone. According to Ted Krantz, CEO of App Annie, a company that measures apps, mobile is “democratizing gaming to the masses by putting a portable gaming experience in the pocket of every smartphone owner globally.” Of course, if consumers want in-depth entertainment, Console games are the winner. However, not everyone can afford the hardware and thus there is a lower network effect in console games compared to mobile games. Even traditional PC and Xbox game-producing companies are trying to get their foot into the mobile gaming market. For example, Activision made a move to acquire mobile game maker King in 2016. Netflix knows the importance of the mobile gaming market and has thus chosen to penetrate this market first.

Bull Point 3: Gaming is the most natural expansion route for Netflix.

Netflix has pivoted twice in its lifetime so far. It first pivoted from the distribution of physical CDs to the distribution of online content. It then pivoted from distribution to the production of online content. As a content producer, NFLX’s most natural expansion route is to use its IP to produce games. Netflix’s theory is that the games — offered at no additional charge — will enhance the value of its core streaming-video business, and help it attract and retain subscribers in a heavily competitive market. At face value, this makes sense, especially since there have already been so many crossovers between game and movie franchises. For example, the popular video game, Assassin's Creed, a game developed by Ubisoft, was made into a movie in 2016. Sega's popular Sonic the Hedgehog game was made into a successful movie in 2020 and set the record for the biggest opening weekend for a video game–based movie.

Gaming is the most natural expansion route for Netflix, especially as the lines dividing gaming and movies increasingly get blurred. Welcome to the world of Interactive Storytelling! Interactive Storytelling is a form of digital entertainment in which the storyline is not predetermined. For example, there will be a point in the movie where the user can choose which story path to take and the subsequent parts of the show will be altered based on interactions with the viewer. Netflix first ventured into interactive storytelling four years ago, when it launched “Choose Your Own Adventure”-style children’s shows. The next year, it took the format to content for adult viewers with the “Bandersnatch” episode of “Black Mirror.” Since then, it’s added other interactive children’s shows like “Minecraft: Story Mode,” and “Emily’s Wonder Lab.” Such innovation blends films and gaming into one seamless otherwordly experience and has the potential to change both films and games forever.

Some analysts posit that Netflix should develop its own ad platform instead of investing in gaming. Advertising is a tantalizing high-margin business model. However, it is hard for Netflix to engage in the advertising business as it is not an operating system and so does not collect massive amounts of data from its users. Companies like Google, Amazon, and Roku own operating systems that have access to much better quality data than NFLX ever can. It would not be wise not to compete against these strong competitors, but rather partner up with them, as Netflix already seems to be doing. Therefore, I endorse the move of Netflix to delve into gaming.

Bull Point 4: Games are more profitable than shows.

In 2021, the Global “Games Market” had a whopping $180 billion in revenue. In fact, Gaming is bigger than Hollywood and the music industry combined. The top games are earning more than the big blockbusters. For example, Grand Theft Auto V game has raked in more than $6 billion, according to Marketwatch, compared to Avatar’s revenue of $2.8 billion.

In 2020, the gaming industry generated $155 billion in revenue, By 2025, analysts predict the industry will generate more than $260 billion in revenue. That's a CAGR of 11%. Moreover, NFLX is entering the fastest growing segment of gaming - mobile gaming. I think it is safe to assume that NFLX's gaming segment will see a growth of 15% CAGR up till 2025. This is a competitive growth rate compared to NFLX’s streaming business.

Bear Points (-)

Bear Point 1: Developing games are expensive, and may hurt Netflix’s profitability.

Since Netflix has not released any financial documents for its games, it is impossible to determine the financial health of its gaming segment. However, it did reassure investors in Oct 2021 that it would not be rushing to acquire game studios but wouldn’t turn down a good opportunity.

Let’s wrap up

We can conclude that expanding into mobile gaming is a wise move for NFLX. It is synergistic in the sense that NFLX can use its TV show IPs to create games for its viewers to play. Moreover, gaming is a fast-growing service that is attractive to the younger generation and thus has the potential to bolster NFLX's top and bottom lines. Therefore, I will add a premium to NFLX's valuation for its push into gaming. That being said, it is important to keep an eye on NFLX's future plans for gaming, lest it goes on another spending spree as it did for its streaming segment. Now, let us analyze NFLX's prospects of creating an advertising subscription tier!

Analysis on Advertising

Co-CEO Reed Hasting announced NFLX’s move into advertising in the excerpt below: “Those who have followed Netflix know that I've been against the complexity of advertising and a big fan of the simplicity of subscription. But as much I'm a fan of that, I'm a bigger fan of consumer choice. And allowing consumers who would like to have a lower price and are advertising-tolerant to get what they want makes a lot of sense. So that's something we're looking at now. We're trying to figure it out over the next year or two. But think of us as quite open to offering even lower prices with advertising as a consumer choice.”

To develop its advertising capabilities, Netflix plans to work with advertising companies. In the recent 2022Q1 Earnings Call, Co-CEO Reed Hastings mentioned “...the online ad market has advanced. And now, you don't have to incorporate all the information about people that you used to. So we can be a straight publisher and have other people do all of the fancy ad-matching and integrate all the data about people. So we can stay out of that and really be focused on our members creating that great experience and then again, getting monetized in a first-class way by a range of different companies who offer that service.” In fact, NFLX has announced a deal with Microsoft to handle Netflix’s upcoming ad-supported offering.

Bull Points (+)

Let’s first take a look at Discovery+ as a reference point since they implemented an ad tier for some time already. Discovery’s CEO David Zaslav announced for Discovery+: “So we charge $5, we make over $6 [in ad revenue] and we’re making $11 a subscriber, 50% more what we were making on a cable sub.” That’s right, its ad tier makes more money than its ad-free tier. This may also be a possibility for Netflix.

Cowen analyst, John Blackledge, estimates that NFLX can earn an ARPU of $17/month for an ad tier. This figure is derived from a combination of ad revenue of $10 per month and a subscriber revenue of $7 per month.

I too believe that Netflix content has a higher acquisition strength than compared to Discovery+ content. Moreover, I would think that since NFLX has many more data points on its viewers than Discovery+, it is reasonable to expect that NFLX can monetize its ads better than Discovery+ can. Conservatively, I would anticipate that NFLX would be able to make $7 in ad revenue per month per subscriber, with a subscription cost of $6. This means that NFLX will have an ARPU of $13/month for an ad tier. This is 17% greater than NFLX's current global average monthly paid-tier ARPU of $11.10.

Bull Point 2: Even if Netflix does not own its ad platform, it still has the opportunity to undertake the next generation of advertising - Virtual Product Placement.

Virtual Product Placement is the live modification of streaming content to personalize advertisements on-the-fly to viewers within the show that they are watching. The article below explains this clearly.

Although Amazon may be the most synergistic entity to carry this out, it is also possible for Netflix to engage in this futuristic advertising.

Bear Points (-)

Bear Point 1: Netflix is late to advertising.

NFLX competitors have beat NFLX in this regard. Disney has experience with ad-based streaming plans through its HULU service. Comcast also has decades of experience in the ad-selling market, and its Peacock+ streaming service comes in three tiers with varied blends between subscription fees and advertising. WBD also has decades of experience in managing its ad inventory and has already implemented advertising into HBO Max and Discovery+. NFLX announced that it would only be able to implement its advertising tier in early 2023. This may not seem like a very long time for some, however, with the intense streaming wars, 1 year can make all the difference in deciding who the winners will be.

Bear Point 2: Netflix will never be able to transition out of being a content-producing company. Hence, it should be valued as one.

With its transition to outsourcing its ad inventory, it becomes clearer to investors that NFLX should be valued purely as a content-producing company and not like a tech company. Thus, in my valuations in a later article, I will experiment with NFLX's valuations by using a Linear TV multiple.

Let’s wrap up

NFLX's move into advertising will certainly affect both its topline and bottom line positively. Based on our calculations elaborated above, we believe that there is a strong probability that NFLX could see a 17% increase in ARPU just by implementing an advertising tier.

Up Next!

In our next article, we will be comparing NFLX's move to clampdown on password sharing. How much more can Netflix actually make from the freeloaders? What are you waiting for? Subscribe (top right!) to not miss out on our next drop!!!

Wait a minute!

It takes us weeks of research to produce our articles. If you found value in this read, it would mean the world to us if you would support us on Twitter! We would love for you, to join our community! Where’s the fun in investing alone? Thank you so much for your support!

Our calls so far

Transparency

The current holdings in my portfolio are shown below. If you want a live update of my portfolio, check out JoshuaHD. I showcase this for transparency’s sake so that you as a reader can make an informed decision of any bias I might have. This is by no means a model portfolio.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own due diligence or consult a financial advisor. Investing includes risks, including loss of principal.