Time to Read: 10 min

First, I’d like to welcome new readers to The Griffin’s Stock Report. So glad to have you join us! Our mission is to analyze companies that have exciting prospects and unpack them in a logical way for our readers.

This month’s deep dive is on a company whose name has become a verb and whose product is loved by many worldwide. That company is none other than Netflix, the King of streaming.

We dug deep on this one, and boy, our research revealed so much to us that we decided to split our research into separate articles to break it down nicely for you. This article is the 2nd of 5 articles analyzing Netflix. If you'd like to see our previous articles, click here. Here's the outline for this month's deep dive:

Article 1: Understanding NFLX's revenue breakdown and acquisitions

Article 2: Analysing NFLX's content library.

Article 3: Analysing NFLX's push into gaming and advertising

Article 4: Analysing NFLX's subscription prices and the crackdown on password sharing.

Article 5: Valuations

Without further ado, let’s get right into it!

Breakdown

The article today will elucidate the following segment:

Analysis of Netflix content library

Analysis on NFLX content library

When NFLX first launched its streaming service in 2007 it fully licensed shows from traditional media conglomerates. Only in 2013 did it start producing its own content. Within a short time span of just 8 years, Netflix has produced over 1,500 original titles, making up 40% of Netflix's overall library.

Bull Points (+)

Bull Point 1: Netflix owns many high-quality movies and TV Shows.

The company produces two kinds of original content—TV shows and movies that it pays for and develops in-house, and TV shows and movies that it acquires the exclusive rights to broadcast. Netflix tends to put the term “Netflix Original” on both, adding notable difficulty to pin down the exact number of TV shows and movies that it’s actually produced in-house.

Regardless of whether the content is the first or second kind, it is undeniable that Netflix possesses an award-winning library of some of the most popular movies and TV shows. In fact, the number of Netflix Originals that have been nominated has ballooned over the years. This is illustrated in the chart from Statista below.

Number of nominations/wins for Netflix Originals at the Primetime Emmy Awards

In 2017, Netflix won its first Oscar for its show The White Helmets. In 2018, Netflix surpassed HBO in the amount of Emmy nominations. Just two years later, in 2020, Netflix earned more nominations at the Oscars than any other film studio. A Nielsen report showed that 9 of the top 10 original streaming properties in 2020 belonged to Netflix. In 2021, Netflix won 44 Emmys that year, more than double the total number of awards in the previous year, and more than any of the other networks or studios. This feat matched the record for most Emmys won in a single year set by CBS in 1974.

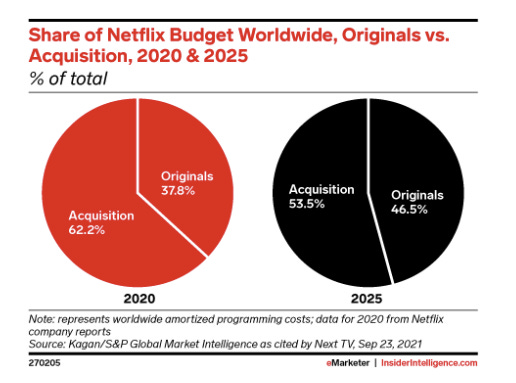

Some critics assert that Netflix managed to make this many hits, only because it spent an inordinate amount on content. However, that's not true. From 2016 to 2020, NFLX spent a total of $28.5 billion on licensing content and only $21 billion on producing originals. We can see that in the past 5 years the majority of Netflix's budget was spent on licensing content, not original content. If it were the case that the company spent all $54 billion of its budget since 2016 on original content to make those hits then that would be a bummer. However, if the number is actually $21 billion then that's really impressive. Remember, The Walt Disney Company (DIS) will be spending $33 billion on content this year, more than Netflix spent over the past six years combined on original content. It is truly impressive that NFLX managed to produce so many hits as a relatively new content-producing company. The secret behind this is - data. I promise I will elaborate more on this later on.

Netflix Content Spend ($ billion)

Bull Point 2: Netflix can license out its own Original shows and earn more revenue.

In fact, this has already begun. On April 25, 2017, Netflix signed a licensing deal with IQiyi a Chinese video streaming platform owned by Baidu, to allow selected Netflix original content to be distributed in China on the IQiyi platform. According to reports, Netflix has also been in talks with ViacomCBS and NBCUniversal about licensing Netflix Originals, both shows, and movies, to their platforms — including their linear networks. This is a major strategy reversal and a new revenue stream for Netflix.

Bull Point 3: Netflix can also release its Originals in theatres and earn extra revenue.

One big movie can generate $1 billion+ from the global box office. NFLX competitors are already engaged in this. Amazon has released some of its movies in theaters prior to their release on Prime. The e-commerce giant also plans to acquire Landmark Theatres, which has more than 50 theaters in the United States. If NFLX follows suit, they will definitely be able to expand their revenues.

Bull Point 4: Netflix is reaching an inflection point where it no longer has to increase content spending to keep customers engaged.

Over the years, Netflix's output has ballooned to a level unmatched by any television network and streaming service. According to Variety Insight, Netflix produced 371 new original shows and movies in 2019, a figure "greater than the number of original series that the entire U.S. TV industry released in 2005." Netflix's total budget allocated to production increased annually, reaching $17 billion in 2021. In comparison, DIS plans to spend a total of $33 billion on both its Linear TV and Streaming content this year. Out of the $33 billion, DIS intends to spend only $15 billion will be allocated to DTC content this year. Below is a table I have gathered to track the content spending of each streaming company.

Annual Content Spend ($ billion)

There is a limit on the number of shows people can watch because of time, relationships, and work constraints. Streaming companies should be mindful of this ceiling when producing shows to keep subscribers entertained.

I assume DTC content spending for each player to eventually stabilize around $25 billion. This is because:

$25 billion is the average figure that WBD and DIS spend on content across Linear TV and Streaming. If all content eventually shifts from Linear TV to Streaming, the full $25 billion will be spent on streaming.

As of August 2021, Netflix Originals made up 40% of Netflix's overall library in the United States. Netflix achieved this with its $21 billion spent on Original content since 2016. If Netflix were to increase its spending to $25 billion, it would immediately more than double the amount of Original content it currently has. Thus, a limit of $25 billion on spending puts Netflix in a very safe spot safe as a content-producing company.

Any spending above this would be unhealthy for streaming companies and consumers. Imagine the number of shows being released if you had 5 streaming companies releasing $25 billion worth of content each year!

Therefore it seems, that Netflix is about to reach an inflection point where it no longer has to increase spending any further to keep viewers engaged. When this point is reached, NFLX can focus on monetizing its customers and focus on developing other avenues of entertainment experiences to engage customers in.

Bear Points (-)

Bear Point 1: Competition pulling off shows from Netflix

For example, in November 2013, Netflix and Marvel Television announced a five-season deal to produce live-action Marvel superhero-focused series: Daredevil, Jessica Jones, Iron Fist, and Luke Cage. The deal involves the release of four 13-episode seasons that culminate in a mini-series called The Defenders. The series, however, was removed from Netflix on March 1, 2022, following Disney's announcement to reacquire the series' rights after Netflix's deal expired.

According to The Guardian, in the first two months of this year, 31% of the 150 most-viewed shows and films by British users belonged to Netflix’s competition, and a quarter of all viewing was to content owned by rivals with streaming services of their own, according to the research firm Digital i.

This is not a cause for concern, however, as covered in the bull points above. NFLX has its own award-winning shows and its large content spending would generate more than enough content to make up for the loss of licensed content. New content, unlike older content, has stronger customer acquisition strength, which means they have a greater ability to attract viewers. On top of this, many old tv shows can be found on the corners of the internet for free. According to Richard Broughton, an analyst at Ampere: “Of the titles which were first released in 2021 and 2022, Netflix Originals dominate. Just 10% of the most popular shows and movies that were released since the start of 2021 were not Netflix Originals. So while there is inevitably a risk of popular titles driving consumption being lost, Netflix does have a huge range of alternative options for subscribers.”

Bear Point 2: Netflix does not have diversified content like sports and news, which means its churn will be higher than its competitors.

Sports

Some readers may question the importance of having sports content. However, sports content is imperative in making the content provider more attractive. Bob Chapek, CEO of Disney said “Sporting events continue to be the most powerful draw in television, accounting for 95 of the 100 most-watched live broadcasts in 2021."

Levy, chairman of data firm Genius Sports said: “With sports, there’s a guaranteed built-in audience, It’s much different than entertainment. With entertainment, every show is hit or miss, and you always have to market content. You never know what will succeed and what won’t. That’s why sports is the best content to invest in, and it will be no matter what the distribution model is.” Essentially, this means that providing sports content in addition to movies and TV helps retain subscribers.

Moreover, sports content provides a potential arm of revenue generation - sports betting. In fact, Disney already has plans to go into sports betting. Bob Chapek said that the future of sports programming would extend to "sports betting, gaming, and the metaverse”. If Disney has plans to go into sports betting, I am sure WBD will soon follow. However, Netflix will be left behind, as it has no exposure to sports content.

In terms of sports coverage, Disney is the best. It owns ESPN which is the most popular sports coverage channel. WBD follows in 2nd place with the Eurosport channel, and Paramount comes in third with its CBS sports channel. In this regard, many of the other streaming competitors are at a disadvantage. Netflix, Amazon Prime, and Apple TV all do not have their foot in the realm of sports. The saving grace for Amazon and Apple is that they bundle their shows with other services like delivery and cloud storage, hence reducing churn. Therefore, I anticipate Netflix and Paramount to have the worst churns among their peers.

News

Like sports, news content is highly important. Because of its ever-changing nature, people continuously have to keep up to date with breaking news, and that is why news content has very low churn. However, it is of no surprise that news content has the lowest acquisition strength. Nobody would realistically pay for news as there are many avenues for it, especially with the prevalence of social media. Thus, as a standalone product, the odds of its success are dismal, but together as part of a bundle with stronger acquisition strengths such as movies and TV shows, news would help reduce churn.

Netflix’s competitors WBD and Disney can reduce their churn by incorporating their news channels into their streaming services. WBD owns CNN, one of the largest news networks in the world regardless of your political alignments. Disney and Paramount don’t lag too far behind as they still have exposure to news, but Netflix, Amazon, and Apple tie for last place with zero exposure.

In short, Disney and WBD have news and sports offerings, while Amazon has an E-commerce offering, and Apple bundled its streaming service with its cloud and music service. Only Netflix offers its shows as a standalone service. Therefore, we can conclude that Netflix’s content is likely to have a much higher churn than competitors. This just means that NFLX has to consistently spend more than its competitors to keep viewers on its platform.

In order of lowest to greatest churn:

Bear Point 3: Netflix is spending less than some of its competitors on content.

As mentioned in the earlier bear point, because of the high churn rate due to the nature of Netflix’s content, Netflix has to always outspend its competitors to keep its viewers engaged. However, looking at the total budget spent on content, its competitors are spending more on content than Netflix is. Granted that Netflix is still the largest spender on DTC content, its competitors are spending more in totality (Streaming + Linear TV). Disney leads the pack with a whopping $33 billion spent on content this year. Warner Bros. Discovery comes in second and will spend $22.4 billion on 2022 content. If we assume that all content will eventually be ported over to streaming, Disney and WBD will likely be producing more shows than Netflix will be. On top of that their offering should also have lower churn because of their news and sports offerings.

Let’s wrap up

We can conclude that Netflix is great at producing quality hit shows. Moreover, it has done so without overspending. However, it may have to spend more than its competitors for eternity as it has a high churn rate since its shows are not bundled with other kinds of low-churn content like its competitors. Therefore, if I were to rank how each company’s content offering would stand relative to each other in 5 years time, it would be like this:

Disney

WBD / Amazon / Netflix

Paramount / Apple

Up Next!

We will be analyzing Netflix’s move into gaming in our next article. Is it a masterstroke by Netflix or an absolute death wish? What are you waiting for? Subscribe (top right!) to not miss out on our next drop!!!

Wait a minute!

It takes us weeks of research to produce our articles. If you found value in this read, it would mean the world to us if you would support us on Twitter! We would love for you, to join our community! Where’s the fun in investing alone? Thank you so much for your support!

Our calls so far

Transparency

The current holdings in my portfolio are shown below. If you want a live update of my portfolio, check out JoshuaHD. I showcase this for transparency’s sake so that you as a reader can make an informed decision of any bias I might have. This is by no means a model portfolio.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own due diligence or consult a financial advisor. Investing includes risks, including loss of principal.