Time to Read: 10 min

First, I’d like to welcome new readers to The Retail Deep Dive. So glad to have you join us! Our mission is to analyze companies that have exciting prospects and unpack them in a logical way for our readers.

This month’s deep dive is on a company whose name has become a verb and whose product is loved by many worldwide. That company is none other than Netflix, the King of streaming.

We dug deep on this one, and boy, our research revealed so much to us that we decided to split our research into separate articles to break it down nicely for you. This article will be the 1st of 5 articles analyzing Netflix. Here's the outline for this month's deep dive:

Article 1: Understanding NFLX's revenue breakdown and acquisitions

Article 2: Analysing NFLX's content library.

Article 3: Analysing NFLX's push into gaming and advertising

Article 4: Analysing NFLX's subscription prices and the crackdown on password sharing.

Article 5: Valuations

Without further ado, let’s get right into it!

Breakdown

The article today will elucidate the following segments:

1) History of NFLX

2) Stock Price

3) Definitions and Concepts

4) Revenue Breakdown

5) Acquisitions

History

Netflix was founded on 29 August 1997 by Reed Hastings and Marc Randolph in Scotts Valley, California. Initially, the company sold and rented DVDs by mail. It only launched its streaming service in 2007 and got into content production in 2013. Today, Netflix is a full-blown streaming company and enjoys the greatest number of subscribers among its peers.

Stock price action

NFLX stock price currently trades at $220, down 68% from its all-time highs in Oct 2021. Some reasons for this massive decline include:

Reason 1: Losing 200,000 subscribers in Q1 2022.

Reason 2: Forecasting a decline of 2 million paid subscribers for the second quarter.

Reason 3: Bill Ackman selling his NFLX shares for a loss of $450 million after only holding the shares for 3 months.

Reason 4: Strong competition with DIS, WBD, and AMZN.

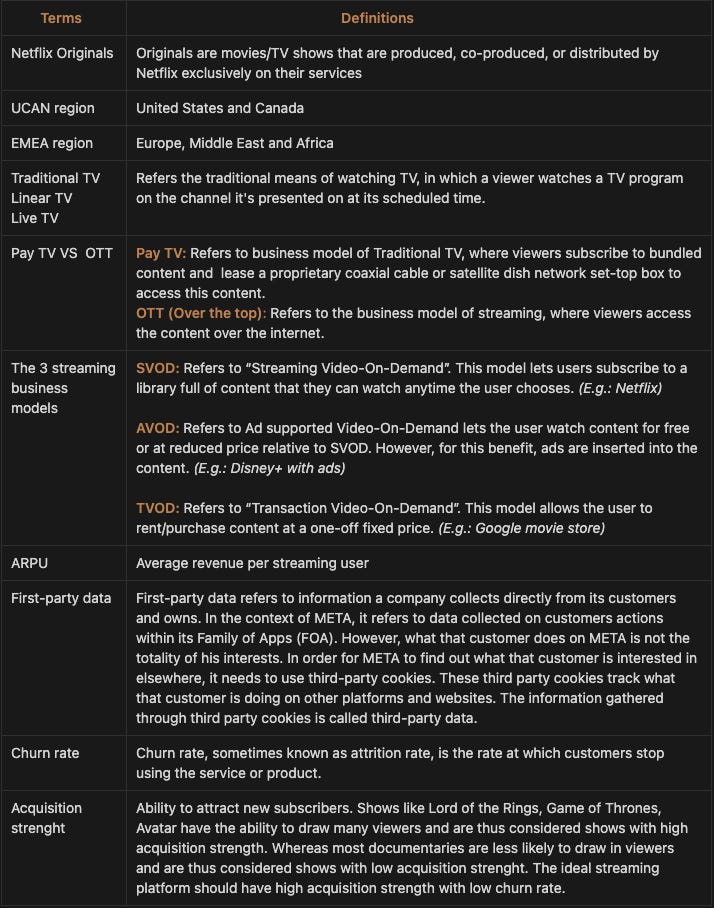

Definitions & Concepts

To analyze NFLX’s business model, there are some terms that we must understand first.

Revenue Breakdown

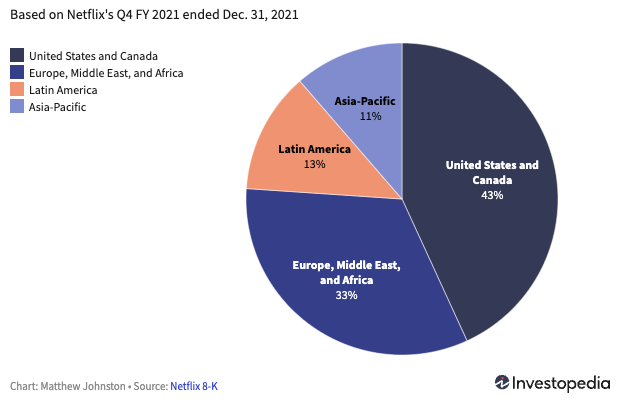

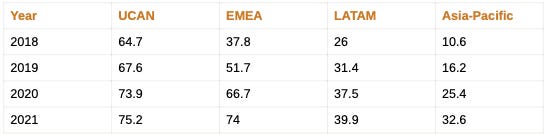

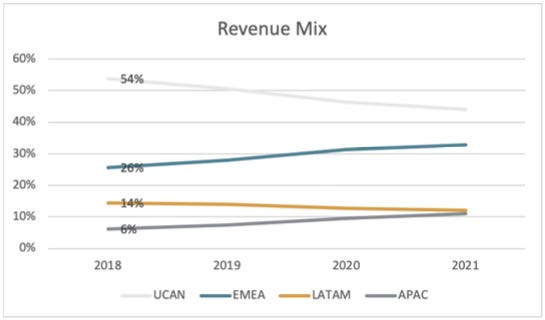

NFLX has only a single revenue stream - Streaming. As of today NFLX does not advertise or sell its user's data. NFLX breaks out its streaming revenue into four broad regions. For 2021, its breakdown is as follows:

As seen from the pie chart, the majority of NFLX’s revenue comes from the UCAN region, followed by the EMEA region. This is because of two reasons. Firstly, those regions have more subscribers, and secondly, those regions have a higher ARPU. Here is how many subscribers NFLX has per region:

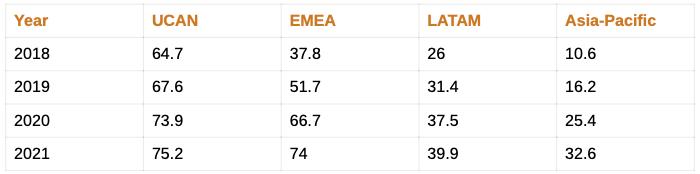

Subscribers by region (millions)

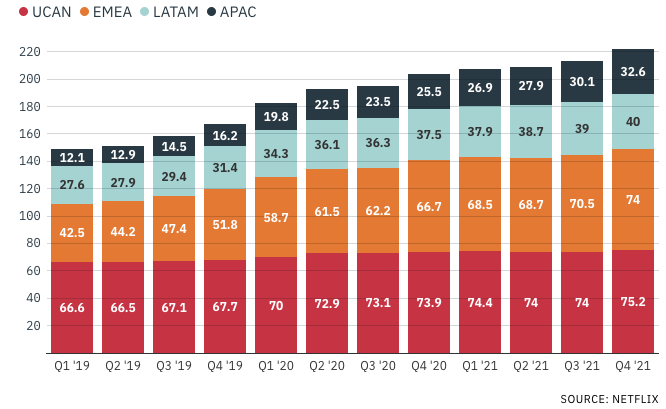

Below is a graphical representation of the numbers above.

Annual ARPU by region ($)

NFLX annual revenue by region 2018 to 2021 ($ bn)

As seen from the table and the chart above, annual revenues from all regions have been increasing over the years. Revenue contribution from EMEA has had the highest growth rate followed by APAC. Now, see how much market share the King of streaming has.

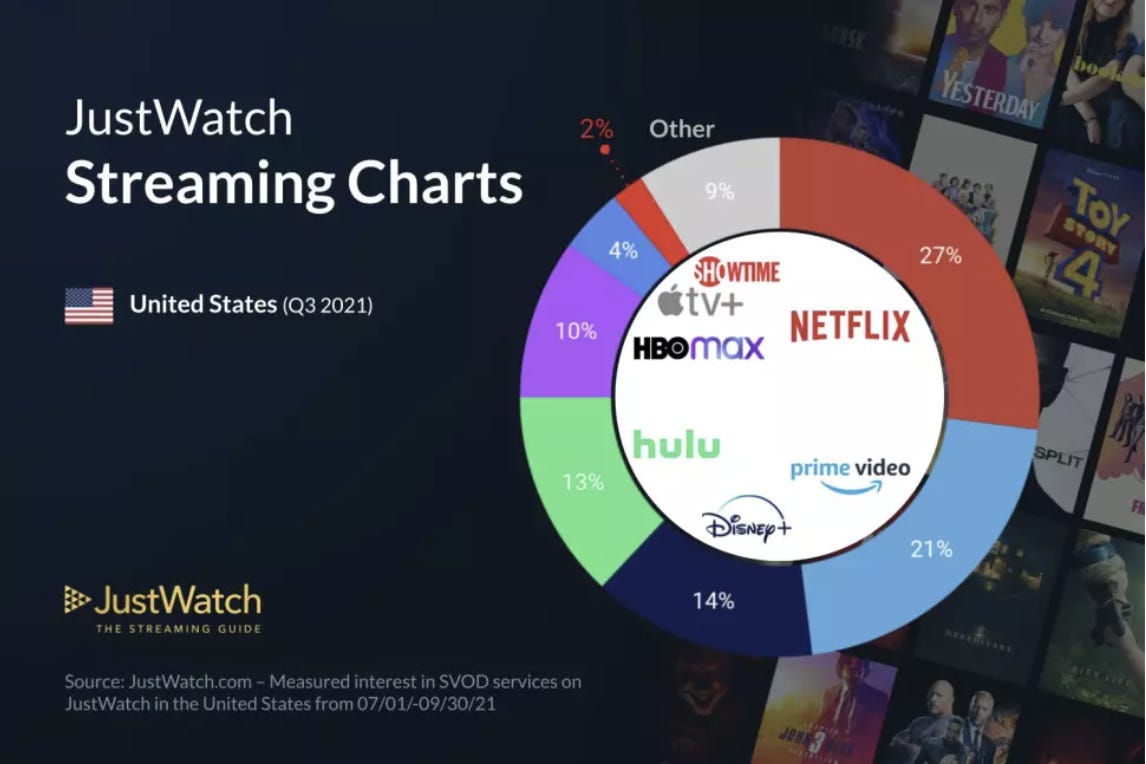

Streaming market share

NFLX has the largest market share in the US (27%). Prime video comes in second with 21% followed by Disney+ in the third spot. Although NFLX currently has the largest market share, we can clearly see that it has been steadily losing market share to its competitors throughout 2021. If this trend continues, Prime Video and Dinsey+ may overtake NFLX within the next couple of years. This is a risk we have to account for in our valuation of Netflix. Now, let’s look into NFLX's recent acquisitions. Is it doing anything to address the loss in market share?

Acquisition

Analyzing a company’s acquisition is essential in determining the company's future. Looking at NFLX, it seems that there’s a strong gaming angle in its acquisitions. We will start with NFLX's latest acquisition.

Acquisition 1: Boss Fight Entertainment

NFLX announced its acquisition of Boss Fight Entertainment on 24 March 2022 for an undisclosed amount. Boss Fight Studios is a Texas-based mobile game developer. Amir Rahimi, Netflix’s VP of game studios, explained that “This studio’s extensive experience building hit games across genres will help accelerate our ability to provide Netflix members with great games wherever they want to play them.”

Acquisition 2: Next Games

NFLX announced its acquisition of Next Games on 2 March 2022 for a total cost of $73 million. Next Games is a Finnish mobile games developer whose strategy has been to develop games based on popular entertainment IP. Next Games has already developed titles related to some of Netflix’s biggest draws, such as “Stranger Things” and “The Walking Dead.” This means that the two companies already had a strong relationship. This deal will cement that, and improve NFLX’s margins by bringing in-house Next Games’ IP, talent, and existing business selling in-app purchases into the company.

“Next Games has a seasoned management team, strong track record with mobile games based on entertainment franchises, and solid operational capabilities,” Michael Verdu, VP of games at Netflix, said in a statement. “We are excited for Next Games to join Netflix as a core studio in a strategic region and key talent market, expanding our internal game studio capabilities. While we’re just getting started in games, I am confident that together with Next Games we will be able to build a portfolio of world-class games that will delight our members around the world.”

Currently, Next Games has 120 employees, and its last annual results showed €27.2 million in revenues in 2020. Some 95% of its sales came from in-game (in-app) purchases that year. So it seems that NFLX bought Next Games for a P/S ratio of 2.7x.

Acquisition 3: Night School Studio

NFLX announced its acquisition of Night School Studio on 29 September 2021 for an undisclosed amount. Night School Studios is a California-based gaming studio best known for its supernatural mystery adventure title “Oxenfree”.

Netflix acquired Night School Studio for its expertise in developing narrative-driven games. “We’re inspired by their bold mission to set a new bar for storytelling in games,” Netflix said at the time.

In a blog post, Night School’s Krankel wrote: “Our explorations in narrative gameplay and Netflix’s track record of supporting diverse storytellers were such a natural pairing. It felt like both teams came to this conclusion instinctively. It really was this very – I hate overusing the word organic, but it just kind of came together organically." He goes on to say: "We were not shopping ourselves around, and we got to a point where the more we talked to them, the more our visions really aligned for what we like to do and where they want to head with the platform.”

Night School is currently developing Oxenfree II: Lost Signals, planned for a 2022 release on PlayStation 5, PlayStation 4, Nintendo Switch, and PC. Before you get excited, I have to clarify that despite now owning the studio, Netflix isn't involved with this particular project. Instead, MWM Interactive is publishing Oxenfree II. However, you can be sure that NFLX will be publishing future Night School Studio projects. One thing that interested me was that Night School Studio does not only develop games for mobile but for consoles as well, meaning NFLX has inroads into console gaming.

Acquisition 4: Roald Dahl Story Company

NFLX announced its acquisition of Roald Dahl Story Company (RDSC) on 29 September 2021 for an undisclosed amount. RDSC monetizes Charlie and the Chocolate Factory, Matilda, The BFG, Fantastic Mr. Fox, and The Twits. Roald Dahl’s books have been translated into 63 languages and sold more than 300 million copies worldwide, with a new book sold every 2.6 seconds. This acquisition will allow NFLX to get rights to Dahl’s classic characters and stories.

Like many of the other acquisitions, this acquisition was based on a previous partnership too. Netflix said “This acquisition builds on the partnership we started three years ago to create a slate of animated TV series. For example, Academy Award-winning filmmaker Taika Waititi and Academy Award nominee Phil Johnston are now hard at work on a series based on the world of Charlie and the Chocolate Factory. In addition, NFLX is working with Sony and Working Title on an adaptation of Matilda The Musical.

RDSC appears to be a profitable entity on its own. “The company exceeded the directors’ expectations in the year ended 31 December 2020, with revenue 13.2% ahead of budget,” TRDSC’s former directors Luke Kelly and Claire Wright wrote in their strategic report. Moreover, according to U.K. financial filings for RD Payments Limited (the holding company that houses RDSC), the company had revenues of £25.77 million ($35.2 million) in 2019, and £23.98 million ($32.81 million) in 2018. Operating profits were £13.1 million in 2019 and £12.6 million in 2018.

This acquisition has had some negative press though. This is because while Dahl is one of Britain’s most celebrated authors, his works have come to be viewed in a different light more recently amid concerns over his antisemitic views. Dahl, who died in 1990, has also been criticized for misogynistic and racist portrayals of some of his characters.

Acquisition 4: Scanline VFX

NFLX announced its acquisition of Scanline VFX on 29 September 2021 for an undisclosed amount. Scanline, a visual effects company, was founded in 1989 and is now led by Stephan Trojansky, a trailblazing VFX Supervisor. Scanline is known for its ability to create photorealistic natural phenomena such as fire, smoke, and water, having developed its propriety fluid simulation software, which was the recipient of a Scientific and Technical Achievement Academy Award. The company has also won numerous other awards:

Visual Effects Society award in 2010 for outstanding supporting visual effects for Hereafter

Emmy Award and Hollywood Post Alliance Award for outstanding special visual effects in 2014 for Game of Thrones S4

Emmy Award, and HPA Award in 2019 for Game of Thrones final season as well as a VES Award for outstanding created environment.

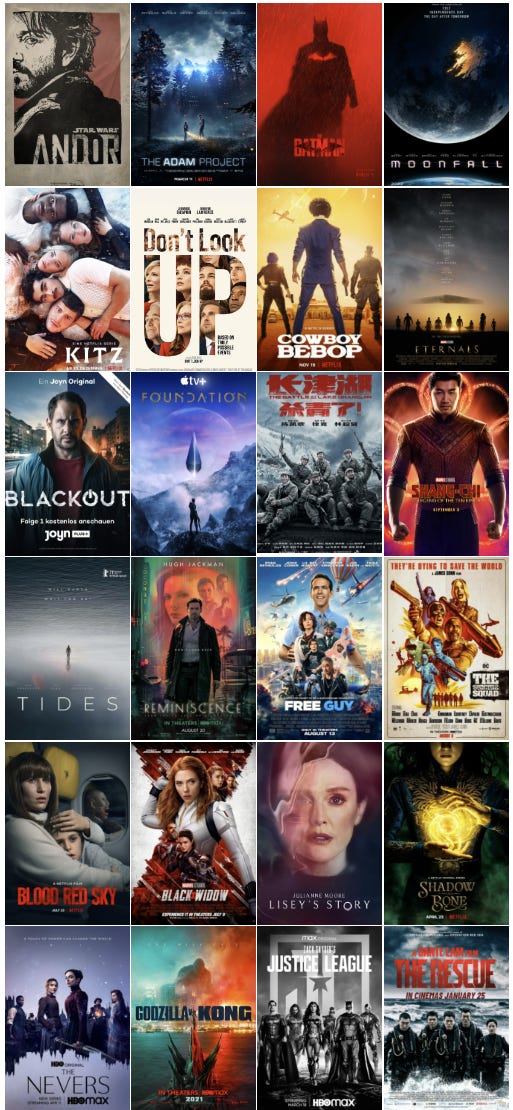

Scanline VFX has already done work for many NFLX movies and TV shows. Beyond Netflix, Scanline has worked on:

Eternals

Shang-Chi and the Legend of the Ten Rings

Black Widow

Black Panther

Captain Marvel

Iron Man 3

Captain America: The Winter Soldier

Game of Thrones

Godzilla vs King Kong

Zack Snyder’s Justice League

Free Guy

Joker

Clint Eastwood’s “Hereafter"

Scanline has done VFX for so many famous movies, that it seems to me that they did VFX for almost every single movie I watched in the past 2 years! If you would like to see how amazing their work is, I highly recommend you visit their website.

Netflix acquired Scanline to get its own in-house visual effects team that can be used for its own movies and shows. That being said, Netflix said it will operate Scanline VFX as a standalone business that will continue to work with longstanding and new clients outside of Netflix. Netflix also plans to continue to work with many other VFX studios worldwide “so we can continue to ensure that our creators have access to the world’s most innovative tech.”

Let’s wrap up

Clearly, most of NFLX's acquisitions have been to grow its expertise in the gaming segment. I think this is a brave move from management, and I hope it plays out well. Alas, the analysis of its gaming division will be covered in a later issue, so stay tuned for it!

Up Next!

We will be comparing NFLX movies and TV shows with its competitors in our next article. Are Netflix’s shows really worse than its competitors? Or is Netflix becoming a genius content producer? What are you waiting for? Subscribe (top right!) to not miss out on our next drop!!!

Wait a minute!

It takes us weeks of research to produce our articles. If you found value in this read, it would mean the world to us if you would support us on Twitter! We would love for you to join our community! Where’s the fun in investing alone? Thank you for your support!

One last thing!

When you first subscribe to The Griffin’s Stock Report, our newsletter to you may be classified as spam mail. Be sure to bring our emails out of your span folder! This way you won’t miss out on any of our articles when published!

Our calls so far

Transparency

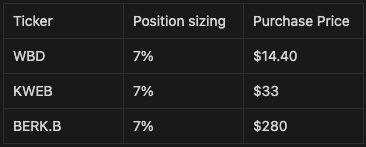

The current holdings in my portfolio are shown below. If you want a live update of my portfolio, check out JoshuaHD. I showcase this for transparency’s sake so that you as a reader can make an informed decision of any bias I might have. This is by no means a model portfolio.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own due diligence or consult a financial advisor. Investing includes risks, including loss of principal.