Summary

The S&P 500 rebounds out of bear market territory as investors reassess the current macroeconomic terrain.

GS revises their recession expectations by doubling the probabilities.

Consumer sentiment worsens as the University of Michigan index posts an all-time low reading.

China remains the preferred market within APAC as QE progresses and lockdowns gradually lifted.

Bitcoin and Ethereum remain the most oversold they have ever been on a monthly RSI timeframe. I still expect more downside.

In this market report series, I will summarize key developments in the prior week as well as provide outlook for the upcoming week. This way, investors will be better able to navigate the uncertainty and volatility as the Fed ramps up i/r and QT.

Weekly Market Movements

Markets staged a stunning rebound, ending the week up significantly as investors reassessed the current macroeconomic terrain. The SPY (NYSEARCA:SPY) closed the week up 645bps, Dow (DIA) up 539bps, and the Nasdaq (NASDAQ:QQQ) up 745bps. Year to date, the SPY remains down 18.5%, DIA down 13.9%, and the technology index down 26.6%.

This week, the Fed changed their policy tone to guiding that a soft landing would be very challenging to achieve. Charles Evans, part of the Fed, said another 75-bp hike is a "very reasonable place" for discussion at July's FOMC meeting, but "I don't think 100 basis points is necessary."

Goldman Sachs Revises Recession Probabilities

GS has revised their probability of a recession to 30% over the next year, compared to 15% previously.

"We now see recession risk as higher and more front-load," say economists led by Jan Hatzius wrote in the note.

"The main reasons are that our baseline growth path is now lower and that we are increasingly concerned that the Fed will feel compelled to respond forcefully to high headline inflation and consumer inflation expectations if energy prices rise further, even if activity slows sharply."

The slowdown in activity refers to demand destruction in the case of a resulting/forced recession.

Treasury Yields and The Greenback Reverse

In the bond markets, treasury yields have reversed course once more as fears of a recession mount. This comes against a backdrop of investment banks all revising their probabilities for a recession upwards based on May data. The US10Y currently trades at 3.13%. JPMorgan now also sees select opportunities in government debt, with the risk to reward ratio more favorable with as yields have room to fall as investors assess the reality of a recession. The alternative case remains that the Fed is really on path to tighten aggressively and 10Y yields will rise to 4% before falling. If true, treasury holders risk exposure to more pain from here.

Similarly, the greenback has seen outflows once more as worries over growth proliferate. The $DXY currently trades at $104, down from the $106 high observed last week.

Wage Inflation Lags The Broader CPI

Wage growth has also not kept up with inflation, further evidence that consumers are unable to sustainably weather the rising prices organically, and this data corroborates the ATL 4.4% personal savings rate print 2 weeks ago, the portion of which one saves one's paycheck.

The effects of rising prices are also starting to be felt on a broader level with all types of workers seeing their purchasing power diminish.

At the start of 2022, 64% of the U.S. population was living paycheck to paycheck, up from 61% in December and just shy of the high of 65% in 2020, according to a LendingClub report. Even among those earning six figures, 48% said they are now living paycheck to paycheck, up from 42% in December, the survey of more than 2,600 adults found.

The problem is that despite the slowdown in core inflationary pressures since the peak acceleration in March (+6.5% YoY), food, and energy, the 2 categories of goods that consumers just simply can't cut back entirely (party inelastic demand), have been surging higher.

"You've got to eat, you've got to commute, these are not discretionary expenses".

Some economists also believe that we are likely headed into an inflation explosion on the 4th of July, which would reflect in the following July CPI result and not the immediate June one. Independence day (4th of July) is 1 of the 3 holidays that US consumers travel and splurge the most, with the AAA predicting that 47.9M consumers will travel 50miles+ over the weekend.

Despite the higher prices, consumers will be buying BBQ cookouts and filling up their tanks into the weekend. The anticipated travel volume for 2022 is 3.7% higher than 2021 and just shy of 2019 levels. Car travels in particularly has breached a new high as consumers forego airfares, and this pent-up DD, particularly squeezing energy and food prices despite a slowing core, poses a significant risk to CPI readings for the month of July which came in at 8.6%.

UMich Consumer Sentiment Hits An ATL

UMich Consumer sentiment data released for the month of June has also posted a reading worse than the preliminary record low reading of 50.2 disclosed 2 weeks ago. Consumer sentiment has fallen to a new low of 50.0, lower than the 2008 lows and the 1980s record low of 51.7. This marks a new low in entirety of the stock markets existence.

Upcoming Week Outlook

Looking to the coming week:

US Consumer Confidence for June (Tuesday)

US PCE Headline + Core -YoY + MoM (Thursday)

US Chicago PMIs for June (Thursday)

US ISM Manufacturing Index (Friday)

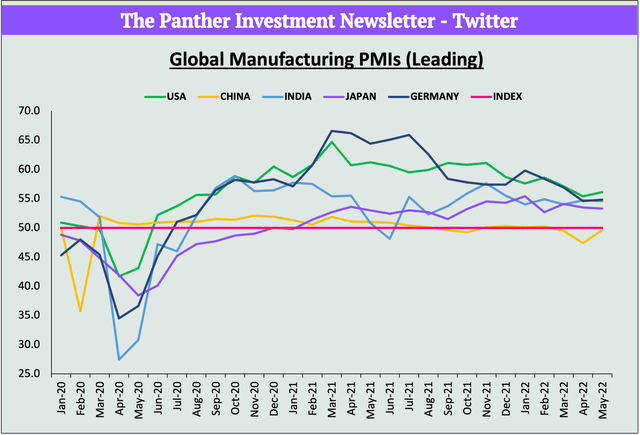

The key reading that I will be on the lookout for would be Friday's manufacturing PMIs. A reading above 50 indicates expansion and a reading below 50 contraction.

May's 56.1 PMI surprised to the upside, coming in higher than April's 55.4. Regardless, most manufacturing regions have started to see some sort of a slowdown in activities year-to-date, but most still remain in expansionary phase with the exception of China. For the US, a reading higher than 56.1 would be good news for consumption and production in general.

Till next time!