Summary

NNDM’s 4 recent acquisitions seem to have solid narratives behind them.

The company’s BOD have authorized a new SRP up to US$100M.

Q122's preliminary report suggests that management is on track to beat FY22's estimates.

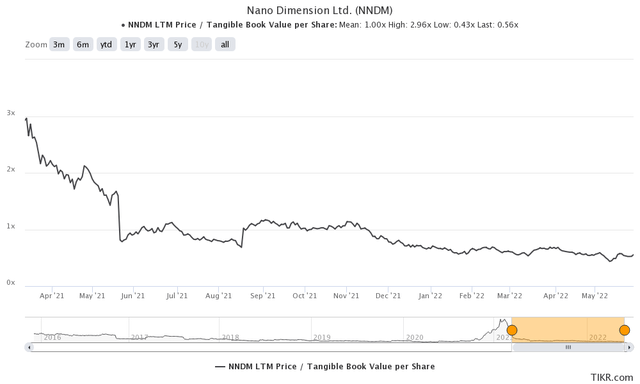

P/BV valuations have further compressed. Buy NNDM for 56 cents on the dollar.

Introduction

Nano Dimension Ltd (NASDAQ:NNDM) is an Israeli-based provider of machines for the fabrication of AME (Additively Manufactured Electronics) and other additively manufactured products.

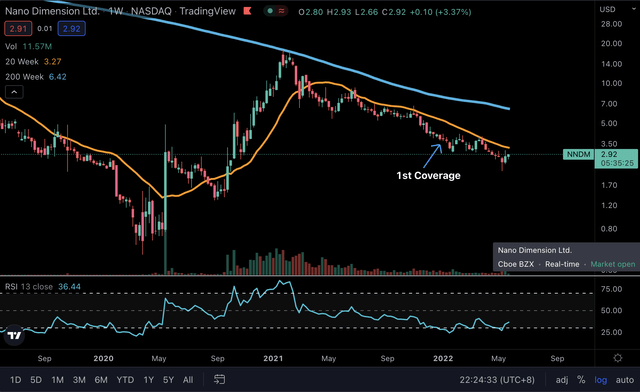

The stock currently trades for US$2.92 a piece, down 85% from its February highs and close to 30% since I last covered it here on what I believed to be substantial mispricing surrounding the name, attributable to its close affiliations with Cathie Wood and the ARK ETFs. For a more quant-like primer on the company, it would be best to read my earlier coverage first before this update.

In my previous article, I suggested that:

Although the valuations of the company were certainly frothy in the past, the current financials of the company (more specifically, the cash on hand, the pristine balance sheet, and the current EV) all point to a case of substantial mispricing that the markets seem to have ignored, which may reward early investors in this narrative.”

I argued that investors who initiated a speculative play and base capital exposure of just 1-2% AUM to the name could be rewarded handsomely should a near-term positive catalyst emerge. The near-term catalyst has somewhat emerged, and more may be in store for bulls in its upcoming earnings. I also examine the acquisition spree in the past year to identify any other tailwinds pre results-release May 31st.

Just a heads up, the 1st half of this coverage is rather dry, delving into the business models of the acquired companies. So if you just want a financial and quant perspective, feel free to skip to the 2nd half. Let’s begin.

Business Model

Additive manufacturing (AM), otherwise known as 3D printing, is the process of creating an object by building it one layer at a time. It is the opposite of subtractive manufacturing, in which an object is created by cutting away at a solid block of material until the final product is complete. AM seeks to revolutionize the electronics industry which can benefit from the doing away with minimum unit counts and allowing for shorter turnaround times. There are many different applications for AM, but NNDM specialises in AME, specifically the AM of circuit boards and electronic devices.

As I mentioned in my previous article, a large percentage of Nano Dimension’s current sales comes from its hardware printers. However, like all printers, once a customer has bought a printer, he will need to continuously buy the printer’s “ink” which serves to be some sort of ‘recurring fees’ that should provide investors and the company with more stability in cashflows and visibility into earnings. Markets tends to love firms with ARR and hence the hope for NNDM is that as it scales, the percentage of recurring revenues as part of the net sales breakdown grows to outweigh sales attributable to the lower margin hardware segment.

Acquisitions

NNDM has made 4 acquisitions since April 2021.

DeepCube (April 2021)

NanoFabrica (April 2021)

Essemtec AG (November 2021)

Global Inkjet Systems GIS (January 2022)

DeepCube

NNDM acquired DeepCube, an Israel machine learning company in April 2021 for a total of $70M. DeepCube has developed an algorithm for improving data analysis and implementation of artificial intelligence.

According to BusinessWire:

DeepCube’s proprietary framework can be deployed on top of any existing hardware (CPU, GPU, ASIC) in both data centers and edge devices, enabling over 10x speed improvement and memory reduction. This delivers the most advanced form of deep learning to edge devices, which has previously been unattainable at scale.”

DeepCube was acquired by NNDM so that its award winning training platform and real-time inference engine can be “integrated into Nano Dimension AME 3D-printers, acting as smart nodes in a Smart Fabrication Network (SFN), as well as being the AI control center for these networks.”

Yoav Stern, CEO of NNDM explains this acquisition well:

The core of this solution will be DeepCube’s ‘brain’ that is expected to manage a neural network of edge devices. This will usher in a new design and production flow, offering customers cutting edge capabilities to innovate and create a new line of electronics products that is not achievable today.

Therefore, it seems rather reasonable to acquire DeepCube’s technology to enable a smart fleet of AM 3D printing machines.

NanoFabrica

NNDM acquired NanoFabrica, a micro 3D printing specialist company, in April 2021 for a total of $55M. NanoFabrica’s industrial AM systems have an unprecedented micron-resolution with ultra-fine features, details, accuracy, and precision – enabled by the innovative Micro Adaptive Projection technology. This video should give you a better idea of NanoFabrica’s AM technology.

NanoFabrica fits Nano Dimension’s vertical original equipment manufacturers’ (OEM) target markets, and as such will be leveraged by the distribution channels and go-to-market efforts of both. In parallel, our mutual vision is to merge the technologies of NNDM’s micro-electronic 3D-fabrications machines for Hi-PEDsTM (Hi-Performance Electronic Devices) with NanoFabrica’s micro-mechanic 3D printing".

The vision of this acquisition becomes clearer with Dr Donner, CEO of NanoFabrica commenting that:

By combining the advanced capabilities of deep learning (DeepCube) together with our manufacturing systems, we hope to improve printing speed by five times and yield by 20 times.

Nano Dimension-NanoFabrica’s combined offering will greatly increase the number of applications that can be relevant for mass manufacturing on our planned neural network of digital manufacturing systems.

NNDM originally specialised in AME. Their flagship product was the Dragonfly, a printer for PCB’s. However, after acquiring NanoFabrica, they now specialise in both micro-electronic 3D printing (AME) and micro-mechanic 3D printing (AM), and thus have a higher cumulative TAM. In fact, becoming adapt at micro-mechanic 3D printing strengthens their micro-electronic products as well. On top of that, DeepCube’s acquisition can benefit two lines of AMs instead of one.

Essemtec AG

Next, NNDM acquired Essemtec AG, a Swiss manufacturer of surface mount technology (SMT), in April 2021 for a total of $24.8M.

To quote Printed Electronics Now:

Essemtec’s product portfolio is comprised of production equipment for placing and assembling electronic components on printed circuit boards (PCBs).”

PCBs are just boards with wires and NNDM could already 3D print complex multi-layered PCBs, but did not have the technology or product to automate the process of placing electronic components (such as memory, CPUs, etc) onto the PCBs. However, this changes with their acquisition of Essemtec AG, given that they own the technology and machines required to automate this process of placing electronic components onto the boards printed by Nano’s flagship Dragonfly. Watch this video for more information.

Yoav Stern also commented, saying:

The end goal is to reach a capability for maintaining an inventory of high-end PCB devices, micro-mechanical parts and Hi-PEDs® in digital form: print and assemble them as you need them, where you need them, only the quantity you need, in the best quality at competitive prices, as it is done in highest yield and throughput possible for that point in time, specifically in high mix/low volume scenarios.

This acquisition further synergizes Nano’s lead in the Americas with Essemtec’s lead in Europe to create a more comprehensive end product that leverages the technology attained from their initial acquisition of DeepCube.

Financials wise, there isn’t much disclosure provided, but we do know that revenues for CY20 totaled $17.2M and GM was 60%. In the 8 months ending CY21, revenue totaled $15.4M. “The backlog of signed purchase orders as of Sept’21 was approximately $6.9M”. This means that NNDM would have acquired Essemtec at a P/S ratio close to 1x.

Global Inkjet Systems (GIS)

NNDM acquired Global Inkjet Systems, a UK-based developer of high performance control electronics, software, and ink delivery systems, in January 2022 for $28M. GIS has been inventing and delivering inkjet products for 2D & 3D printing, including a proprietary software system called Atlas, since 2006 and now counts more than 130 global customers.

NNDM describes this as:

“win-win for both organisations” that will see its 3D printers upgraded with GIS’s hardware and software products to open up new applications in markets requiring GIS's precision, and in turn expand GIS’s commercial reach.

GIS’ ink delivery technology and software are essential to any ink deposition methodology within our AME and AM solutions. GIS’ research and development roadmap will help us to deliver better resolution and higher productivity in our industrial 3D printing solutions...

...commented Yoav Stern.

The combined company will own and have access to innovative and yet-to-be-released printing technologies, providing value and leading-edge solutions tailored to our customers’ needs and giving us a clear competitive advantage.

To summarize, this acquisition will see NNMD’s 3D printers get an upgrade. By leveraging the ink and printing technology of GIS, NNDM can upgrade its whole suite of 3D printers to be able to print more quickly and accurately.

For the 12 months ended March 31, 2021, the company generated revenue of ~$10M and a gross margin of 51%, which would mean that NNDM paid 3x sales for GIS. At least on surface level, that ain’t too shabby.

Financials & Valuations

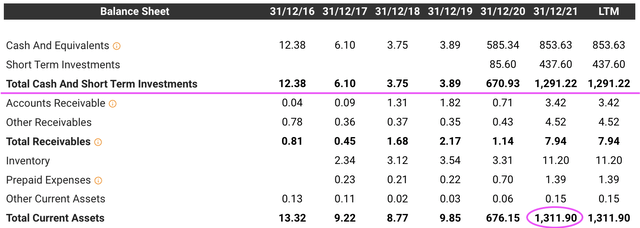

NNDM currently trades at an equity value of 705M and an enterprise value of -578M. Based on its last annual report, NNDM has a cash pile of 853M and STI of 437M. Liquidity stands close to 1.3BN, (1.31 to be exact) while its total debt of 6.9M totals 0.53% of the former.

Since NNDM’s last report, Essemtec AG and Global Inkjet Systems have been acquired and their operations will contribute towards the topline in the upcoming disclosure. Their combined acquisition cost was 53M, and given that they were both largely cash deals, the impact should total 4% max of its total ST liquidity.

On a cash only basis, their short-term liquidity itself amounts to about $5.00/share based on an outstanding share count of 257.44M, 71% higher than the current market price. And for more contextualization, short-term liquidity represents about 95% of Total Assets.

With net assets amounting close to 1.35BN, Nano Dimension trades for a book value per share of US$5.22, 78% higher than the current market price. Its LTM P/BV has further compressed from the 0.66x highlighted in the previous article to 0.56x as of today, and once again, starting a position today is akin to buying the company for 0.56 on the dollar, which presents a remarkable undervaluation, not on earnings but rather on net assets that aren’t even skewed based on arbitrary line items like Goodwill. In other words, initiating a position today would require one to fork out 56 cents for a theoretical guaranteed dollar worth of value attributable to shareholders should NNDM be liquidated and file for bankruptcy today. Sounds like a good deal to me.

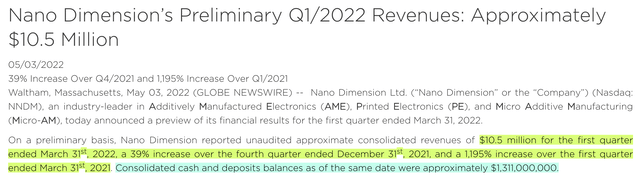

Turning to its preliminary Q1'22 results released earlier this month (post Q1 period), management disclosed revenues of US$10.5M, a 39% increase QoQ and a close to 1200% increase YoY. If Q1 numbers are used as a proxy for the remaining quarters (assuming Q2-4 is similar), Nano dimension would be on track to deliver US$42M revenues for the year ending FY22, 300% higher on a YoY basis. That being said, this is way too simplistic an extrapolation and likely not reflective of how results will actually pan out for the remaining quarters. Furthermore, the street is expecting US$30M for FY22’s topline, below that of the US$42M guesstimate which may be a harbinger of an early potential beat on estimates. However, this set of earnings estimates could be outdated and easily revised upwards when the Q1'22 ER is actually disclosed.

Share Buybacks

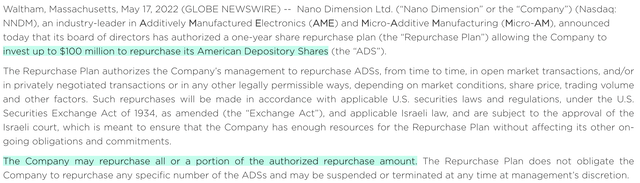

Share buybacks was one of the key catalysts mentioned in my previous article, and Nano Dimension surprised markets when they announced that their BOD had authorized a 1Y SRP up to $100M on May 17th. It is key to note, however, that this SRP is not guaranteed to manifest and NNDM has no obligation to follow through on this disclosure. Still, markets reacted positively, trending close to 15% higher on the news itself, and has maintained at a level 17% higher since.

On the day of the news itself, the 100M value represented close to 14% of the company’s equity’s value and hence why the gains since are also in a similar ballpark. That being said, the true extent to which the 100M SRP will affect Nano’s market capitalisation is unknown as it depends on when management decides to begin removing shares from the market. Regardless, the 100M doesn’t even tally up to 10% of their remaining cash holdings and NNDM still has the means to buy out the entire company 1.6X over. (Remaining cash/revised market capitalisation)

Conclusion

To bring this piece to a close, NNDM largely seeks to grow through acquisitions and their acquisitional history as covered above seems 'logical' to say the least, although my judgement is likely impaired as I am no professional in the 3D printing field. Although shareholders have given management a lot of stick for dilution in the past, much of which is largely warranted, the share issuance flooded the markets when prices were trading significantly higher than today, giving management leverage today and substantial gunpowder that they need to double down on their M&A growth strategy. With a fortress of a balance sheet like theirs, primed for a macro environment like today, Nano Dimension is also well positioned to further their M&A course and is at good odds of picking up distressed peers that will sell at dirt cheap valuations.

I was looking for a potential catalyst in my previous article, and it has emerged from the SRP announced. Based on preliminary revenues, NNDM’s upcoming Q1’22 earnings and the full breakdown as well as guidance may further add fuel to the fire (in a positive manner) and shares may continue to trend higher. Still, the company’s future is a lot more than just a surface level improvement in revenues which is almost guaranteed for any company that grows through the M&A route. Any improvement in margins, trend in cash balance, and cash burn also needs to be observed by investors. Furthermore, in a time like today with a hawkish Fed and rising i/r, it is a risk starting a position before earnings. Markets today care more about the bottomline, guidance, profitability and FCF margins rather than just a topline beat, and a miss on any other line item is a very real risk that could easily send NNDM down 20-30% despite its already significant undervaluation.

Regardless, I have always maintained that a position in NNDM would be a speculative one at best, and investors should keep their exposure between 1-2% of AUMs. NNDM traded at a P/BV of 0.66X in my last coverage and it was a buy. Today, it trades at a P/BV of 0.56x and is still a buy. I have doubled down on my position and remain bullish, but be careful on this one, the markets are brutal and can stay this irrational for long. Till next time!