Summary

Gores Guggenheim is set to merge with Polestar.

The transaction is projected to close on 1H22 and a few weeks remain.

Polestar is unlike other EV pure-plays and already has meaningful revenues, production, scale, deliveries, and global presence.

Polestar’s non-capital-intensive approach as it leverages its parent’s infrastructure and manufacturing facilities is a gamechanger and has served them well in terms of production and deliveries thus far.

Introduction

Polestar and GGPI (GGPI), led by SPAC sponsors, Gores Group and Guggenheim Capital is expected to finalize their merger in the coming weeks. Polestar is a Swedish based European EV pureplay, owned by parents Volvo Group (OTCPK:VOLAF) (OTCPK:VLVLY) (OTCPK:VOLVF) and Geely Holdings (OTCPK:GELYF) (OTCPK:GELYY).

As a Swedish automotive brand, Polestar had its start as a racing brand founded in 1996. Polestar Cyan Racing has since been spun out, and Polestar was fully born again as an electric vehicle offering when Geely, one of the world's leading Chinese auto manufacturer acquired Volvo in 2010, before Volvo then acquired Polestar in 2015.

Ownership Summary

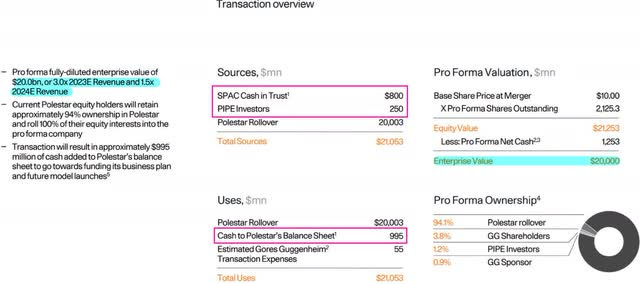

As part of the planned SPAC business combination, Polestar will be raising slightly over $1Bn dollars of which $995M will be added to their balance sheet, net of expenses. Existing shareholders will receive 94.1% of the post-merger entity, with the largest shareholders currently being Volvo that owns close to 50%, of the company, followed by Geely Holdings.

Polestar's Product Pipeline

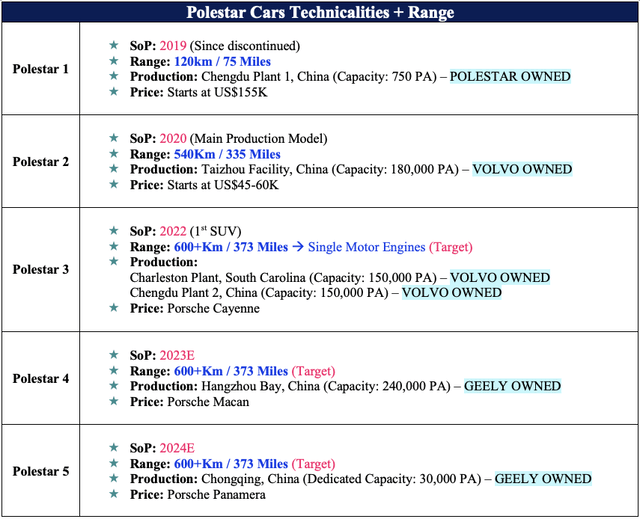

Polestar currently has fully unveiled 2 of their 5 planned models, with sales of Polestar 1 that was the hybrid sedan since been discontinued as the company transitions into a full electric pure play offering with the Polestar 2. Polestar 2 has been and is expected to continue to be the main driver of volume, in terms of deliveries, and management even managed to meet their guidance of delivering 29,000 vehicles by end FY21. Their O2 electric roadster is also extraordinarily cool but is not guaranteed for production and only serves as a concept car for now.

Moving forward, the company expects to deliver 65,000 vehicles end FY22, all of which will still originate from the sales of Polestar 2. Polestar 3, the company's 1st SUV offering will start production later this year, with the first of its sales to be registered in FY23. Polestar 4 is also planned to start sales next year, but will only fully ramp up in FY24 alongside when the precept (Polestar 5) is introduced into markets.

Why Polestar Isn't Just Your Typical EV SPAC

Given the fade in hype and bullish sentiment around EV players, especially those going public via the SPAC route, it wouldn't surprise that most investors treat Polestar as yet another EV player aspiring to disrupt the market whilst having no sales and deliveries to back up their bold claims. But this is where investors are wrong.

Polestar isn't just about pre-orders and an ambitious vision, but rather the underdog that actually delivers. Polestar delivered $1.34Bn in revenues end FY21, up a 120% YoY. In 2020 itself, they delivered a 560% increases YoY from the $92M in topline recorded in 2020.

The 29,000 cars delivered last year trumps the deliveries of high-profile peers, namely Lucid (NASDAQ:LCID) and Rivian (NASDAQ:RIVN) who have delivered nowhere close to that number but yet command much higher valuations. Lucid only delivered a 125 electric vehicles in 2021 alone, and Rivian a little better at 920. Despite this, both Lucid and Rivian managed to notch a valuation well above US$100Bn, about 5X higher than the enterprise value Polestar is set to go public with. Although both companies' stock have since fallen off a cliff due to the prevailing market sentiment, the point being that Polestar is far ahead of their North American peers in terms of deliveries, possible due to the asset light operational strategy they adopt as well as the connections that they have.

Polestar leverages the manufacturing facilities its parents, both Volvo and Geely Holdings, who are seasoned incumbents in the automotive space. Although not electric vehicle pure players themselves, both parent companies are well capable of delivering millions of cars per annum and have state of the art production facilities for Polestar to utilize to get deliveries out into the hands of the customers.

As of now, Polestar only owns and operates 1 facility with a capacity of just 750 cars per annum in Chengdu, China. Yet, as Lucid and Rivian need to spend time and CAPEX investing into manufacturing facilities and factories to scale their production, Polestar has immediate access to 5 other manufacturing facilities, 3 of which are owned and operated by Volvo in China and the US, as well as 2 others owned and operated by Geely in China, providing them with the cumulative capacity of over 750,000 cars to be produced and delivered per annum, on-demand.

The access that Polestar has to such manufacturing facilities provides them with the infrastructure they need to meet demand for deliveries, whilst allowing them to maintain an asset light business model and a one rid from the need of heavy CAPEX investments. As such, capital can be directed towards reinvestments into their technology and design to better the experience for consumers.

Furthermore, not only does Polestar have the production capacity and a track record of actually delivering vehicles unlike their peers, who although maintain impressive pre-order numbers but have yet to prove themselves, Polestar also has the global reach with further extends their presence internationally.

Polestar currently operates in over 19 countries, with plans to break into Middle East this year and boost its presence internationally to over 30 markets by 2023. The manufacturing reach attained from their relations with Volvo and Geely has also allowed the Swedish-based startup to expand faster into the global market, away from the regional markets that their peers are concentrated in for now and the foreseeable future.

Looking into the geographical breakdown of their sales ending FY21, the majority of sales originated from 4 key areas, inclusive of the USA, Norway, UK, and Sweden that made up 18.6%, 17.3%, 15.5% and 14.2% of the topline. Yet, with Polestar 2 finally entering into the US market this year March, it is expected that the US alongside Europe will make up the majority of their sales moving forward. The Chinese market will also stand to be a big market for Polestar given that Geely is based there and is sure to leverage their home-based expertise and presence to promote the adoption Polestar.

Delivery Update for 2022

As mentioned earlier on, Polestar's management have guided for a target of 65,000 vehicles delivered this year, which has already been adjusted downwards to factor in the ongoing chip shortage. This 65K delivery is in line with their 5Y goal to deliver 10X their deliveries to 290,000 cars in FY25 as it takes on the likes of industry giant Tesla.

Although no official delivery number has been disclosed for Q1'22, a rough estimate can be made to judge the progress that Polestar has made year to date, especially important given the onset of the Russia-Ukraine war and supply chain disruptions that still persists till today. TechCrunch estimates that:

Polestar's sales climbed 1,179.7% to 1,510 units, compared with the 118 units the company sold during the first quarter last year, due to the arrival of the Polestar 2 luxury sedan."

However, that seems to contradict the 2,384 units sold in the US that Twitter account ev_spacs seems to claim. On a broader level, the number of deliveries for Q1'22 (USA + EU + Norway) totals 8,583 units, and that doesn't seem to include the deliveries in other markets, namely China and Canada. China's sales have reportedly come in under expectations at just 444 vehicles delivered within the quarter, driven by the lockdowns from the resurgence of COVID. Although it is hard to verify all the different sources of data, including a more in depth breakdown by Lightning Invest on YouTube, it is reasonable to estimate that total number of deliveries for Q1'22 come in anywhere between 8500-9500 deliveries.

Although concerning on surface level if we were to extrapolate that for the rest of the year (34K-38K) deliveries ending FY22, Polestar seems to deliver most of their cars in the 2H of the year. This, alongside the lockdowns in China that have skewed deliveries to the downside and the fact that Polestar 2 has just entered into the US markets, it may be too soon cast judgement on the feasibility of the 65K target. SPAC filings also tend to be radically unrealistic at times, yes, but management has proven that targets are feasible by meeting with their goal of 29K cars last year. Besides, if extraneous factors do really inhibit Polestar's ability to deliver, it would be an industry wide issue and not one solely subject to the Swedish automaker, as we have already seen Lucid adjust their projected delivery numbers downwards by 30%,"citing supply chain problems".

Valuations

At the peak of the frenzy, both Lucid and Rivian were trading at ridiculous multiples. Since then, both companies have seen significant valuation compressions as high multiple, unprofitable companies were abandoned by investors as the FED aggressively pivoted to a hawkish stance and committed to quantitative tightening.

Yet, Lucid still trades at an EV of US$27Bn, at a EV/Rev multiple of 7.5X 2023 numbers, higher than the 3.1X Polestar trades at despite the significant selloff. The premium that still exists may be justified from the fact that Lucid has the best battery technology within the entire industry in terms of range compatibility (520 miles on a single charge vs Polestar's 335 miles), but if anything, that much range isn't really a game-changer given that the average American only travels 39 miles per day. Polestar's vehicle would still be able to last them travelling for more than 8 days on a single charge. Furthermore, Polestar has a far better chance at actually performing in line with projections given that they already have the track record, production capacity, manufacturing scale, and international reach, all of which Lucid has still yet to prove for themselves and remains to be seen.

With regards to their Chinese peers, Polestar doesn't deserve to trade in line with the depressed multiples of the pact given that they are not a true onshore company like the rest. Despite having a Chinese parent, the automaker is still based in Sweden and its international presence guarantees that they are a true global competitor with no concentration of sales in China unlike rest of them. As such, investors should not make the mistake of extrapolating the same negative sentiment surrounding Chinese names to Polestar.

Investor Takeaway

To wrap things up, Polestar is set to merge with GGPI in the coming weeks having filed their 6th F-4/A. The pure play EV manufacturer is a true underdog in the space with its unique asset and CAPEX light business model, backed by their parents, Volvo Group and Geely Holdings. This connection allows them to leverage the manufacturing facilities and production capabilities of incumbent giants in the industry that have been at it for years, meeting customer demand and having the freedom to redirect capital towards improving their digital architecture. The relationship it has with Geely also grants Polestar seamless access to the biggest EV market in the entire world, China.

Given that markets are currently defensive as it should be, it wouldn't surprise me if we don't see the follow through run-up in prices post-merger. Regardless, Polestar is a real contender in the EV space, is undervalued relative to peers, and is one here to stay for the long haul. I'm bullish either way and am holding onto shares for the long run. Till next time!